Flat Worldwide Life Insurance Sales: Predictable or Surprising?

IIS Executive Insights Life & Health Expert: Ronald Klein, Founder, Obtutus Advisory GmbH

Introduction

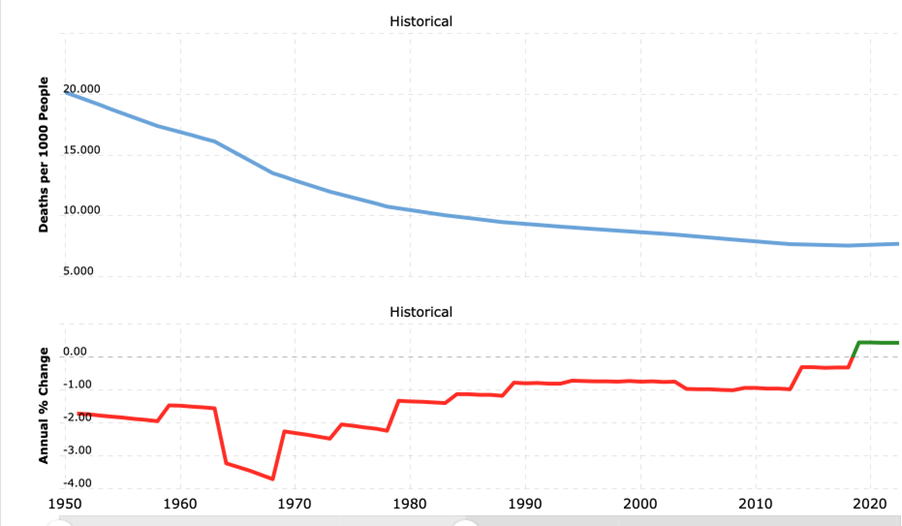

During the past few decades, the world has become a much more dangerous place in which to live. Since 1970, the annual rate of change in the number of worldwide deaths has been increasing, but still was negative through 2018 (see Figure 1 below)1 Since 2019, the rate of change began to increase. And, this is prior to the COVID pandemic which became a mortality event later in 2020.

Figure 1

Source: United Nations – World Population Prospects

A portion of these increased deaths can be attributed to war or conflicts. In the continent of Africa alone, there are conflicts in Afghanistan, Burkina Faso, the Democratic Republic of Congo, Ethiopia, Mali and Yemen accounting for tens if not hundreds of thousands of premature deaths. And, it is estimated that over 250,000 deaths have occurred in Ukraine to date. The newest conflict between Israel and Palestine is estimated to have already killed 20,000 people as of the writing of this report2.

Some of the increased number of deaths can be attributed to the opioid crisis, mainly in the US. The Center for Disease Control and Prevention in the US (CDC) estimates that since 1999, over 1 million people have lost their lives to opioid overdoses3. Over 70% of these deaths occur at ages 25 – 54, the prime life insurance purchasing years4. The crisis looms so large that it was a major topic of conversation between President Xi Jinping of China and President Joe Biden of the US during their recent summit in San Francisco.

Natural disasters have increased during the past decade adding to lives lost. Climate change is certainly the main culprit, but other factors such as building in flood zones, building too close to the shore, building near active volcanoes, poor infrastructure and poor maintenance certainly contribute. In 2004, an earthquake and following tsunami in the Indian Ocean killed an estimated 230,000 people5. There was famine and drought in Ethiopia in 1983-85, an earthquake in Haiti in 2010 and a cyclone in Myanmar in 2008 causing tens of thousands of additional deaths. In 2023, wildfires in Canada and the US, an earthquake in Morocco and flooding in Lebanon caused many premature deaths.

Gun violence more than doubled in the US since 1970 according to the Pew Institute. Anyone watching the news in the US will certainly be aware that mass shootings occur way too often. Gun violence deaths usually affect the younger population. Both murder and suicide rates are up. Suicide deaths point to another problem that the world is facing – mental health issues.

Finally, we should not forget the recent pandemic that accounted for an estimated 6.9 million deaths worldwide6. COVID is not done yet with new strains and new waves hitting many countries. Other epidemics such as Ebola, SARS and even the current human metapneumovirus have been or may become major mortality events.

