Planning and Caring for Special-Needs Children

From Diagnosis to Estate Planning: Roadblocks Leave Families Overwhelmed and Financially Under Protected

by Molly Hanzelka, Senior Manager, Annuity Operations Transformation, Transamerica

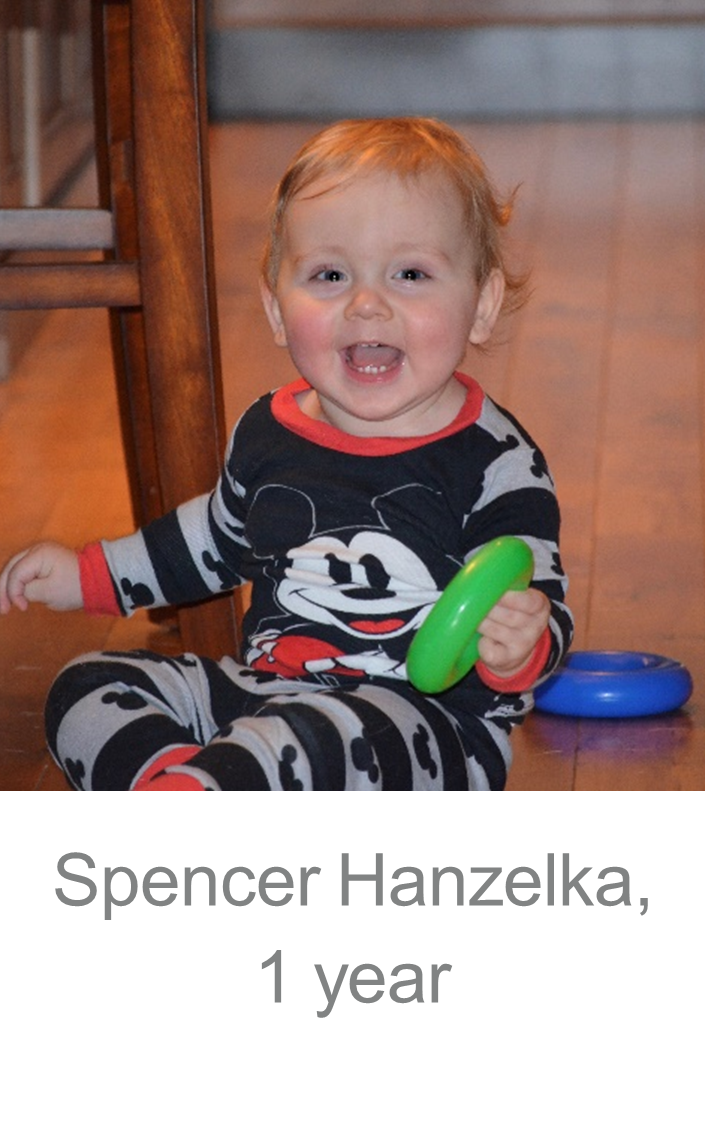

In this essay I introduce you to my son, Spencer, and convey the difficult journey to get him diagnosed with autism spectrum disorder, get coverage for life-changing treatments, and get him into those treatments. You will learn about the challenges with private insurance, the current state of Medicaid and Social Security benefits and the unlikely hero – the public school system.

Moving beyond the diagnosis and treatments, you will understand the hurdles that special needs families face while estate planning and learn about the gaps in the health and financial services industries. Lastly, you will learn about unique approaches to gaps in health and life insurance and how our legislative landscape could be updated to ease burdens felt by special-needs families.

I had the pleasure of interviewing a fellow special-needs mother, Kish Pisani, who works for the National Disability Institute. She had wonderful insights from her own journey and work experience that are included in the essay.

In the end, you will learn that the health care industry needs a massive overhaul, our legislators missed opportunities year after year to update Medicaid and Social Security qualifications. However, the financial industry has made significant headway in prioritizing special-needs families. Parents, legislators, and financial advisors still need more education and awareness.

Spinning: that is how I knew my child was different.

Spencer was nine months old when he pulled himself up to our coffee table and started spinning his colorful stackable rings. He could get all six rings spinning at the same time. He bounced up and down with excitement as he watched them spin. I would later learn that this behavior was called “stimming”, short for self-stimulating behaviors which “refers to repetitive or ritualistic moves or sounds that help an individual self-soothe when stressed or otherwise cope with their emotions” (Stimming, n.d.). Playing with toys in abnormal ways is another early sign of autism (Warner, 2007).

