Genetic Testing and Insurance Implications (Full Report)

Genetic testing and insurance implications: Surveying the US general population about discrimination concerns and knowledge of the Genetic Information Nondiscrimination Act (GINA)

Anya E.R. Prince, JD, MPP*[1], Wendy R. Uhlmann, MS, CGC[2], Sonia M. Suter, JD, MS[3], & Aaron M. Scherer, PhD[4]

Abstract

Globally, due to public concerns of genetic discrimination, some countries and insurance industries have adopted policies restricting insurer use of genetic information, such as the US Genetic Information Nondiscrimination Act (GINA). This study reports on combined analysis of two surveys assessing public knowledge of GINA and concerns of genetic discrimination in a diverse U.S. sample (N=1616). We focus on whether occupation, genetic testing history, and insurance status are correlated with knowledge of GINA or concerns of discrimination. While bivariate analysis identified some populations with higher subjective/objective knowledge and concern relative to counterparts, multivariable regression identified very few significant associations with outcomes of interest. Overall, this study highlights lack of awareness and understanding of GINA, even among subpopulations hypothesized to have greater knowledge of the law. These findings have implications for the broader debate around insurer use of genetic information.

As scientists started to unravel the secrets of our genes in the Human Genome Project in the 1990s, public concern about the possibility of genetic discrimination began to grow (Billings et al., 1992; Gostin, 1991). The main concern has long been insurance discrimination, which has led to an ongoing debate, both in the United States and abroad, over whether insurance companies should be able to use the results of genetic tests in underwriting (Hall et al., 2005; Wauters & Van Hoyweghen, 2016). In much of the world, the debate has predominately focused on non-health insurance lines (Joly et al., 2010), since many countries have national health systems or insurance programs. In the US, however, since health insurance is still predominately sold by private companies to groups and individuals, concerns about discrimination on the basis of genetic information initially focused on health insurance markets (Hall & Rich, 2000). This paper broadly discusses both health and non-health lines of insurance, although discussions of policies outside the US will predominately focus on insurance lines beyond health.

Insurers argue that lack of access to information about genetic risk could lead to instability in the market since they would not be able to set premiums with full knowledge of risk (Born 2019; NAIC, 1996). This is especially a concern if there is asymmetrical information between the insurer and the applicant, such as where the individual knows about future genetic risk that the insurer is unaware of or barred from learning (Born, 2019; Lombardo, 2018). From the insurer perspective, information about risk is central to the insurance enterprise (American Academy of Actuaries, 2011). For example, if two life insurance applicants have the exact same risk profile, except one has a genetic predisposition to cancer and the other does not, the life insurer may charge the individual with the predisposition more for the policy—all else being equal—since cancer is linked to higher mortality rates. Insurers worry that if they cannot consider genetic test results, there may be anti-selection, where information asymmetry between the insurer and applicant allows the applicant to obtain insurance for a lower premium than their risk reflects (Berry, 1996; Macdonald & Yu, 2011). Anti-selection could lead to economic instability or, at an extreme, a death spiral for the insurance industry (Born, 2019). If such instability occurred, the harm to both insurers and the public could outweigh any benefit derived from restricting information as premiums could increase across the board (Born, 2019).

Opponents of insurer use of genetic information worry that it is unfair to discriminate against someone based on such an immutable, personal, and uncontrollable trait as one’s genetic make-up, in the same way it is unjust to discriminate based on race or gender (Prince, 2017). They also fear that discrimination could lead to a so-called genetic underclass—a group of people unable to access insurance or other parts of society because of their genes (Holmes, 1996; Macdonald & Yu, 2011) Finally, they argue that barring insurer use of genetic information can potentially save lives (Rothstein, 2018). Evidence has shown that some individuals fail to get medically necessary, preventive genetic testing out of fear of insurance discrimination and may therefore miss the opportunity to prevent or mitigate disease in themselves or their family (Rothstein, 2018).

In response to public concerns of genetic discrimination, a number of countries have adopted policies regulating insurer use of genetic information. One worldwide review identified policies addressing genetic discrimination in insurance across 47 countries (Joly et al., 2010). For example, in Great Britain, in 2001, the Association of British Insurers (ABI) agreed to a short-term, renewable moratorium on the use of predictive genetic test results, defined as those that “predict a future risk of disease in individuals without symptoms of a genetic disorder” (Mayor, 2001; HM Government [UK Code], 2018). The moratorium applies to insurance companies that are members of the ABI, including life, critical illness, income protection, motor, and travel insurance. Under this agreement, insurers can only consider genetic test results that are approved by a committee for high-value insurance policies. The only genetic test that insurers can take into account is a predictive test for Huntington’s Disease (HD), a severe, neurodegenerative condition, and only when a person is applying for a life insurance policy of over £500,000. Insurers and the British government have renewed the policy multiple times (UK Code, 2018).

In 2017, the Canadian Parliament passed the Genetic Nondiscrimination Act (GNA), which makes it a criminal act to consider a person’s genetic test results during contract formation, including any insurance contract (S201, 2017; Bombard & Heim-Myers, 2018). Despite the Canadian insurance industry’s strong opposition, the GNA passed unanimously in the House of Commons and with wide support in the Senate. The bill was challenged as unconstitutional, but the Canadian Supreme Court upheld it in 2020 (Stefanovich, 2020).

In 2008, the United States Congress passed the Genetic Information Nondiscrimination Act (GINA), which bars health insurers and employers from discriminating on the basis of genetic information (GINA, 2008). GINA focuses only on one line of insurance—health; it does not prohibit other insurances—life , disability, long-term care (LTC), auto, or property—from using genetic information (McGuire & Majumder, 2009).[5] One primary motivation for the law was to encourage greater participation in genetic testing and research by assuaging public fears of genetic discrimination. However, in the thirteen years since GINA’s passage, knowledge and utilization of the law has remained low (Huang et al, 2013; Areheart & Roberts, 2018). Under the US federalist system, states are left, jurisdiction by jurisdiction, to decide whether other insurers should have access to genetic test results (Anderson et al., 2021; NHGRI 2021). Notably,in 2020, with bipartisan support, Florida became the first US state to prohibit life, LTC, and disability insurers from using genetic test results to set premiums or to cancel, limit, or deny coverage (Born 2019; Lewis et al., 2021).

This paper reports the results of two surveys of the general US public that measure current knowledge and understanding of GINA’s legal protections, as well as individuals’ concerns of genetic discrimination. Overall, we find that knowledge of GINA is low and that even those who report that they are aware of the law often misunderstand its actual protections. Respondents also report concerns of discrimination across insurance lines and indicate that they would decline hypothetical genetic testing due to these concerns. In this paper we explore whether and how occupation (science, medicine, legal, military), history of genetic testing (clinical and direct-to-consumer), and insurance status are associated with knowledge of GINA and concerns regarding genetic discrimination.

Section 2 briefly summarizes the changing landscape of genetic testing. Section 3 presents a literature review on global studies measuring fear of discrimination and US studies assessing knowledge of GINA. Section 4 introduces the methods and analysis of surveys presented in this paper, and Section 5 presents an overview of initial findings reported separately and results of the combined analysis. Section 6 concludes with a discussion of the results, including considerations about what these findings could mean for other countries that have regulation in this area and topics for future research.

Section 2: GENETIC TESTING LANDSCAPE

Although discussions of insurer use of genetic information often reference genetic testing broadly, not all tests are equally as helpful or important to insurers. Therefore, the impact of policies that restrict use of genetic tests will depend on the scope of testing included. This section introduces some of the complexities of genetic testing and the implications for insurance. First, it defines types of genetic tests and discusses how policies regulating insurer use of genetic testing have defined genetic information. Second, it notes how genetic testing complexities create varied predictive values.

Scope of policies

To understand the scope of regulation of insurer use of genetic tests, it is important to distinguish between diagnostic and predictive tests. For example, BRCA1/2 testing may be done in a woman who has breast cancer (diagnostic) or in an asymptomatic woman with a positive family history of cancer (predictive). Policies regarding insurer use of genetic test results have approached the scope of testing differently. For example, while the UK Code on Genetic Testing only covers predictive testing (UK Code, 2018), the GNA in Canada applies to both diagnostic and predictive testing (S201, 2017). The GNA, therefore, could have a greater economic impact on the insurance industry than if it had been narrowed to predictive testing (Bélisle-Pipon et al., 2019; Lombardo, 2018; Prince, 2018). In the US, GINA defines genetic information broadly to include not only genetic test results, but also family medical history, participation in genetic research, and use of genetic services, such as genetic counseling, therefore significantly expanding the impact on covered health insurers (GINA, 2008).