Flat Life Insurance Sales

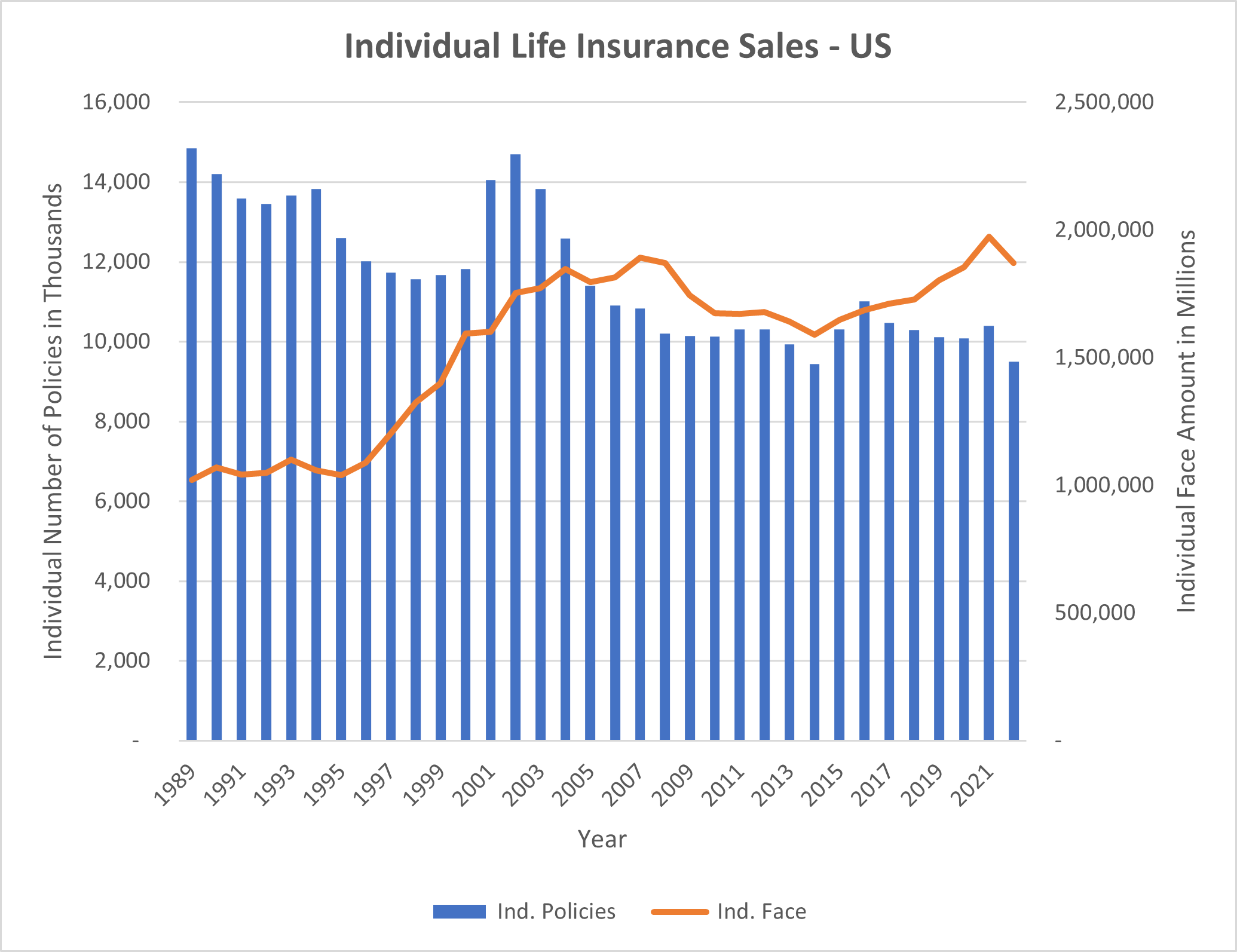

One would think that with all this uncertainty and added danger, life insurance policies would be flying off the shelves. It is just not the case. In fact, during all of this increased uncertainty, life insurance sales worldwide have been quite flat. Even during the recent pandemic, sales of life insurance could not show a significant bump. The American Council of Life Insurers (ACLI) publishes its Fact Book annually which tracks sales of life insurance by number of policies and face amount. The recently published 2023 Fact Book shows that while face amount has generally increased since 2013, there was a dip in 2022 and it is still hovering around 2005 levels (see Figure 2 below). The number of individual policies sold has been on a general decline since 2002. It should be noted that group life insurance sales have been rising in the US, but this is most likely linked to increases in population and inflation as group insurance is usually a multiple of income and is mostly mandatory. Similar patterns can be seen in most major insurance markets around the world.

Figure 2

Source: ACLI Fact Book 2023

It appears that uncertainty is not causing an increase in life insurance sales. Even a one-in-100-year pandemic cannot sustain growth. So, what possibly can be driving continued flat sales of individual life insurance? To explore this, one only need to look at the main drivers of life insurance sales. While there are many uses of life insurance worldwide including, estate planning, tax deferral, tax avoidance and as an investment, the main reason for purchasing life insurance remains to protect against the financial consequences of premature death of a family breadwinner. If there is no family, there is less need for this protection.