This first behavior set off a multi-year effort to get a diagnosis. Once Spencer was diagnosed, we faced these equally daunting tasks: to find therapies and meaningful interventions, fight with insurance companies, apply for Medicaid, and set up an Individualized Education Program (IEPs) with the school district. When it came to estate planning, I was already exhausted, financially drained, and I struggled to find a financial professional who fully understood the Medicaid and Social Security Disability rules to help my family navigate this uncertain landscape.

Kish Pisani works for the National Disability Institute and has an adult special needs son who will need supports the rest of his life. I talked to her about her experiences. She described her concerns regarding estate planning, “I think that the biggest challenge is the fear of the unknown . . . What if the money runs out? What happens to our child with a disability?” Pisani has an estate plan but is still concerned that her daughter will be put into a position to feel her brother is a burden.

After nine years from the start of our autism journey, I wanted to learn if there were significant improvements in the health and life insurance industries to support families with special needs. Are there better resources that will minimize the concerns special-needs families have? Or is this still a greatly underserved population?

Medicaid and Supplemental Security Income: Godsend or Nightmare?

In the US, there are government benefits that disabled individuals can use. Disability for a child is defined as “a medically determinable physical or mental impairment or impairments which result in marked and severe functional limitations (Understanding Supplemental Income SSI for Children - 2022 Edition, 2022).” Medicaid and Medicare cover medical expenses. Medicaid is for low-income persons, and Medicare is for those over 65 and some disabled children. Unlike Medicaid, Medicare does not have income requirements. Supplemental Security Income (SSI) and Social Security disabled child’s benefit both provide a monthly income for basic needs like food, clothing, and shelter. With SSI, the disabled individual must also be impoverished. Social Security disabled child’s benefit is for children whose parents are retired, disabled, or deceased (Ehrenberg, 2019). Our journey was through Medicaid and SSI.

I assumed that getting approved for assistance programs to provide care would be straightforward once Spencer had an autism diagnosis qualifying him as disabled. For some who already meet the income requirements, the process is relatively painless; but for my family and many parents that I met through the years, the process was frustrating, lengthy, and frequently fruitless.

In 2016, we were denied both SSI and Medicaid as we did not meet requirements. Medicaid income requirements were 133% of the Federal Poverty Level (Who Receives Medicaid, n.d.) or annual income of $26,813 for a family of three (US Department of Health and Human Services, n.d.). Our employer’s insurance covered only the autism diagnosis and not the traditional treatments.

Our only other option was to apply for a waiver which, as it sounds, could waive some of the Medicaid eligibility requirements. This would provide funding for services and supports (Home and Community Base Services , 2022). A 20-page application with extensive documentation, two-year wait, one interview, and a quick denial email later, our Medicaid journey came to an end. Unfortunately, the wait times in Iowa for waivers have not improved since 2016. According to the Iowa Department of Human Services, as of July 2022, the Intellectual Disability Waiver next application date is December 2017, a backlog of over four and a half years. The number of applicants waiting is over 6,200 and has grown by 762 this year alone (Iowa Department of Human Services, 2022). For those wait-listed, they must either rely on private insurance (which may not cover the services), pay out-of-pocket, or forgo much needed services. The middle class suffers through the waitlist process. They make too much to qualify for assistance, and often, not enough to afford the treatments even with insurance.

If it is not bad enough that the wait went from two years to four and a half years, the autism rates continue to rise. From 2000 to 2018 the autism rate increased from .67% to 2.3% (Data & Statistics on Autism Spectrum Disorder, 2022). That means unless a change is made, the wait will only get longer.

While we were on wait lists for treatment and waiting for our waiver application to be reviewed, we did not rest. We looked for alternative ways to fund the services he desperately needed. We petitioned our employers to adjust our insurance plan to include meaningful autism coverage like Applied Behavior Analysis (ABA). This is a type of therapy that works to improve social skills, communication, and fine motor skills, to name a few (Applied Behavior Analysis, n.d.). We researched the out-of-pocket costs to see if we could afford the treatment for a few years. ABA is provided by different levels of board-certified analysts (Applied Behavior Analysis, n.d.). According to Raypole, in 2021, the cost of one hour of ABA therapy was $120. The recommended hours per week for my son was 15, which equates to $93,600 per year, not including the parent training and bi-weekly review sessions. I was living my worst nightmare knowing there were life changing treatments, but we were not able afford it.