Genetic tests and insurance underwriting

Even within the scope of genetic tests that insurers are allowed to take into account, available tests greatly vary in their sensitivity (ability to detect a genetic variant in an affected individual) and predictive value (likelihood of having symptoms if have a genetic variant). Limitations in technology mean that not all genes and gene changes that cause a genetic condition can be detected with current testing. In addition, depending on the genetic condition, even when a gene change is identified, an individual may or may not be symptomatic and age of onset, type of symptoms and severity can vary. This is especially the case for genetic conditions that vary in their penetrance, which is the likelihood a person is to develop a disease if they have a genetic variant. HD is one of the few adult onset genetic conditions that is near 100% penetrant—meaning that a person who has the genetic variant is certain to get the disease if they live long enough. However, there are many genetic conditions with much lower penetrance, lessening the predictive value for insurers (Macdonald & Yu, 2011). Additionally, the symptoms can range from mild to severe and often, it is not possible to predict which person will develop the severe symptoms. For some genetic conditions, there can be genotype-phenotype correlations where specific gene changes have implications for symptom severity. Depending on the genetic condition, an individual’s lifestyle and environment may have an impact. Finally, for some genetic conditions, screening or preventive measures are available which can reduce risk. For example, women with a pathogenic BRCA1/2 variant can undergo prophylactic surgery to reduce the risk of cancer. In the case of life insurance, this prevention may successfully mitigate much of the mortality risk. In short, genetic testing is incredibly complicated and the predictive value of many genetic tests may be low for a wide variety of reasons (Macdonald & Yu, 2011).

Section 3: FEAR OF GENETIC DISCRIMINATION AND KNOWLEDGE OF LAWS

Fear of genetic discrimination has been studied across the globe. A 2016 systematic literature review identified 42 studies spanning 19 years (1996-2014), comprising research from the US, Canada, Australia, and Europe (Wauters and Van Hoyweghen, 2016). Several studies looked at both legislative policies and concerns of genetic discrimination (Wauters & Van Hoyweghen, 2016; Klitzman, 2010; Hall et al., 2005; Geelen et al., 2012; Allain et al., 2012). For example, one qualitative study highlighted interviews from families who were still worried about genetic discrimination despite Dutch regulations that outlaw such discrimination (Geelen et al., 2012). Although Wauters and Van Hoyweghen note that a policy may fail to address concerns of genetic discrimination for a number of complex reasons, one key explanation cited is a lack of awareness of the existence and scope of the policies (2016).

Both the lack of awareness of legal protections and concern about discrimination have also been studied in the US. For example, studies have found patient awareness levels of GINA ranging from 8.8% (Huang et al., 2013) to 20% (Parkman et al, 2015; Cragun et al., 2019). Additionally, even amongst patient groups with a genetic condition, knowledge of GINA was still lower than that of other privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA) (Dorsey et al., 2013).Studies of US health care professionals have found greater knowledge than among the general population, but still low levels of awareness. For example, two studies revealed that over half of surveyed physicians reported they were not aware of GINA’s passage (57.1% and 54.5%, respectively) (Fusina, 2009; Laedtke et al., 2012). Another study found that only 33.8% of surveyed nurse practitioners were familiar with GINA (Steck et al., 2016). Studies of genetic counselors yielded more promising results; overall, genetic counselors were knowledgeable about GINA’s major protections (99.3%), although there remained confusion about some specific provisions (Pamarti, 2011).

As noted by Wauters & Van Hoyweghen, US studies have also identified concerns of genetic discrimination (2016). They found that, across the studies, people had greater concerns about genetic discrimination in insurance than in employment and that fear of discrimination in insurance settings is linked to a greater unwillingness to undergo genetic testing. One study, published after the systematic review, found that 28% of people who declined to participate in a genetic research study cited fear of insurance discrimination as their primary reason for declining (Amendola et al., 2018).

Section 4: METHODS, MEASURES, AND ANALYSIS

In this paper, we report combined analysis from two surveys of the general US population conducted in April and July 2020. Both surveys recruited US residents aged 18 and older using Qualtrics Research Services. Sampling quotas were created for gender, age, race, ethnicity, educational attainment, and total household income to have characteristics closely mirror the general US population. Participants were excluded if they did not reach the end of the survey questions (although individual questions could be skipped) or if their responses did not meet data cleaning standards. Further details on the methods and measures are available in additional publications (Lenartz et al., 2021; Prince et al., fc). Participants received compensation through Qualtrics Research Services. The surveys were determined to be exempt by the University of Iowa IRB.

The first survey (n=421) included a total of 58 questions designed to gather information about respondents’ demographics, knowledge of GINA, and concern of genetic discrimination. The second survey (n=1195) included a total of 67 questions designed to test how informed consent language influenced respondents’ willingness to participate in a hypothetical genetic research study. The questions were developed based on literature reviews and included both validated survey measures and novel questions. Questions included multiple choice and Likert scale formats. Although the two surveys had different primary research goals, a total of 56 questions were the same between the surveys. This allows for a combined analysis (n=1616) utilizing several shared questions.

Demographics

Both surveys collected standard demographic questions including age, gender, race/ethnicity, education, and income. We also included questions that we hypothesized may correlate with concerns of genetic discrimination or knowledge of GINA. These additional questions fell into three categories: 1) occupation; 2) history of genetic testing and/or genetic conditions; and 3) insurance status. We were unable to include these three demographic categories in previous study analyses due to insufficient numbers of respondents in each category to achieve satisfactory power. The combined analysis allows us to interrogate whether and how these characteristics are associated with our outcomes of interest: knowledge of GINA and concern of genetic discrimination.

Occupation

We asked respondents about employment status, including whether they worked, were retired, were a student, or had a disability that prevented them from working. If respondents indicated that they worked part-time or full-time, we then asked whether they worked in science, health, or legal fields. We hypothesized that individuals with these occupations may have greater knowledge of GINA. Additionally, because GINA does not cover military or veteran health insurance programs (Baruch & Hudson, 2008), we asked whether respondents currently serve in the military or are veterans.

Genetic Testing

We also hypothesized that individuals who had been offered genetic testing or had a personal and/or family history of a genetic condition would be more familiar with GINA. We asked two questions about whether the respondent and/or a first-degree relative (parent, child, sibling) had been diagnosed with a genetic condition. We also asked whether respondents had been offered and completed genetic testing, including diagnostic, predictive, carrier, prenatal, and direct-to-consumer genetic testing.

Insurance status

Since the most commonly cited GINA gaps are in life, LTC, and disability insurance, we asked a series of questions about coverage across these three insurances. Respondents could indicate whether they had group, individual, government (when applicable, like short term disability insurance plans in several states), or another type of coverage. However, for the current analysis we collapsed these responses into three separate dichotomous variables for having life, LTC, and disability insurance. We also asked about specific categories of health insurance coverage (no coverage, individual, group, or government insurance like Medicare or Medicaid). Finally, we asked whether respondents had ever been denied insurance due to a medical condition. We did not specify which type of insurance and this question followed those about all four types of insurance.

Knowledge of GINA

Respondents across both surveys were asked how familiar they were with GINA. We collected this subjective familiarity using a 7-point Likert scale with scale anchors of Not at all familiar (1) and Extremely familiar (7). Both surveys also assessed respondents’ objective knowledge of GINA by asking whether the law provides protection in health insurance, employment, life insurance, LTC insurance, disability insurance, auto insurance, and property insurance. Only health insurance and employment are correct answers. Both surveys included identical objective knowledge questions. While respondents from survey 2 were given some information about GINA’s protections in mock informed consent language, the subjective knowledge questions were asked prior to the mock informed consent language.

Concern of genetic discrimination

Respondents were asked how likely it was that genetic information would be used to determine employment status and health, life, LTC, and disability insurance coverage. Then respondents were asked how likely they would be to decline genetic testing based on concerns of results impacting each of the areas above. Both questions used 7-point Likert scales with scale anchors of Not at all likely (1) and Very likely (7). For survey 2 respondents, these questions were asked after the mock informed consent language.

Data from both surveys were combined and analyzed using Stata. In addition to descriptive statistics, we tested for significant bivariate correlations, differences in means using t-tests and ANOVAs, and multiple regression analyses.

Section 5: RESULTS

In this section, we first briefly summarize key findings of each of the two surveys individually. Then we present the results from analyses using combined dataset of responses. In particular, the new analyses focus on the respondents’ occupation, genetic testing history, and insurance status and their associations with knowledge of GINA and concerns of genetic discrimination.