A Predictable Surprise

It is no secret that fertility rates are down in most, if not all, major countries around the world. Many of these countries such as Japan, Russia, Greece and Italy, are experiencing negative population growth. That is, there are more recorded deaths than births each year. The only other factor is migration, and for these countries, migration does not fill the gap. In general, world population is still expected to increase through the end of the century before declining, but this is due to fertility in lower income nations. Lower fertility rates mean smaller families and could lead to less purchasing of life insurance.

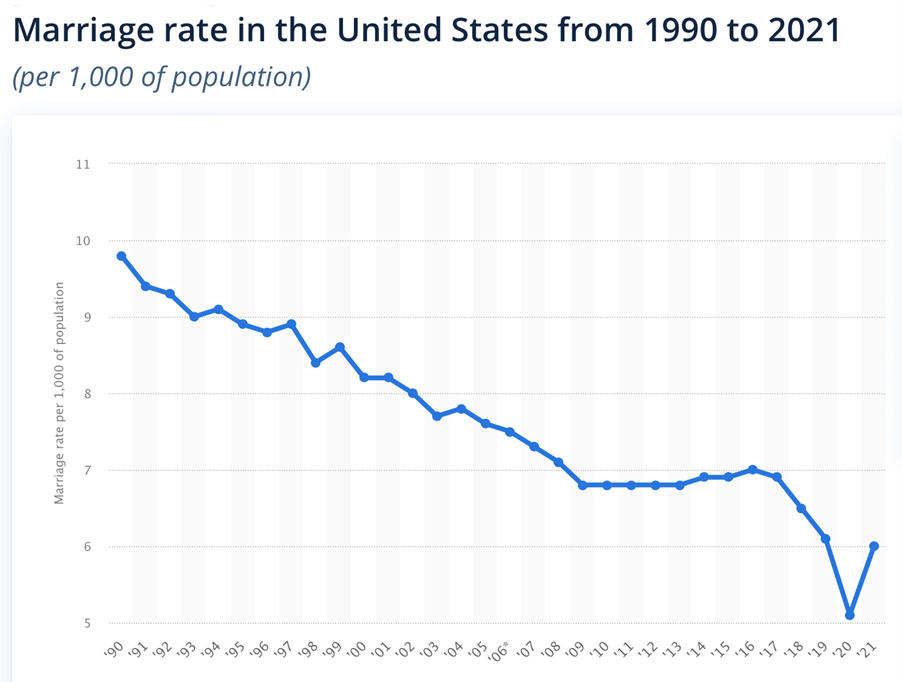

It is not only fertility rates that are down. Marriage rates are falling as well. In the US, marriage rates fell from approximately 9.9 per 1,000 in 1990 to about 6.0 per thousand in 2021 (see Figure 3 below). This is not a US-only issue. It is estimated the worldwide marriage rates have dropped in a similar fashion as in the US from 8.2 in 2000 to 6.0 in 20207. The decrease in marriage rates and the decrease in fertility rates must be a big factor in flat sales of life insurance globally. In fact, since both trends have been observed for decades, these flat sales should have been forecasted earlier.

Figure 3

Source: Statista.com

The only ways to increase sales in this environment are: 1) companies must sell more insurance to those who already purchased life insurance, 2) companies must increase penetration rates by selling to those who never purchased a product, 3) companies must increase fertility rates, or 4) companies must increase marriage rates. With options 3 and 4 out of the question as even governments are struggling to incentivize women to have more children through subsidies, tax breaks and childcare, only options 1 and 2 remain. The battle is uphill at best. Recognizing that growth in life insurance sales will be a tough slog, insurers may be better suited to focus on the needs of an aging population of singles or childless couples.

Payout Annuities to Fill the Gap

While singles and childless couples may not feel that life insurance serves an important need for them, lifetime income through annuities certainly will serve a vital need. A combination of fewer traditional families and longer life expectancies create a perfect scenario for annuity sales. And, if the aging individual does not have a family, he or she will not have children to assist with care at older ages. This may require a long-term care policy as well as an annuity.

According to the Life Insurance Marketing and Research Association (LIMRA) in the US, sales of Fixed Income Annuities (FIA) have been on the rise since 2020 (see Figure 4 below). Looking at FIAs is a better indication of payout annuity purchases as products such as Variable Annuities are typically investment products and annuitize at a very low percentage. Some companies saw flat life insurance sales and an increase in annuity sales coming and have exited individual life insurance sales. For example, VOYA Financial announced that it was exiting the individual life insurance business in 2018.