Our last-ditch effort was in 2017; we wrote our state legislatures and participated with a group of other autism advocates for the annual Autism Awareness on the Hill event in Des Moines Iowa. This was the 7th year the group had gone to the capital to get a house bill (HSB41) through the House Commerce Committee. We were delighted that our lobbying efforts succeeded. The bill passed unanimously, and it mandated certain health insurance plans pay for medically necessary autism treatments including ABA (IA HF215 2017-2018 87th General Assembly, n.d.). It was a massive financial win, but we were still on a wait list to get into a treatment center.

In 2018, we could finally get our five-year-old son started on what would be life changing interventions; and we were fortunate enough Spencer was still young. Daphne Standford explains that children respond most favorably to ABA therapy when it begins at a young age like three or four. This is due to a child’s brain being malleable, meaning it can create new neural pathways by consistently practicing new habits or behaviors. This is called neuroplasticity (Stanford, 2016). It is imperative that children with autism be diagnosed early to get the most benefit from treatments, which our medical system in Iowa is struggling to support. We were told the soonest appointment was a year and half out to get into the University of Iowa Hospitals and Clinics. In addition, it was another one year wait to get into either of the two ABA clinics in Cedar Rapids, and two years waiting for the Medicaid waiver. It would take three and a half years to wait if private insurance were not available. For many autistic children, their crucial early years are tragically spent waiting rather than treating.

Where the medical and health insurance fields lack speed and agility to support some special-needs children, the school system can provide supports through the Individuals with Disabilities Education Act (IDEA). IDEA ensures early intervention, special education, and related services to eligible children with disabilities through age 21 (About IDEA, n.d.). By the time Spencer was two, the school was his best avenue to services and not the medical community. That meant he was pulled into pre-school a year early, provided speech, occupational and ABA therapies. I was grateful for the school district and the wonderful teachers that helped him as I did not need a formal diagnosis to get services. These supports are helpful and necessary, but they are not equal to what a child can get in the private sector. For example, Spencer’s ABA therapy in school was 20 minutes two to three times a week vs three hours a day through his private therapy. The results of the extra hours in private therapy were remarkable. He started engaging in imaginative play, reading comprehension soared past his age level, and they helped him to self-regulate in stressful situations all but eliminating meltdowns and behavior issues at school.

Though my experience with lengthy delays and the immense expense for treatments is specific to autism, it is not unique. However, my experience demonstrates that it is essential to keep Medicaid and Social Security benefits after waiting years to qualify for them.