Individual Surveys

Demographics

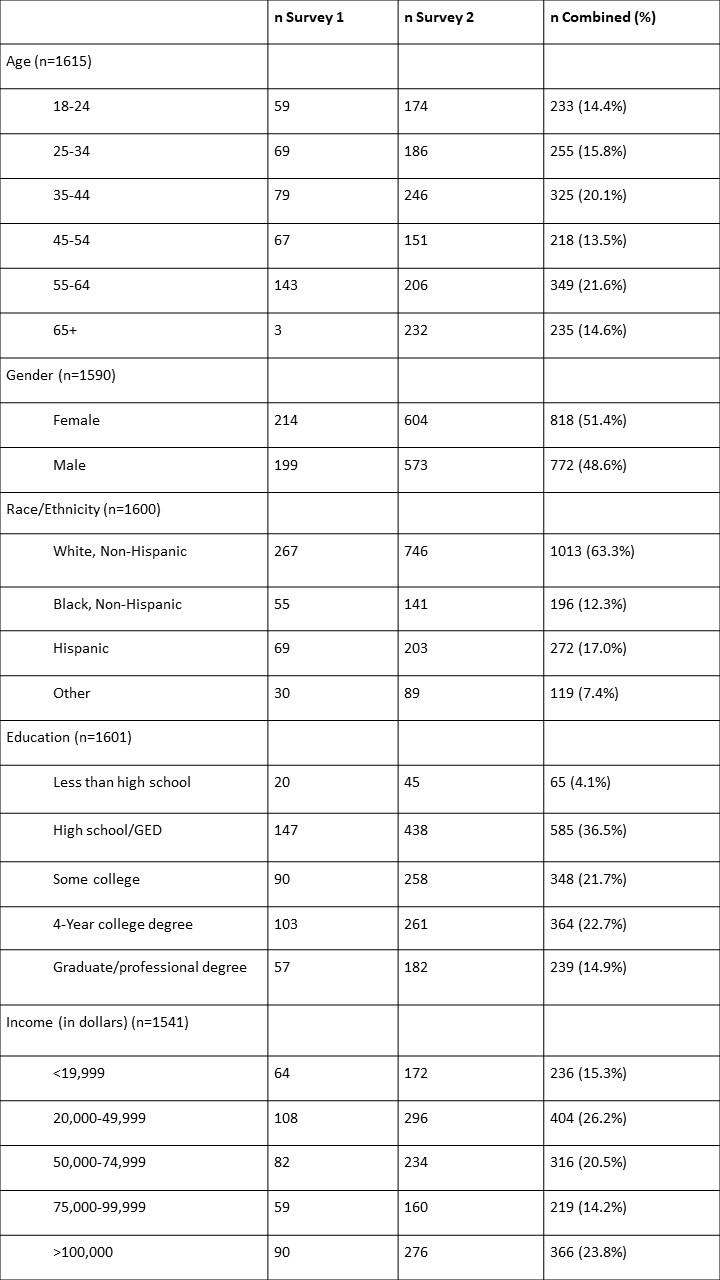

The initial surveys were comprised of 421 and 1195 respondents respectively who approximately mirrored the general U.S. adult population in terms of age, gender, race/ethnicity, income, and educational attainment (Table 1). In the combined group (n=1616), 54.1% identified as female; 63.3% identified as white, non-Hispanic; and 37.6% had completed a college or professional degree (Table 1). Overall, many of the key findings regarding knowledge of GINA and concern of genetic discrimination were replicated across the two surveys.

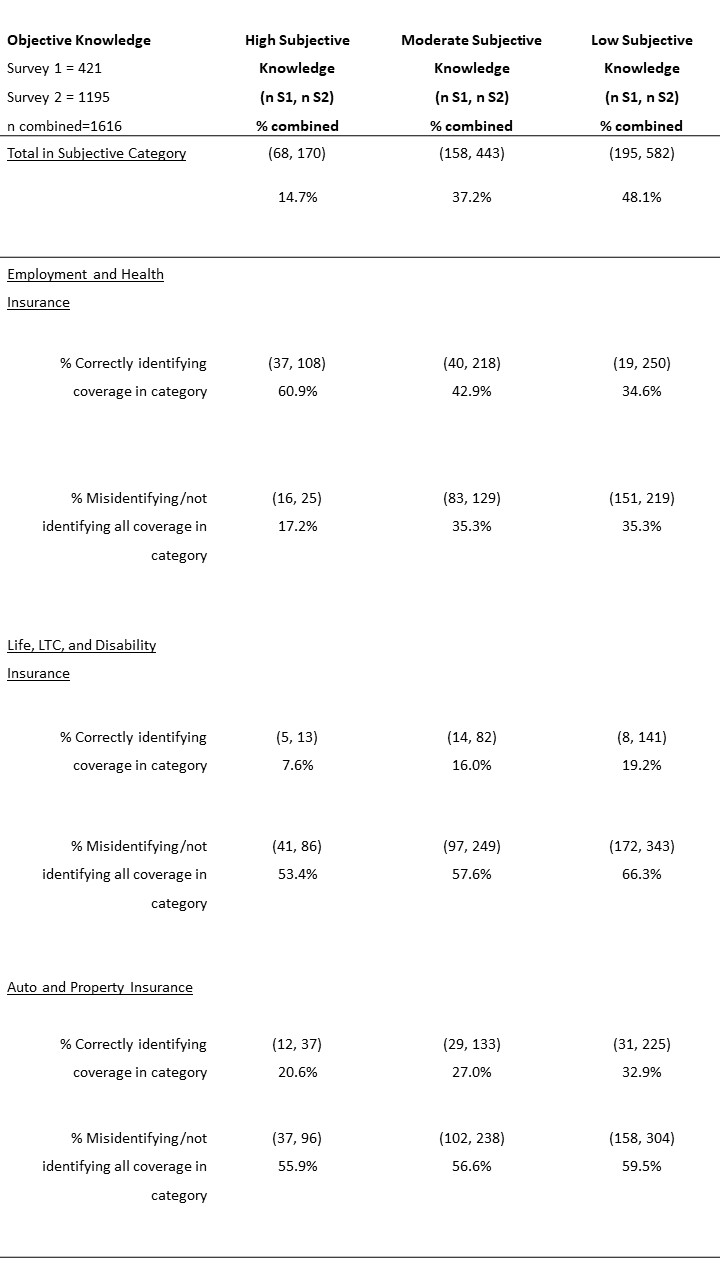

Knowledge of GINA

In previously reported individual survey findings, we found that most respondents (>75%) reported low (48%) or moderate (37%) subjective familiarity with GINA. Approximately 15% of respondents in each survey reported high subjective familiarity. However, of those with high subjective familiarity, only about 60% correctly identified that GINA protects against discrimination in the context of health insurance and employment (Table 2). Of those with self-reported high familiarity with GINA, more than half incorrectly believed that GINA covered life, LTC, disability, auto and property insurances (Table 2). Some differences in objective scores across the two surveys may be explained by the fact that respondents in the second survey received information about GINA’s protections in mock informed consent language. However, analysis from the second survey found no statistically significant difference in objective knowledge scores for GINA across respondent groups shown different informed consent language. All respondents in the second survey read information that GINA protected against genetic discrimination in employment and health insurance, but additional information about gaps differed across the respondents (Prince et al., fc).

Multivariable regressions found several common results. In both studies, older age was statistically associated with a lower subjective knowledge of GINA. Better self-reported health and greater religiosity were associated with higher subjective knowledge. We had included religiosity because previous research has showed an association between increased religiosity and increased concern about personal liberty (Iyer et al., 2012), which we hypothesized could relate to knowledge of privacy laws. In multivariable regressions focused on knowledge variables, both studies found that subjective knowledge of GINA was positively associated with subjective knowledge of genetics. There were other statistically significant findings in the multivariable regressions, but they were not replicated across both studies (Lenartz et al., 2021; Prince et al., fc).

Concern of genetic discrimination

Overall respondents in both studies were likely to believe that genetic information would be used in insurance determinations and were most likely to think that it would be used in life insurance, as compared to health, LTC, and disability insurance. Out of a 7 point Likert scale from not at all likely (1) to very likely (7) respondents in both surveys had an above mean response that they would be likely to decline hypothetical genetic testing out of concern for its use in employment and health, life, LTC, and disability insurance. Both surveys found that individuals were statistically more likely to say they would decline genetic testing out of concern for use in health insurance than for disability insurance and use in employment.