Figure 4

Selling annuities is not an easy task. There are many reasons why people are reluctant to purchase payout annuities. An annuity is a reasonably complicated product and is not well-understood. People do not like to purchase things that they do not fully understand. Sales of annuities have suffered because of the extremely low interest rate environment experienced worldwide since 2008. With interest rates rising, sales have begun to pick up. But an annuity typically requires a large up-front payment that many are not willing to make. This lump-sum premium is sometimes difficult to part with. The potential policyholder may ask, “What if I only life a few more years? I just made a bad investment.” The answer is that while you may have made a bad investment, annuities are protection against outliving your retirement assets. In short, if you die earlier than expected, you didn't really need that money. The “extra” money will go to those who outlive expectations. This pooling concept is exactly what insurance is all about.

Other issues such as insurance company credit risk, not having the funds for an emergency, not having money to bequeath to heirs and locking in a monthly income that does not increase with inflation also impede sales. These are all valid concerns and can be dealt with in other ways. Using a strong insurer with top financial ratings should alleviate credit risk concerns. Keeping some money on the side for an emergency is certainly recommended. Purchasing a life insurance policy for heirs should cover any inheritance issues. And, although there are some payout annuity products that offer inflation protection, they are not the norm. This is an issue for the industry and one that should be dealt with by a creative product development team.

Annuity sales would be greatly improved if/when 401k plans in the US offer in-plan annuitization. This is available in most other major insurance markets. In Switzerland, for example, not only do Pillar II plans (occupational savings plans similar to 401k plans in the US) offer in-plan annuitization, but there is a governmental minimum rate for the conversion for the mandatory portion the of account. When the participant retires, the mandatory portion of the Pillar II account will be multiplied by a percentage which will translate into the annual income amount to be paid monthly. For example, if a participant has CHF 500,000 of mandatory contributions in his or her account and the rate is 5%, the annual payout will be CHF 25,000 per year or a little more than CHF 2,000 per month. (Currently, CHF 100 ≅ USD 115). There are options to annuitize only a portion of the Pillar II account and extra-mandatory portions may have a higher or lower annuitization rate depending upon the plan.

A similar system in the US would increase annuity sales and help to protect an ever-increasing single population from outliving their retirement savings. Access to annuities must become easier in the US. As more of the population purchases annuities, they will become better understood and recommended more often. There is nothing better than receiving a monthly check guaranteed for the rest of your life!

Conclusion

While flat life insurance sales could have and should have been predictable, selling 1.5 billion policies with face amount protection of USD 2 trillion in the US alone, is not too bad. The life insurance industry is extremely strong, continues to serve an important need and will exist forever. To serve more of the population, insurers need to contrate product development resources on payout annuities that provide guaranteed lifetime income. Products that have the potential of increasing income will help to generate sales. Also, providing the opportunity to annuitize retirement savings accounts in-plan with a potential minimum annuitization rate for a certain portion or savings could take some of the anxiety out of the annuity purchase.

The world is becoming more unpredictable which should lead to increased life insurance sales. But the industry is fighting against changing demographics. Instead of fighting changes in fertility and marriage rates, the industry needs to see these changes coming and prepare better. Annuities can provide vital protection for everyone, but especially for those who are not married or have no children. The life insurance industry is the only industry that can provide this protection.

1https://www.macrotrends.net/countries/WLD/world/death-rate

2https://edition.cnn.com/2023/11/07/middleeast/palestinian-israeli-deaths-gaza-dg/index.html

3https://www.cdc.gov/drugoverdose/deaths/index.html#:~:text=Opioids%20were%20involved%20in%2080%2C411,and%20without%20synthetic%20opioid%20involvement.

4https://injuryfacts.nsc.org/home-and-community/safety-topics/drugoverdoses/#:~:text=Currently%2C%2071%25%20of%20preventable%20opioid,among%20children%20younger%20than%2015.

5https://www.worldvision.org/disaster-relief-news-stories/2004-indian-ocean-earthquake-tsunami-facts#:~:text=Approximately%20230%2C000%20people%20died%20in,23%2C000%20Hiroshima%2Dtype%20atomic%20bombs.

6https://covid19.who.int

7https://onlinemftprograms.com/worldwide-marriage-statistics/#:~:text=2022%20Marriage%20Data%20and%20Statistics,rate%20of%208.2%20in%202000.

1.2024

About the Author:

Ronnie is founder of Obtutus Advisory GmbH, an expert witness, contributor to the International Insurance Society and Advisor with Achaean Financial. He has over 40 years of insurance and reinsurance experience having worked and lived in 3 countries. Ronnie is Co-Chair of the Programming Committee for the ReFocus Conference and served on the Board of Directors of the Society of Actuaries. Before this, Ronnie worked as the Head of Life Reinsurance for Zurich Insurance Group in Zürich, Head of Life Reinsurance for AIG in New York and Global Head of Life Pricing for Swiss Re in London. Ronnie began his career at Mutual of New York. A little-known fact is that Ronnie holds a patent (US20060026092A1) for the first Mortality Bond issued called Vita when he was with Swiss Re.