Medicaid and Social Security Ongoing Eligibility

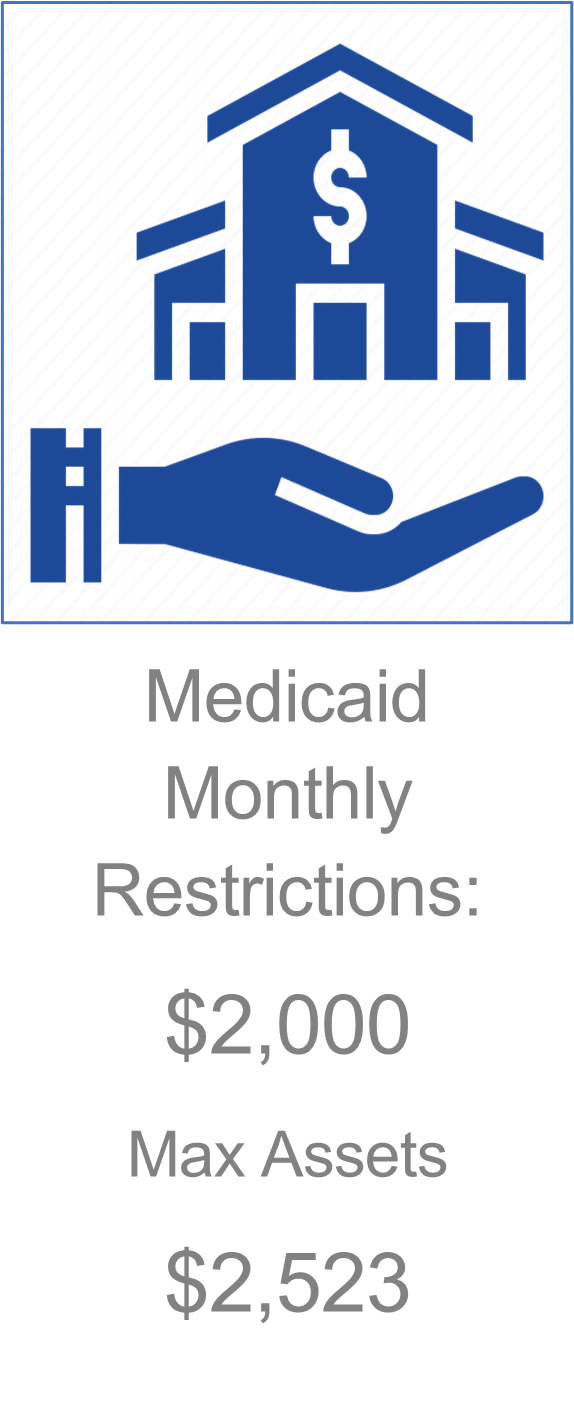

Medicaid and SSI benefits have ongoing eligibility requirements such as asset limits. SSI assets include cash in hand, checking and savings accounts, stocks, bonds, and vehicles (except for one). An SSI recipient who is single cannot have more than $2,000 in assets, $3,000 if married. There are similar rules for parents of children who receive SSI benefits. The difference is the first $2,000 if living with one parent or $3,000 if living with two parents is ignored, but any assets above that will follow the same asset limit of $2,000 or $3,000 for adults (Laurence, 2022).

Medicaid asset limits are similar to SSI, but Medicaid is not as straight forward as each state has their own rules regarding asset limits. For example, New York has a limit of $16,800 whereas Connecticut is $1,600 (Married couples $24,600 and $3,200 respectively) (MedicaidLongTermCare.org, 2022).

In addition, Medicaid and SSI also have income limits which are complicated and vary by state. In general, in 2022 the income limit for Medicaid is $2,523 per month for a recipient, double if married (Will Receiving an Inheritance Disqualify a Medicaid Long Term Care Beneficiary, 2022). The critical take away is that if the recipient goes over the income or asset limits, they could be disqualified from eligibility for all months they are over the limit and could be required to reimburse any benefits received while ineligible.

For example, a Medicaid/SSI recipient receives $100,000 directly from an inheritance putting the recipient over the income and asset limits. It is possible to spend the entire inheritance in the month it was received, but there are rules. If the rules are violated, there is a penalty of months or even years of Medicaid ineligibility (Medicaid's Look-Back Period: Rules, Exceptions & Penalties, 2021). Violations include:

- Large gifts of money

- Donating a car

- Selling assets for less than fair market value

There are also exemptions from countable assets like a primary residence, a car, certain trusts, and a somewhat new addition called Achieving a Better Life Experience (ABLE) accounts. This is important as we start to consider how to effectively estate plan. A Medicaid/SSI recipient should not be directly named as a beneficiary unless the inheritance is going to be under the asset limit ($2,000) or else they are likely to lose their insurance and/or monthly income.

According to Ehrenberg, special needs trusts are “generally the best way to leave an inheritance”. Transfers of property, gifts for the special needs individual, and life insurance payouts made to the SNT do not count toward the asset limits (Ehrenberg, 2019).

There are several types of SNTs. When planning for special-needs children, a common type of trust is a third-party special needs trust. This is where a family member is providing the funding, and a trustee will have complete discretion regarding distributions. Another benefit of a third-party SNT is that it is not subject to Medicaid’s right to recover once the individual passes away. For example, if a home is in a recipient’s name and not an SNT, Medicaid can put a lien on the house after death to recover funds spent while alive.

Funds from the trust cannot be used for every type of expense as there is risk of jeopardizing government benefits. Distributions should be used to for expenses that Medicaid and SSI do not automatically cover such as clothing, personal care, entertainment, electronics (phones, TVs), internet, pet care, payments to caregivers, etc (What is a Special Need Trust? The Complete Guide, n.d.).

There are drawbacks to setting up SNTs. The biggest hurdle is the cost. The legal fees can be thousands of dollars. Estate Planning Lawyer News states special needs trust can cost anywhere from $2,000 to $3,000 but can be up to $10,000 (How much does it cost to set up a Special Needs Trust? , 2022). My financial advisor estimated that in Iowa legal costs could be between $6,000 to $10,000 and even more in bigger cities like Chicago or New York. The cost is due to the specialized nature of setting up the trust. For lower income families, this may be a barrier to effectively providing for their loved one.