Combined Analyses

Demographics

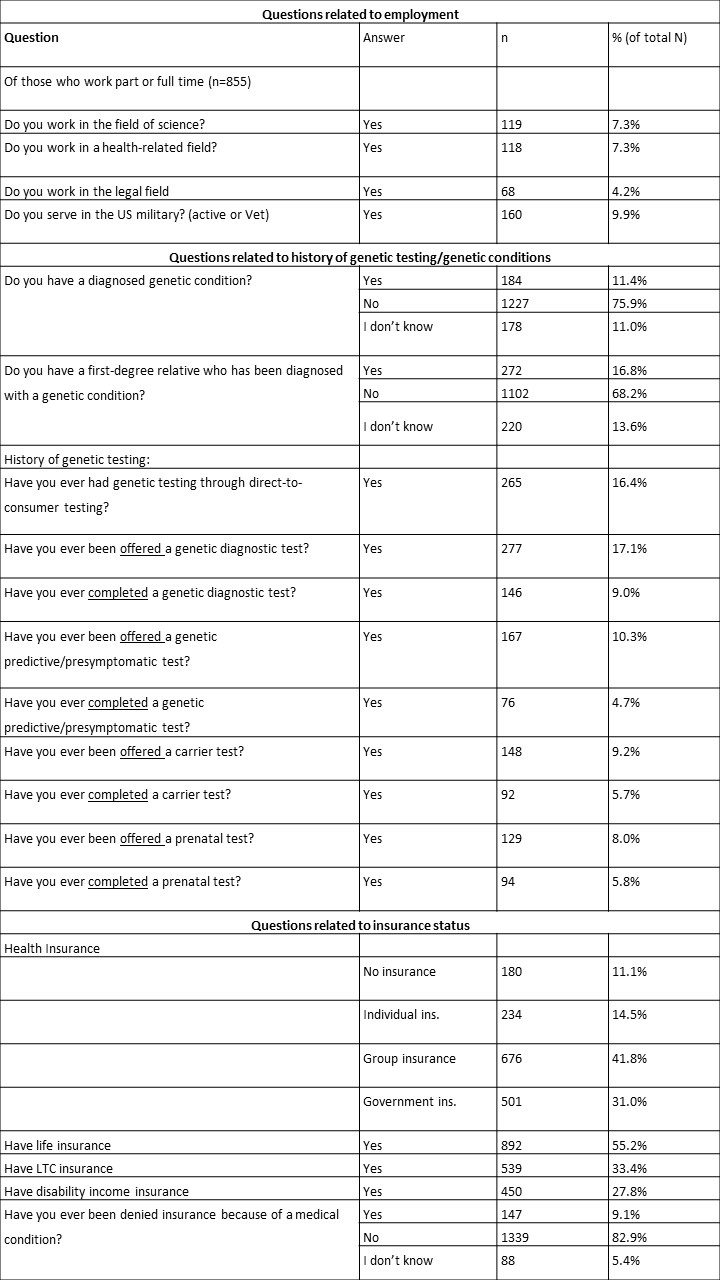

Combining data from both surveys allowed us to interrogate the effects of three demographic categories: occupation, history of genetic testing/genetic conditions, and insurance status. Overall, a small proportion of respondents worked in the fields of science (7.3%), health (7.3%), and law (4.2%) (Table 3). Just 9.9% of respondents served in the US military or were veterans.

When asked about diagnosed genetic conditions, 11.4% reported they had been diagnosed and 16.8% reported a first-degree relative had been diagnosed (Table 3). Of note, 11.0% and 13.6% of respondents indicated that they did not know if they or their first-degree relative had been diagnosed. Respondents reported that they had been offered and completed a variety of genetic testing such as diagnostic (17.1% offered, 9.0% completed), predictive (10.3% offered, 4.7% completed), carrier (9.2% offered, 5.7% completed), and prenatal (8.0% offered, 5.8% completed) (Table 3). These categories were not mutually exclusive. Overall 17.3% of respondents had completed at least one of these types of genetic tests. Some respondents (16.4%) had completed direct-to-consumer genetic testing.

Approximately 90% of respondents reported having health insurance coverage through either individual coverage (14.5%), group coverage (41.8%), or government insurance, such as Medicare or Medicaid (31.0%). Additionally, 55.2% of respondents reported having life insurance coverage, 33.4% LTC coverage, and 27.8% disability coverage (Table 3). Finally, 9.1% of respondents indicated that they had been denied insurance due to a medical condition.

Knowledge of GINA

To assess whether and how knowledge of GINA was associated with demographics related to occupation, genetic testing history, and insurance status, we ran a series of bivariate comparisons and multivariable regression analyses across two outcomes of interest: subjective knowledge of GINA and objective knowledge of GINA. As will be discussed further below, since multivariate analysis did not find many statistically significant findings, this indicates that bivariate analysis results should be interpreted with caution as the results could be driven by other factors outside these subpopulations, like age, education, or an unmeasured characteristic.

An overall objective knowledge of GINA score was calculated by taking the percentage of correct responses from seven objective questions regarding GINA’s scope of protections. Overall, objective knowledge of GINA scores were low across groups, with all analyzed subpopulations receiving an average objective score below 50%. This means that many did not know or erroneously believed that GINA either did not cover health insurance and employment or did cover life, LTC, disability, auto and/or property insurance.

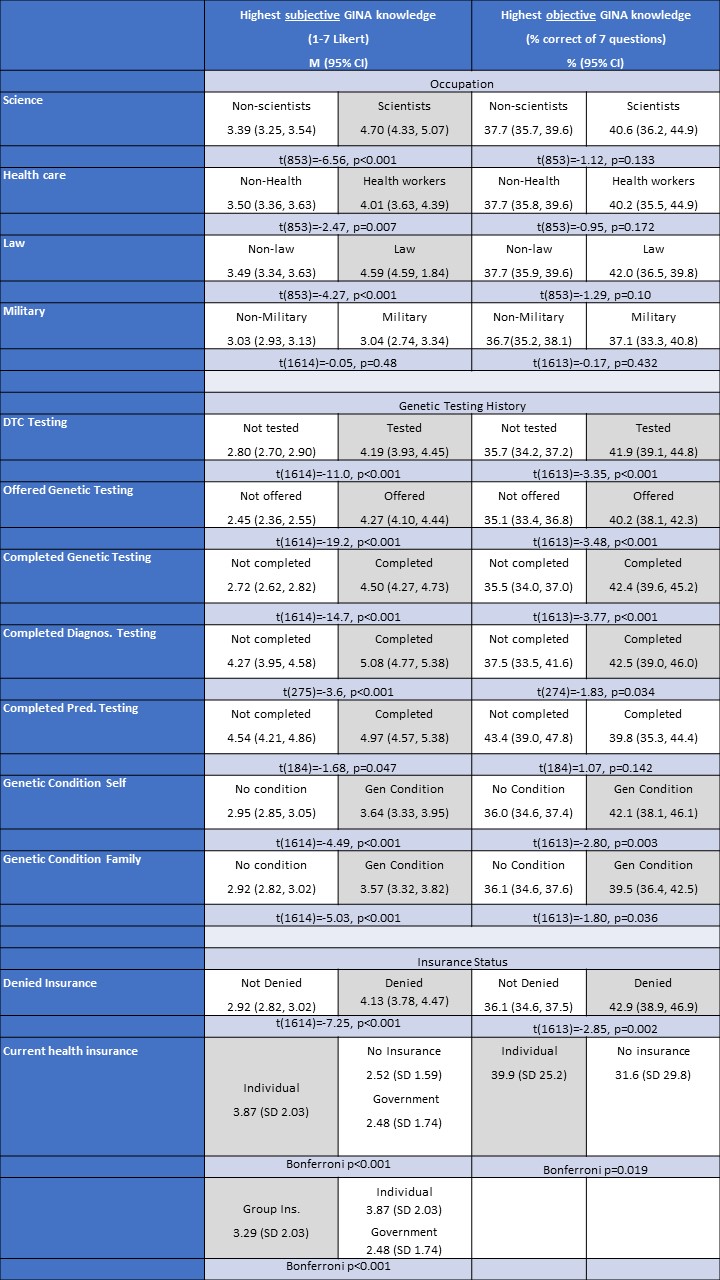

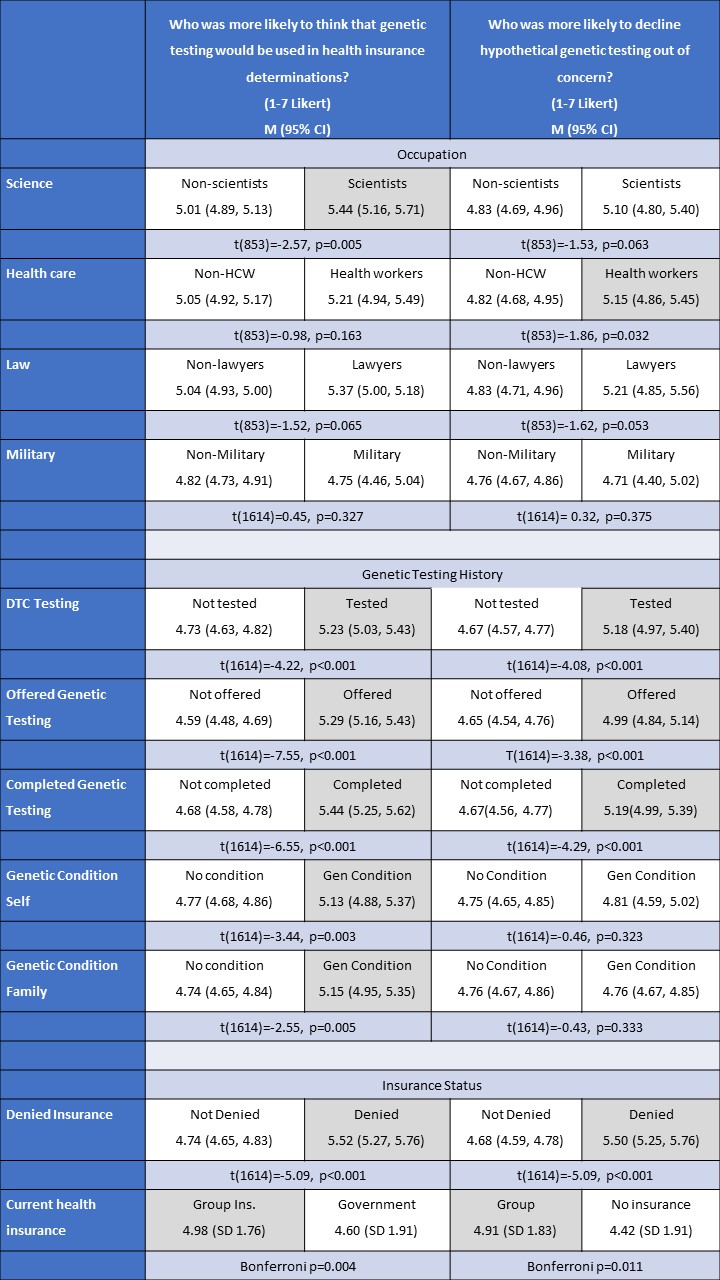

Bivariate analysis indicated that those working in science, health, and law reported higher subjective familiarity with GINA than those not working in the respective fields (Table 4). However, bivariate analysis indicated that those in all four occupations did not have statistically significant differences in objective knowledge of the law than their counterparts (Table 4).