Another consideration with SNTs is ensuring that someone is a responsible manager of the trust. It can have disastrous effects if the wrong person is selected. Family members are frequently the first choice to be a trustee; however, they may not be the right person. An effective manager must stay apprised of changes in benefits and manage day-to-day finances. In addition, there must be a contingent trustee in the event the family member is unable to continue as trustee or dies. To mitigate this risk, family members can either be a co-trustee or act as an advisor to the trust with professional corporate trustees as managers. Ehrenberg states “Corporate trustees are bonded, insured, and regulated. In most states they are governed by the Prudent Investor Act, which sets the legal standard for a fiduciary regarding the trust’s investments.”

Achieve a Better Life Experience Act (ABLE)

The Achieving a Better Life Experience Act was passed in 2014 and allows for a tax-advantaged savings account for people with disabilities. ABLE accounts are similar to 529 college savings plans where funds can accrue federal income tax free. Some states also allow tax advantages. Funds can be added by the disabled person or third parties. To be eligible for an ABLE account, an individual needs to be disabled prior to age 26. It is limited to one account (Spotlight on Achieving a Better Life Experience (ABLE) Accounts, 2022). This type of account can provide some financial relief for those with disabilities.

As we were applying for Medicaid, I purposely did not put money away in a 529 plan or into a savings account for my son to avoid a spend down. ABLE accounts were not available in Iowa until 2017, two years after we applied (IAble is here for you!, n.d.). My new advisor informed me that I could have rolled over a 529 plan into an ABLE account and avoided the asset limit.

ABLE accounts follow the annual gift exception limits; for 2022, the limit is $16,000. If the beneficiary is not contributing to their employer’s retirement plan, they can also contribute an additional $12,880 (the federal poverty line) (Mass Mutual Special Care, 2022). One drawback with the contribution limits is that there is not a guaranteed annual raise in the limit to adjust for inflation. Prior to a $1,000 increase in 2022, the last time the gift exception limits changed was 2018. Before that, it was adjusted in 2013. There was only a $2,000 increase in the past nine years (Garber, 2022). According to Inflationtool.com, inflation has increased 85.74% since the gift exception was created in 1997. The gift exception limit has only increased by 60% in that same time period, leaving a 25% shortfall.

ABLE accounts also have maximum balance limits that are based on each state’s 529 plan caps. For 2022, it could be between $235,000 to $529,000. If the account owner is receiving SSI benefits and the ABLE account (plus their other resources) is over $100,000, SSI is suspended until the balance is under that limit. An SSI suspension will not impact Medicaid eligibility (Mass Mutual Special Care, 2022).

Like SNTs, ABLE accounts must be spent on certain expenses defined as qualified disability expenses. Education, housing, transportation, and assistive technology are a few examples. Any expenses that are not qualified are subject to a 10% federal income tax penalty (Mass Mutual Special Care, 2022).

Unlike SNTs, ABLE accounts are also subject to Medicaid’s right to recover. At the time of the account owner’s death, Medicaid can recoup funds regardless of who deposited the funds. Unfortunately, not all states have ABLE accounts: Idaho, North Dakota, South Dakota, and Wisconsin (Webber, 2022). ABLE accounts could be more widely used. In Iowa, the program has been in effect for five years and has around 1,400 accounts (Treasurer Fitzgeral Celebrates Five Years of IAble, 2022). For such a vital resource, it appears to be underutilized.

As we start to think about how to fund either an ABLE or SNT, we need to consider the contribution limits and that SNT distributions can reduce SSI payments. ABLE accounts cannot receive a large lump sum inheritance but could get regular payments. These vehicles can be used separately or in conjunction for estate planning.

Finding a Knowledgeable Financial Professional

It is equally important for a special needs individual to maintain eligibility for public benefits as it is to find a financial professional who understands the intricacies of those benefits. Ehrenberg provides a brilliant analogy comparing financial advisors to family doctors. “While he or she may be fine at treating ordinary illnesses and accidents, one would not select that doctor to perform a heart bypass. One would use a specialist.” When I tried to update our estate plan, I struggled to find an advisor who understood how government benefits worked. My agent did not have the knowledge nor did anyone at the insurance agency. My friends in the industry who worked at local agencies were not able to help either. I searched online for an advisor who focused on special-needs families. I gave up. I recently started my search again hoping this time would be different.