Similar bivariate analyses were completed to assess differences across genetic history. Here there was more consistency with findings across subjective and objective knowledge. Respondents who had been offered genetic testing, completed genetic testing, undertaken DTC testing, or had a genetic condition diagnosed in themselves or a family member had both a higher average subjective knowledge of GINA and higher objective knowledge of the law than those who did not (Table 4). However, when the analysis was broken down further by testing type, there were differences. For example, while those who had completed diagnostic testing had both higher subjective and objective knowledge of GINA, those who had undergone predictive genetic testing reported a higher subjective knowledge than those who did not have predictive testing, but there was no statistically significant difference between the two groups’ objective knowledge of the law. Similarly, there were no significant differences across subjective and objective knowledge for those who had undergone carrier screening or prenatal testing and those who had not completed these tests.

Respondents who had been denied insurance due to a medical condition had both higher subjective and objective knowledge of GINA than those without a denial (Table 4). Those with group insurance were more likely than those with individual health insurance to report high subjective knowledge and those with individual insurance were more likely than those without insurance or with government insurance to report high subjective knowledge (Table 4). Only those with individual health insurance had a statistically significantly higher objective score compared to those without insurance.

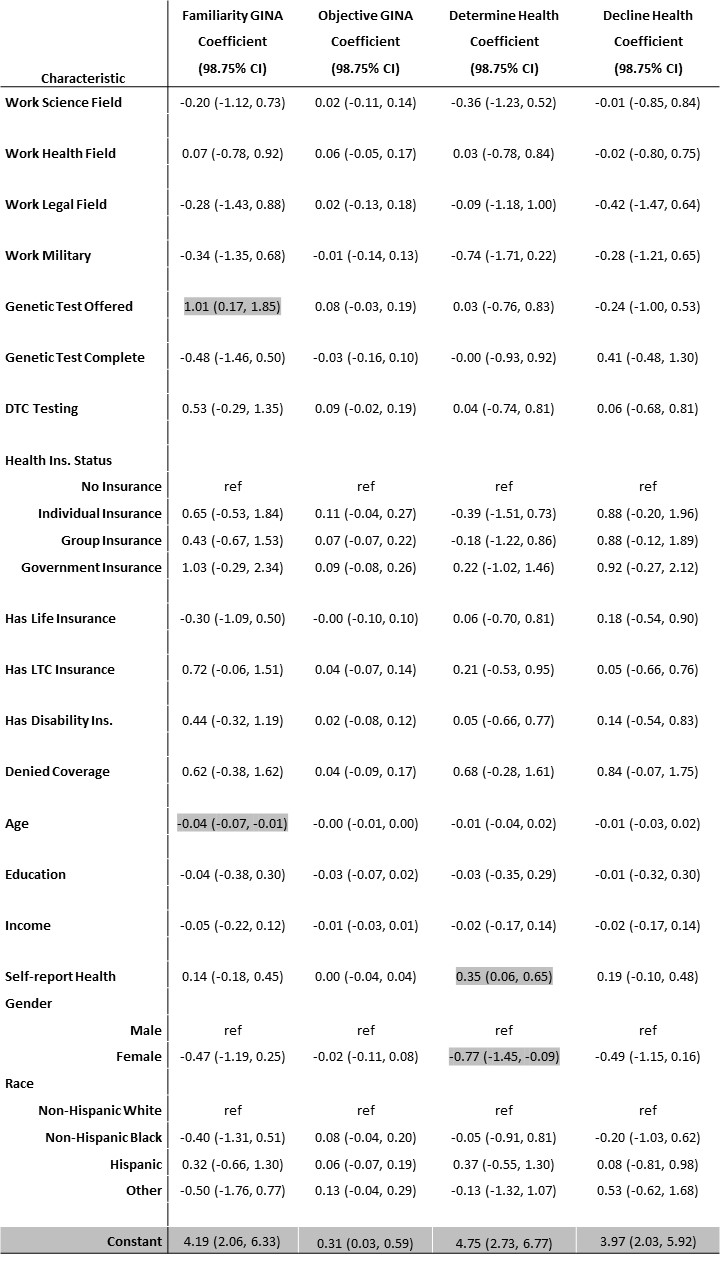

Multivariate regression models were analyzed for subjective and objective knowledge of GINA. The demographic variables of occupation, genetic testing history, insurance status, gender, race and ethnicity, age, income, and education were included in the models (Table 5). Notably, when added to a multivariate analysis, most of the findings from the bivariate analysis were not found to be statistically significant in the overall model. Older age was associated with lower subjective knowledge of GINA (B=-0.04, p<.001) and being offered genetic testing was associated with higher subjective knowledge of GINA (B=1.01, p=.003) (Table 5). However, in the regression model for objective knowledge, none of the demographic variables were found to be statistically associated (Table 5).

Concern of genetic discrimination

We tested whether occupation, genetic testing history, or insurance status were associated with the belief that genetic information would be used in insurance determinations and whether one would be likely to decline hypothetical genetic testing out of concern for its use in one of these settings. Respondents who work in science were more likely to believe that genetic information would be used in health insurance determinations (although GINA legally prevents this) than those not working in science. However, those working in health reported higher intentions to decline genetic testing out of concern for its use in health insurance determinations than those not in the field (Table 6).

Respondents who had taken a DTC test, been offered a genetic test, and completed a genetic test were all more likely than counterparts to both think genetic information would be used in health insurance determinations and to decline hypothetical testing out of those concerns (Table 6). While those with a genetic condition in themselves or family members were likely to think that genetic test results would be used by insurers, there was no statistically significant difference in their likelihood to decline genetic testing out of those concerns (Table 6).

Respondents with group health insurance were more likely than those with government insurance to think that genetic information would be used in health insurance determinations. Additionally, those with group insurance were more likely than those with no insurance to state that they would decline genetic testing (Table 6). Those who had been denied insurance in the past had higher responses for both the determination and declining questions (Table 6).

Multivariate regression analysis found that identifying as female is associated with a decreased belief that genetic information would be used in health insurance determinations (B=-0.77, p=.004), whereas having a better self-reported health is associated with increased belief that it would be used (B=.35, p=.003) (Table 5). No demographics in our regression were significantly associated with increased intentions to decline genetic testing out of concern for use in health insurance determinations.

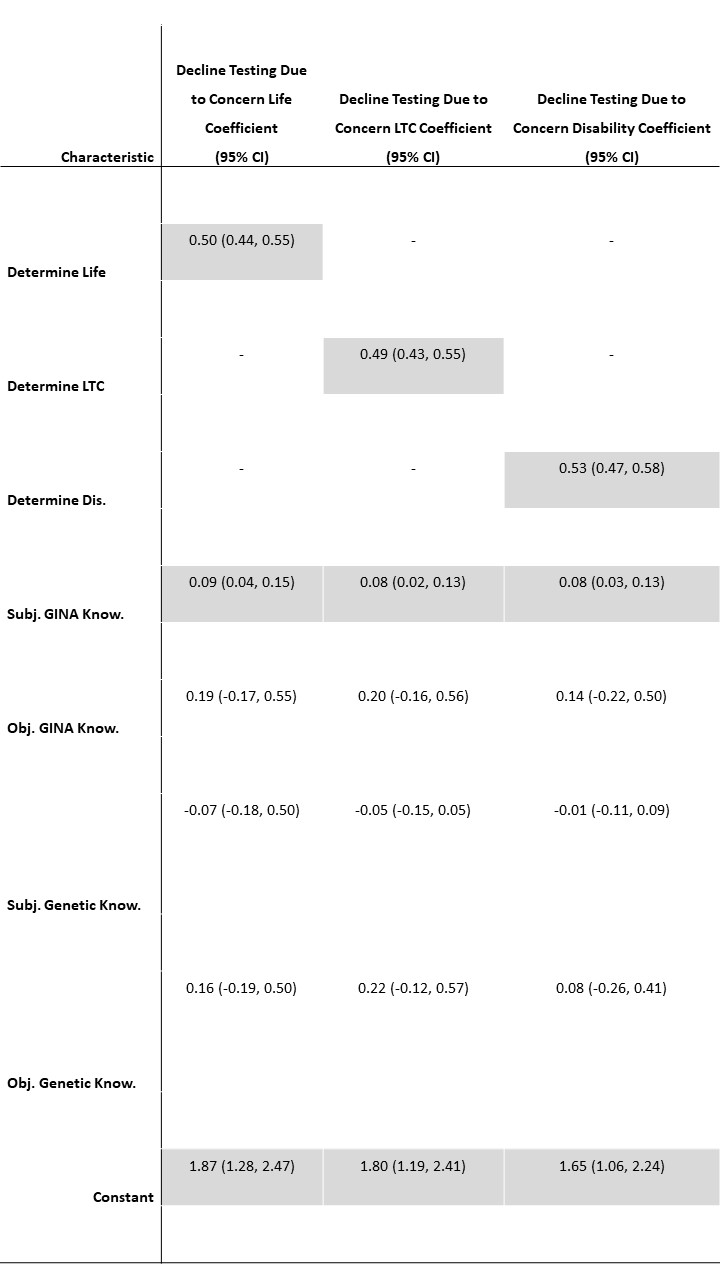

Finally, we ran three multivariate regressions to assess whether the knowledge of GINA measures were associated with the likelihood of declining genetic testing out of concern for the use of results in life, LTC, and disability insurance respectively (Table 7). An increased belief that genetic information would be used in life insurance determinations (B=.50, p<.001) and higher subjective familiarity with GINA (B=.09, p=.001) were associated with a higher likelihood of declining genetic testing out of concern for use in life insurance. This same pattern was mirrored for LTC and disability insurance (Table 7). While subjective familiarity was statistically significant in all three regressions, objective knowledge of GINA was not.

Section 6: DISCUSSION:

These two surveys are part of the first population-based study to assess knowledge of laws and fear of genetic discrimination across a diverse population. Prior studies have predominately focused on particular patient groups or health care professionals (Wauters & Van Hoyweghen, 2016; Lenartz et al., 2021) and few studies have assessed views of the US general public (Huang et al., 2013). By combining responses from two surveys, we were able to explore links between occupation, history of genetic testing, and insurance status and our outcomes of interest.

Knowledge of GINA

Overall, both subjective and objective knowledge of GINA remain incredibly low across the general population and within the specific subpopulations we analyzed. Furthermore, high self-reported subjective knowledge of the law did not always equate to higher objective knowledge. For example, while those working in science, health, and law reported higher subjective familiarity, they did not have better objective familiarity than those outside the fields.

When examining history of genetic testing and knowledge of GINA, we found greater agreement between higher subjective and objective knowledge. Those who had been offered and undergone genetic testing, reported a genetic condition in themselves or a relative, or were denied insurance due to a medical condition had higher subjective and objective knowledge than their counterparts. However, upon further analysis, those completing diagnostic genetic testing had greater objective knowledge than those not tested, but this finding was not replicated for those completing predictive genetic testing. Thus, those groups with both higher subjective and objective knowledge of GINA appeared to be those with symptoms or with genetic conditions in themselves and their family. This makes intuitive sense; those more highly engaged with medical care and specifically genetic-related care could be more likely to gain knowledge of GINA (Allain et al., 2012; Huang et al, 2013). Insurance, however, treats those already diagnosed with medical conditions much differently than those with predispositions. Indeed, GINA explicitly exempts manifested genetic conditions from its protections (GINA, 2008).

The one distinction was the finding that those undergoing DTC testing had both higher subjective and objective knowledge of GINA. These individuals would not necessarily be ones with symptoms or engaged in medical care. Overall, even groups with higher objective knowledge of GINA still had average scores below 50% for our objective GINA scale, showing widescale misunderstanding of the law even in the most knowledgeable groups. This is bolstered by the fact that regression analysis found no demographic variables included in the model associated with higher objective knowledge, although younger age and being offered genetic testing were associated with higher subjective knowledge. Therefore, the differences in knowledge in the bivariate analyses could be due to other respondent characteristics, since DTC testing was not found to be significant in multivariate analysis.

Concern of genetic discrimination

We found that respondents indicated they would be likely to decline genetic testing out of concern for how results could be used across a variety of insurances (M=4.76), a finding supported by previous literature. Additionally, only approximately half of respondents offered genetic testing for each category actually completed testing (Table 3). Some of these decisions not to take genetic testing could be tied to discrimination concerns. While bivariate analysis found that some subpopulations were more likely to decline genetic testing out of concern for use, no demographics were statistically significant in multivariate regression analysis.

In regression analysis, those identifying as male and indicating better self-reported health were more likely to think that genetic information would be used in health insurance determinations. It should be noted that GINA prohibits health insurers from using genetic information. Therefore, respondents may either not fully understand GINA’s protections or may not trust health insurers’ use of genetic information even with the law’s protections (Balkrishnan et al., 2003). A similar dichotomy between understanding of the law and concern for discrimination can be seen in the results exploring the likelihood of declining genetic testing out of concern of use across life, LTC, and disability insurance. Here the two key predictors in multivariate analysis were how likely one was to think that genetic information would be used in these settings and subjective knowledge of GINA (Table 7). Therefore, those who reported more familiarity with GINA were more likely to say they would decline genetic testing because of potential use in these areas. This makes sense given that GINA does not regulate life, LTC, and disability insurers. However, this theory may not explain those attitudes given that objective knowledge of GINA was not predictive. In other words, it is not clear that concrete knowledge of the gaps in GINA was what was driving the individuals’ likelihood of declining testing. Instead it could be that those most likely to be concerned about genetic discrimination would be more likely to be aware of a law in this area. Future study is needed to further interrogate these gaps between subjective and objective knowledge of the law and concerns of discrimination.

Impact

This data can help to increase our understanding of the potential impacts of policies related to regulation of insurer use of genetic information in two primary ways. First, policies restricting insurer use of genetic information often aim to assuage the public’s fear of genetic discrimination to encourage uptake of genetic testing (McGuire & Majumder, 2009; Joly et al., 2010). Lack of awareness or misunderstanding of laws may impede realization of their intended benefits. For example, we hypothesized that those undergoing predictive genetic testing would be likely to have higher knowledge of GINA. This is because informed consent and genetic counseling for predictive genetic testing often includes a discussion of GINA (Henderson et al., 2014). However, while those who completed predictive genetic testing had better subjective knowledge of GINA than those who had not, they did not have better objective knowledge.

Second, our study can help move forward the broader conversations about policies regarding insurer use of genetic information. Public knowledge and understanding of legal protections could impact individual behavior regarding genetic testing and insurance purchasing. The economic impact of policies restricting insurer use of genetic information on global insurance markets has been debated. For example, actuarial studies predict a range of potential effects on premiums following restrictions in life insurance (Macdonald & Yu, 2011; Lombardo, 2018; Howard, 2014). The severity of economic impact depends in part on assumptions about individual insurance purchasing behavior following a genetic test (Lombardo, 2018). Accurate prediction of this assumption is difficult, but can be bolstered by greater empirical evidence, since insurance purchasing behavior could be affected by knowledge of legal protections and fear of genetic discrimination (Golinghorst et al., fc).

One concern within these discussions is that individuals at high risk of genetic conditions will create anti-selection by purchasing large insurance policies. If insurers are not allowed to consider genetic test results, the worry is that applicants will game the system and purchase large face-value insurance policies. However, realization of this worry would require applicants to have both access to genetic testing and some knowledge of the system they are gaming. Our surveys highlight that there is much confusion and low knowledge of the protections of GINA, especially low knowledge of the specific protections of the law. Several groups had higher objective knowledge, such as those who have taken a diagnostic genetic test and those with a genetic condition in themselves or a first-degree relative. However, their relatively higher objective knowledge was still below 50% correct on the objective questions. Additionally, these groups would have manifested symptoms or family histories that could be identified by insurance applications, thus minimizing potential anti-selection impacts.

Advancing technologies

One question about the overarching debate regarding insurer use of genetic information is whether and how advances in genomic technologies will alter the economic or social impact of regulation in this area. Before the last decade, genetic tests were predominately done for single gene conditions that are generally quite rare, such as HD and BRCA1/2. With the declining prices of genetic analysis, it is now possible and increasingly common for patients to have multi-gene panel testing. This means that instead of being tested for one single-gene at a time, an individual can be tested for multiple genes linked to many different genetic conditions, such as through a panel test for cancer risk. Other expanded genetic testing is increasingly being implemented into clinical care. Whole exome sequencing, which looks at all protein-coding regions of genes in the genome, is now offered to patients with unknown genetic conditions or prior negative genetic testing (Genetics Home Reference [GHR], 2020). Whole genome sequencing, where all (or most) coding and non-coding regions are analyzed, is starting to become clinically available (GHR, 2020). Genomic sequencing greatly increases the amount of information about genetic risk that is returned to an individual, although, as discussed above, its predictive value varies greatly. Additionally, this expanded testing is more likely to occur for diagnostic purposes.

In recent years, a new genetic methodology, called polygenic risk scores (PGS), has been introduced and is being developed for use in clinical care. The scores measure the small contribution of hundreds or thousands of genetic variants to risk for disease (Conley, 2019). These scores will potentially be of interest to insurers because, unlike single-gene testing, polygenic scores are being developed for common conditions, like diabetes and coronary heart disease (Conley, 2019; Maxwell et al., 2020). However, there are limitations for wide-scale adoption. For example, most PGS are developed using data from individuals with European ancestry, so their validity may not translate across ancestries (Martin et al., 2019).