Success! Kind of. I was able to find more options that specifically identified professionals that understood planning for a special-needs child; but it could be easier. I found that several well-known firms did not have an option to select special-needs planning as a specialty. For firms that have special-needs focused advisors, I had to dig to locate information. To my surprise, there were firms that clearly made special needs families a priority. My search was by no means exhaustive, but Morgan Stanley and MassMutual were by far the easiest out of the 20 or so firms and carriers to locate a financial professional with a special-needs focus. In fact, one stood out – MassMutual. They created a SpecialCare program specifically designed for special-needs families. Their financial planners have advanced training on issues that impact families like mine.

Living in Iowa made the search even harder. The firms that had special-needs disciplines did not have anyone in my state. Most searches only went 50 miles from my zip code. I would not be able to meet face-to-face, but zoom meetings were an easy concession to speak with a knowledgeable advisor.

What concerned while me researching insurance carriers was that a few had direct-to-consumer life insurance but no way to indicate a desire for special-needs planning. Is the carrier going to be able to fill the role of a knowledgeable advisor to special-needs families? Or will the client be on their own? There is no assurance there will be competent advice at all.

Chartered Special Needs Consultant (ChSNC)

Through working with MassMutual SpecialCare, I became aware of the Chartered Special Needs Consultant (ChSNC) professional designation. It is obtained through the American College of Financial Services. According to the college, it was created in 2014 and “is the only credential specifically designed to prepare financial advisors to help plan for those with special needs.” I was astonished to see that the industry had already put together a meaningful curriculum to shed light on the complexity of special-needs planning.

The curriculum consists of three online courses that focus on special education basics, disability legislation, legal and financial issues including Social Security and Medicaid, special needs trusts, ABLE accounts, and lifetime planning considerations. Each of the three classes has 14 weeks of material allowing for the ChSNC designation to be obtained in less than a year (ChSNC Chartered Special Needs Consultant, n.d.).

You can also find an advisor on the college’s website with filters by designation or expertise (which includes special-needs planning). I found advisors with a ChSNC designation in Iowa, but none that were within 100 miles. If you can find your way to this website, it is a more direct link to knowledgeable professionals. In other words, you must already know where to look.

As an investor, you can verify your advisors’ designations through the Financial Industry Regulatory Authority (FINRA); however, the ChSNC designation is not listed. I contacted FINRA to understand why this designation was absent. They responded that the supporting agency needed to apply to have the designation listed on the website. I also reached out to the American College of Financial Services. They were that not aware the designation was not listed on the FINRA website. I asked if they would apply but I have not received a response.

The Centers for Disease Control (CDC) state that 26% of adults live with a disability. There was an increase in children with developmental disability from 16.2% in 2011 to 17.8% in 2017 (Increase in Developmental Disabilies Among Children in the United States, 2022). Special-needs families are a growing market for which advisors need to be adequately prepared. However, it does not appear that the ChSNC is a well-known designation. The American College of Financial Services stated they currently have 674 people who hold the designation with them. This is an incredibly small number compared to the nearly 93,000 Certified Financial Planners (CFP) designations in the US (CFP Professional Demographics, 2022). This illustrates just how difficult it is to find a trained professional.

Estate Plans and Life Insurance Options

Hanna Horvath, a Certified Financial Planner at Policygenius, reported that it costs $1.4 to $2.4 million to raise a child with autism or an intellectual disability. The more severe the disability, the higher the costs. Getting the right amount of life insurance coverage is critical for special-needs families. Parents must consider transitional expenses (like moving from parent’s home), plus current expenses and discretionary funds to supplement public benefits CITATION Ehr19 \l 1033 (Ehrenberg, 2019).

Pisani explained that the financial planning aspect for her son was something she and her husband gravitated toward as it was in their control. “. . . we just started planning, knowing that essentially, we needed to plan as if we were paying for college tuition for the rest of our life [sic] CITATION Kis22 \l 1033 (Pisani, 2022).”

When it comes to estate planning, the riskiest action is to do nothing. According to the Academy of Special Needs Planners, doing nothing is the most prevalent estate plan in the US. Confronting and planning for your mortality can be overwhelming. Some people simply think they have more time. Either way, your state’s probate code will set the rules. There is no consideration for heirs with special needs. This puts their public benefits at risk CITATION Aca14 \l 1033 (Academy of Special Needs Planners, 2014).