Genetic testing is also increasingly occurring outside of clinical settings and these results may not be included in an individual’s medical records. Increasing availability of direct-to-consumer (DTC) testing means that people may access information about genetic risk independently of a medical provider and without a clinical indication for undertaking testing (Gutman et al., 2013). Additionally, individuals may receive genetic information through return of results in research studies (Gutman et al., 2013; Jarvik et al., 2014; National Academies, 2018).

Overall, although thousands of genetic tests are available (NCBI, 2021), very few currently meet criteria that make them helpful for insurance underwriting (Macdonald & Yu, 2011). This is evidenced by the fact that insurance applications generally do not ask about genetic testing (Klitzman et al., 2014) and only a relatively small handful of tests have been cited in modeling studies as having potential actuarial impact (Macdonald & Yu, 2011; Lombardo, 2018; Howard, 2014). Therefore, insurers are likely only incorporating a few genetic test results into underwriting at this time; however, the public likely believes that much more of their genetic information could or would be used. This creates a disconnect where the public’s fear of genetic discrimination is beyond what may be occurring in actual practice. It remains to be seen how advancing genetic technologies will impact this status quo in the future.

Future study

These combined surveys provide insight into knowledge of GINA and concerns of genetic discrimination in the US general population. Combining the surveys provided the opportunity to assess outcomes of interest across a variety of demographics, however there are some limitations. The survey relied on several questions that have not been validated, such as the objective GINA score, so there is a chance that some questions may have been misinterpreted by participants. Additionally, as noted, respondents in one survey received information about GINA’s protections as part of the survey design, which may have increased objective knowledge scores. However, while groups of respondents in that survey received different information about GINA, there was no statistical difference between objective GINA scores across the groups. Additionally, while the objective GINA scores for this survey group were slightly better than the first survey, they remain relatively low overall.

Future study could further assess potential differences in knowledge and attitude about genetic discrimination between those who purchase insurance at the individual level versus the group level. Additionally, although this survey is focused on the US general population and US specific law, it has implications for the broader international debate about insurer use of genetic information. Future study could be done to better understand the public’s understanding of laws and policies in other countries, especially those that regulate insurer use of genetic information in areas beyond health and employment. For example, a group in Australia is currently undertaking a study to understand the implications of a recent life insurance moratorium (Tiller et al., 2021). Exploration of both the subjective and objective knowledge of law and policy across the globe can help to further understand the impact of these policies on insurance industry, insurance purchasing behavior, and assuaging fear of genetic discrimination.

CONCLUSION

GINA was passed over a decade ago to help alleviate fear of genetic discrimination and encourage uptake of clinical genetic testing and participation in genetic research. Minimizing fear of genetic discrimination has the potential to save lives if it causes individuals to undertake recommended genetic testing that they otherwise would have avoided out of fear.

Yet, as this study shows, both subjective and objective knowledge of GINA remains low in the general US population. There are some subpopulations that have higher subjective and objective knowledge of GINA compared to their counterparts. However, these higher values are relative; knowledge of GINA still remains quite poor even across subpopulations. Additionally, concern of genetic discrimination remains high in the US general population. Multivariate analysis did not unearth many significant associations between demographics of interest and knowledge of GINA or concerns of discrimination.

These results have important implications for the broader debate over whether insurers should be able to use genetic test results in underwriting. While only a handful of genetic tests currently have predictive values high enough for incorporation into insurance underwriting, the public is likely worried about much broader use of genetic test results. Yet insurers argue that they should have access to genetic test results to properly classify risks and to minimize anti-selection. However, there are questions as to how much a broad spectrum of the population will be able to game the system and create anti-selection when misunderstanding and lack of awareness of legal protections and gaps is so high. Future studies should continue to unravel the complex interactions between knowledge of legal protections, concerns of genetic discrimination, and other important factors, such as trust of the insurance industry.

ACKNOWLEDGEMENTS

Research reported in this publication was supported by the National Human Genome Research Institute of the National Institutes of Health under Award Number R00HG008819. The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institutes of Health. Thank you to Andrea Lenartz and Colleen Hartley Anderson for research support during survey design and analysis and the Iowa Social Sciences Research Center for survey support..

REFERENCES

- Allain, D.C., Friedman, S. & Senter, L. (2012). Consumer awareness and attitudes about insurance discrimination post enactment of the Genetic Information Non-discrimination Act. Fam. Cancer 11, 637–644.

- Amendola L.M., Robinson J.O., Hart R., Biswas S., Lee K., Bernhardt B.A., East K., Gilmore M.J., Kauffman T.L., Lewis K.L., Roche M., Scollon S., Wynn J., & Blout C. (2018). Why patients decline genomic sequencing studies: experiences from the CSER Consortium. J Genet Couns, 27(5), 1220–1227.

- American Academy of Actuaries, On Risk Classification: A Public Policy Monograph. (2011). In: Am. Academy of Actuaries: Risk Classification Work Group.

- Anderson, J., Lewis, A.C.F., & Prince, A.E.R. (2021). The Problems with Patchwork: State Approaches to Regulating Insurer Use of Genetic Information. DePaul Journal of Health Care Law, Forthcoming.

- Areheart, B.A., & Roberts, J.L. (2018). GINA, big data, and the future of employee privacy. Yale Law Journal, 128(3), 710-790.

- Balkrishnan, R., Dugan, E., Camacho, F. T., & Hall, M. A. (2003). Trust and satisfaction with physicians, insurers, and the medical profession. Medical Care, 41(9), 1058-1064.

- Baruch, S., & Hudson, K. (2008). Civilian and military genetics: nondiscrimination policy in a post-GINA world. The American Journal of Human Genetics, 83(4), 435-444.

- Bélisle-Pipon, J.C., Vayena, E., Green, R.C., & Cohen, I.G. (2019). Genetic testing, insurance discrimination and medical research: what the United States can learn from peer countries. Nature Medicine, 25(8), 1198-1204.

- Berry, R.M. (1996). The Human Genome Project and the End of Insurances. University of Florida Journal of Law and Public Policy, 7(2), 205-256.

- Billings, P.R., Kohn, M.A., De Cuevas, M., Beckwith, J., Alper, J.S., & Natowicz, M.R. (1992). Discrimination as a consequence of genetic testing. American Journal of Human Genetics, 50(3), 476-482.

- Bombard, Y., & Heim-Myers, B. (2018). The Genetic Non-Discrimination Act: critical for promoting health and science in Canada. CMAJ: Canadian Medical Association journal= journal de l'Association medicale canadienne, 190(19), E579.

- Born, P. (2019). Genetic Testing in Underwriting: Implications for Life Insurance Markets. Journal of Insurance Regulation, 38(5), 1-18.

- Conley, D. (2019). From Fraternities to DNA: The Challenge Genetic Prediction Poses to Insurance Markets. The Milbank Quarterly, 97(1), 40.

- Cragun D., Weidner A., Kechik J., & Pal T. (2019). Genetic testing across young Hispanic and non-Hispanic white breast cancer survivors: facilitators, barriers, and awareness of the Genetic Information Non-discrimination Act. Genet Test Mol Biomarkers, 23(2), 75–83.

- Dorsey E.R., Darwin K.C., Nichols P.E., Kwok J.H., Bennet C., Rosenthal L.S., Bombard Y., Shoulson I., & Oster E. (2013). Knowledge of the Genetic Information Nondiscrimination Act among individuals affected by Huntington disease. Clin Genet, 84(3), 251-257.

- Fusina L. (2009). Impact of GINA on physician referrals for genetic testing for cancer predisposition. Unpublished master’s thesis, Mount Sinai School of Medicine of New York University.

- Genetic Information Nondiscrimination Act (GINA) of 2008, Pub. L. No. 110-233, 122 Stat. 881 (codified as amended in scattered sections of 26, 29, and 42 U.S.C).

- Genetics Home Reference (GHR), Help Me Understand Genetics, Medline Plus, US National Library of Medicine.

- Geelen, E., Horstman, K., Marcelis, C.L., Doevendans, P.A. & Van Hoyweghen, I. (2012). Unravelling fears of genetic discrimination: an exploratory study of Dutch HCM families in an era of genetic non-discrimination acts. Eur. J. Human Genet. 20, 1018–1023.

- Golinghorst, D., De Paor, A., Joly, Y., MacDonald, A.S., Otlowski, M., Peter, R., & Prince A.E.R. (forthcoming). Anti-selection and genetic testing in insurance: An interdisciplinary perspective. Journal of Law Medicine and Ethics.

- Gostin, L. (1991). Genetic discrimination: the use of genetically based diagnostic and prognostic tests by employers and insurers. American Journal of Law & Medicine, 17, 109-144.

- Gutman, A., Wagner, J., Allen, A., Hauser, S., Arras, J., Kucherlapati, R., . . . Sulmasy, D. (2013). Anticipate and communicate: Ethical management of incidental and secondary findings in the clinical, research and direct-to-consumer contexts. Presidential Commission for the Study of Bioethical Issues (2013), 1-146.

- Hall, M.A., & Rich, S.S. (2000). Genetic privacy laws and patients' fear of discrimination by health insurers: The view from genetic counselors. The Journal of Law, Medicine & Ethics, 28(3), 245-257.

- Hall, M.A., McEwen, J.E., Barton, J.C., Walker, A.P., Howe, E.G., Reiss, J.A., . . . Harrison, B.W. (2005). Concerns in a primary care population about genetic discrimination by insurers. Genetics in Medicine, 7(5), 311-316.

- Henderson, G.E., Wolf, S.M., Kuczynski, K.J., Joffe, S., Sharp, R.R., Parsons, D.W., ... & Appelbaum, P.S. (2014). The challenge of informed consent and return of results in translational genomics: empirical analysis and recommendations. The Journal of Law, Medicine & Ethics, 42(3), 344-355.

- Her Majesty’s Government, Department of Health and Social Care. (2018). Code on genetic testing and insurance. London, U.K.: Department of Health and Social Care [UK Code].

- Holmes, E.M. (1996). Solving the insurance/genetic fair/unfair discrimination dilemma in light of the Human Genome Project. Kentucky Law Journal, 85(503), 503-664.

- Howard, R.C.W. (2014). Genetic Testing Model: If Underwriters Had No Access to Known Results. Canadian Institute of Actuaries.

- Huang, M.Y., Huston, S.A., & Perri, M. (2013). Awareness of the US Genetic Information Nondiscrimination Act of 2008: an online survey. Journal of Pharmaceutical Health Services Research, 4(4), 235-238.

- Iyer, R., Koleva, S., Graham, J., Ditto, P., & Haidt, J. (2012). Understanding libertarian morality: The psychological dispositions of self-identified libertarians. PloS one, 7(8), e42366.

- Jarvik, G.P., Amendola, L.M., Berg, J.S., Brothers, K., Clayton, E.W., Chung, W., . . . Gallego, C.J. (2014). Return of genomic results to research participants: the floor, the ceiling, and the choices in between. The American Journal of Human Genetics, 94(6), 818-826.

- Joly, Y., Braker, M., & Le Huynh, M. (2010). Genetic discrimination in private insurance: global perspectives. New genetics and society, 29(4), 351-368.

- Klitzman, R. (2010). Views of discrimination among individuals confronting genetic disease. J. Genet. Couns. 19, 68–83.

- Klitzman, R., Appelbaum, P. S., & Chung, W. K. (2014). Should life insurers have access to genetic test results?. JAMA, 312(18), 1855-1856.

- Laedtke A.L., O’Neill S.M., Rubinstein W.S., Vogel K.J. (2012). Family physicians’ awareness and knowledge of the Genetic Information Non-Discrimination Act (GINA). J Genet Couns, 21(2), 345–352.

- Lenartz, A., Scherer, A.M., Uhlmann, W.R., Suter, S.M., Anderson Hartley, C., & Prince, A.E.R. (forthcoming). The persistent lack of knowledge and misunderstanding of the Genetic Information Nondiscrimination Act more than a decade after passage.

- Lewis, A.C.F., Green, R.C., & Prince, A.E.R. (2021). Long-awaited progress in addressing genetic discrimination in the United States. Genetics in Medicine, 23(3), 429-431.

- Lombardo, M. (2018). The impact of genetic testing on life insurance mortality. Society of Actuaries.

- Macdonald, A., & Yu, F. (2011). The Impact of Genetic Information on the Insurance Industry: Conclusions from the ‘Bottom-Up’ Modelling Programme. Astin Bulletin, 41(02), 343-376.

- Martin, A.R., Kanai, M., Kamatani, Y., Okada, Y., Neale, B.M., & Daly, M.J. (2019). Clinical use of current polygenic risk scores may exacerbate health disparities. Nature Genetics, 51(4), 584-591.

- Maxwell, J.M., Russell, R.A., Wu, H.M., Sharapova, N., Banthorpe, P., O’Reilly, P.F., & Lewis, C.M. (2020). Multifactorial disorders and polygenic risk scores: predicting common diseases and the possibility of adverse selection in life and protection insurance. Annals of Actuarial Science, 1-16.

- Mayor, S. (2001). UK insurers agree five year ban on using genetic tests. BMJ: British Medical Journal, 323(7320), 1021.

- McGuire A.L. & Majumder M.A. (2009). Two cheers for GINA?. Genome Med. 1(1), 6.1–6.3.

- National Academies of Sciences, Engineering, & Medicine. (2018). Returning individual research results to participants: guidance for a new research paradigm.

- National Association of Insurance Commissioners (1996). Report of the NAIC Genetic Testing Working Group.

- National Center for Biotechnology Information (NCBI) (2021). Genetic Testing Registry.

- National Human Genome Research Institute (NHGRI) (2021). Genome Statute and Legislation Database.

- Pamarti A.K. (2011). Genetic Information Nondiscrimination Act (GINA) and its affect [sic] on genetic counseling practice: a survey of genetic counselors. Master’s thesis, Brandeis University, Waltham, MA.

- Parkman A.A., Foland J., Anderson B., Duquette D., Sobotka H., Lynn M., Nottingham S., Dotson W.D., Kolor K., & Cox S.L (2015). Public awareness of genetic nondiscrimination laws in four states and perceived importance of life insurance protections. J Genet Couns. 24(3), 512–521.

- Prince, A.E.R. (2017). Insurance risk classification in an era of genomics: is a rational discrimination policy rational? Nebraska Law Review, 96(3), 624-687.

- Prince, A.E.R. (2018). Political economy, stakeholder voices, and saliency: lessons from international policies regulating insurer use of genetic information. Journal of Law and the Biosciences, 5(3), 461-494.

- Prince, A.E.R., Suter, S.M., Uhlmann, W., Lenartz, A., Hartley Anderson, C., & Scherer, A. (forthcoming). The Goldilocks Conundrum: Disclosing Antidiscrimination Risks in Informed Consent. Available on SSRN.

- Rothstein M.A. (2018). Time to end the use of genetic test results in life insurance underwriting. The Journal of Law, Medicine & Ethics, 46(3), 794-801.

- S201, An Act to prohibit and prevent genetic discrimination, 1st Session, 42nd Parliament, 2017.

- Steck M.B., Eggert J.A., Parker V.G., Crandall L.A., Holaday B.J. (2016). Assessing awareness of the Genetic Information Nondiscrimination Act of 2008 (GINA) among nurse practitioners: a pilot study. International Archives of Nursing and Health Care, 2(2), 1–6.

- Stefanovich, O. (2020). Supreme Court of Canada upholds genetic non-discrimination law. CBC.

- Tiller, J., Winship, I., Otlowski, M.F., & Lacaze, P.A. (2021). Monitoring the genetic testing and life insurance moratorium in Australia: a national research project. Medical Journal of Australia, 214(4), 157-159. e151.

- Wauters, A., & Van Hoyweghen, I. (2016). Global trends on fears and concerns of genetic discrimination: a systematic literature review. Journal of Human Genetics, 61(4), 275-282.

Table 1: Participant demographics (N=1616)*

*Missing values are refused to answer or other

Table 2: Objective knowledge of GINA across subjective knowledge groups.

*Missing values are refused to answer or correctly identifying some, but not all of the coverage.

Table 3: Participant responses to additional demographic questions (N=1616)*

*Missing values are refused to answer or other

Table 4: Bivariate Comparison of Knowledge of GINA and Concern of Genetic Discrimination

*Shaded gray =statistically significantly higher

Table 5: Knowledge of GINA and concern of discrimination–multivariable analysis

Note: Cells in grey indicate statistically significant at p<.0125. Model fit statistics are F(22, 223) =5.29, p<0.001, R2=0.34, for Familiarity GINA, F(22, 223) =2.75, p<0.001, R2=0.21, for Objective GINA, F(22, 223) =1.40, p<0.114, R2=0.12, for Determine Health, F(22, 223) =1.44, p=0.098, R2=0.12, for Decline Health

Table 6: Bivariate Comparison of determine and decline health insurance variables

Table 7: Regression Knowledge Measures

Note: Cells in grey indicate statistically significant at p<.05. Model fit statistics are F(5, 1189) =68.76, p<0.001, R2=0.22, for Decline Testing Due to Concern Life, F(5, 1189) =62.49, p<0.001, R2=0.21, for Decline Testing Due to Concern LTC, and F(5, 1189) =79.86, p<0.001, R2=0.25, for Decline Testing Due to Concern Disability.

[1]University of Iowa College of Law

[2] Department of Internal Medicine, Division of Genetic Medicine; Department of Human Genetics; Center for Bioethics and Social Sciences in Medicine, University of Michigan School of Medicine

[3] The George Washington University Law School

[4] Department of Internal Medicine, University of Iowa

[5] In the context of employment, GINA also only covers employers with 15 or more employees, as well as state and local government employees. Other limitations include that it does not cover some federal government employees or health insurance programs, such as military and Veteran health insurance.