Another risky estate plan is to leave the inheritance to a sibling to be used for the benefit of the disabled child. Because the funds are not earmarked properly, there are several concerns. For the non-disabled sibling, there are additional tax consequences, the entire inheritance could be subject to his/her creditors, included as an asset in divorce proceedings, a bankruptcy, or financial aid for college CITATION Ehr19 \l 1033 (Ehrenberg, 2019). Fortunately, there are better options with SNTs, but what is the best vehicle to fund the trust?

When considering how to fund the trust, anything of value can be put into the trust. Real estate, retirement plans, stocks/bonds, and life insurance are all examples of investments that can help finance the SNT. There are several types of life insurance that can help meet the desires of special-needs families. There needs to be enough money to continue the disabled person’s way of life and to stretch those funds for their entire life. Below are common options:

Whole life is permanent life insurance that can build cash value over time and guarantees a fixed death benefit. If premiums are kept current, the policy is active for the entire life of the policy holder.

Risk: The downside is that it is expensive, costing up to 10 times more than a term policy (Cruz-Martinez, 2022).

Term life insurance on the other hand is typically inexpensive, but only guarantees a payout during a specified period. Policies may be renewed at expiration, but premiums are likely to increase with age (McCarten).

Risk: This can be a great option to fund a SNT; however, if the policy holder outlives the term, the trust gets nothing.

Survivorship or Second-to-die life insurance is another cost-effective means to fund a SNT. It pays out only when the second insured passes away. There are a few risks with this type of policy. If the primary caregiver passes away first, paying someone to take on the caregiver role can be expensive. If the primary breadwinner dies first, life insurance funds may be needed to pay the day-to-day expenses (McCarten).

Risk: The living insured may need life insurance proceeds that are not accessible upon the first death.

Life Insurance can pay a lump sum to the SNT; however, that alone does not mean the funds will last for the disabled person’s lifetime. There are other investment vehicles that can help. Transamerica has an Income Protection Option (IPO) Rider that provides an initial lump sum that could be used to cover burial expenses. The policyholder can then select a duration between five to 25 years for which recurring payments can be made to a beneficiary. This option provides a guaranteed minimum interest rate, and is closer to stretching those funds for the beneficiary’s lifetime.

Risk: If the beneficiary lives longer than the duration specified, the payments will stop.

Single Premium Immediate Annuity (SPIA)

Taking life insurance proceeds and investing in a single premium immediate annuity (SPIA) can satisfy concerns with the money running out. A SPIA is designed to take a lump sum and turn it into an income stream for a duration set by the policyholder. There are payout options that can provide recurring payments for the life of the annuitant, but there are downsides. Annuities have fees that can be expensive. Unlike with a rider, there is no guaranteed minimum interest rate. You get the current interest rate.

Risk: SPIAs are subject to inflation risk; however, you can pay additional fees for an annual cost of living adjustment (COLA). The policy is unchangeable. This type of policy typically does not allow for withdrawals or loans for emergencies.

Many employers offer basic life insurance options that can provide one year’s salary, and sometimes offer the salary to be multiplied by factors. For example, at Transamerica, I can get four times my annual salary at a very low cost. Additional death and dismemberment and disability insurance through an employer adds further protection.

Risk: These benefits are a great complement to other insurance while you are working; however, if you die after you retire, these benefits may not be available.

A knowledgeable financial planner will help identify the amount of coverage and design a plan that will likely feature multiple investment vehicles. There is not a single solution to the complex planning needed as each family will have different requirements. There are still opportunities to create products or features that better support special-needs families. What is challenging for carriers is the inconsistency between states. It is difficult to create a product that is Medicaid friendly which pays an ABLE account because states have different rules: contribution limits, maximum account values and inconsistent increases to both.

Middle class and lower income families have greater limitations to obtain comprehensive coverage for their special-needs child. They already bear a substantial financial burden to support their child. They may only be able to afford term or survivorship policies if anything at all. In fact, “about 83% of potential life insurance buyers find it is too expensive to purchase (Attias, 2022).” Perhaps there is an opportunity for microinsurance which is more prevalent in developing countries.

Microinsurance provides smaller face values with lower premiums that help low-income families when traditional insurance markets are ineffective. Peer-to-peer (P2P) insurance is an alternative to the traditional life insurance model. P2P is typically a small group of insureds that pool their funds, self-organize, and self-administer their own insurance. “The core idea of P2P is that a set of like-minded people with mutual interests group their insurance policies together introducing a sense of control, trust, and transparency while at the same time reducing costs (Peer-to-Peer (P2P) Insurance, 2022).” Lemonade, a burgeoning P2P insurance company, offers term life insurance with no medical exams for as low as $9 a month (Term Life Insurance For the Next Generation, n.d.).

When I look back on our journey with Spencer to get to a diagnosis, find services, and someone to help plan for his future, it was hard. Unnecessarily hard. I wanted to see if special-needs families were still an underserved population. I concluded that it is a mixed bag of improvements and deteriorations. In the health care industry, the experience has gotten worse in many aspects like lengthy delays with getting a diagnosis and getting approved for waivers. But there have been big wins on a legislative front with the creation of ABLE accounts and requiring private insurance to cover treatments. There are many more tools and resources available to support parents who are navigating government benefits and financial planning; but it could still be easier. Current investment vehicles are adequate for some and completely out of reach for others. In other words, the work is not done.

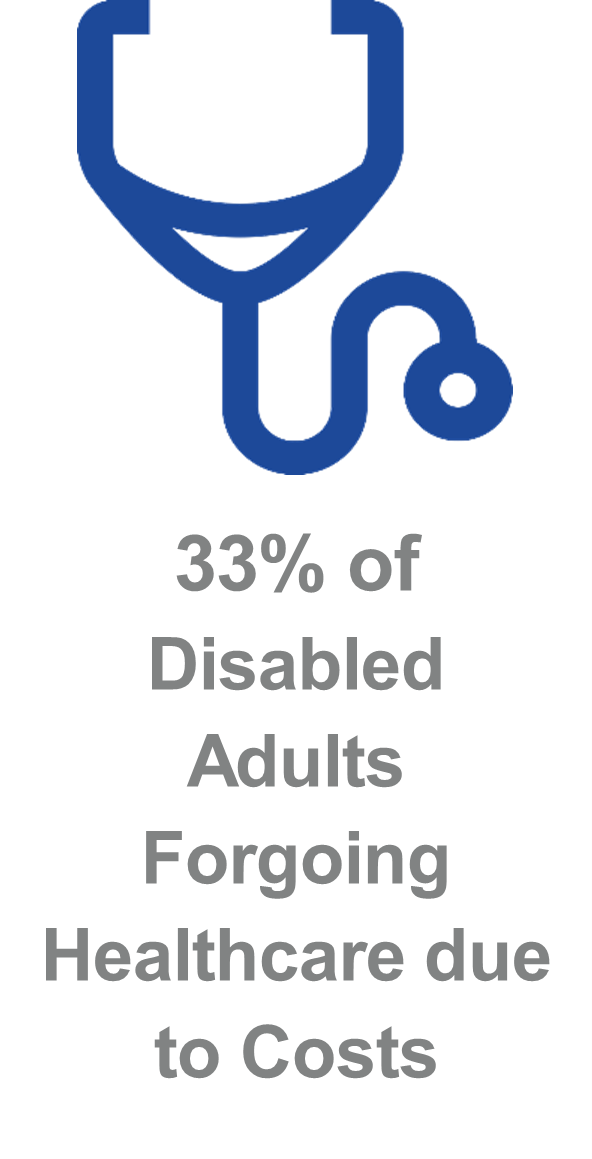

Regardless of political affiliation, all sides agree that health care in the US is broken. In Iowa, there are not enough doctors to diagnose autism spectrum disorder; and this causes year-long delays. After the child is diagnosed, the family still must fight to get and continue treatments. I had to prove every year that my son was autistic to remain in certain therapies, even though it is well known there is no cure for autism. The CDC states that 33% of disabled adults are not getting needed healthcare due to costs (Disability Impacts All of Us, 2020).

Getting approved for waivers and battling health insurance companies is excruciating. The system inadvertently puts pressure on the middle class to make themselves poorer to qualify for government benefits. There is no easy answer, and it is a highly controversial topic. A single-payor system could eliminate some of the issues. At a minimum, government benefits could be more accessible to the middle class by creating income tiers. It could adjust the assistance level accordingly. More special-needs children could get treatments sooner. Microinsurance or even additional supplemental employee benefits may also be an opportunity in the health care space. These solutions could allow individuals to pay premiums for specific treatments while getting the benefit of the negotiating power of an insurance company.

I was overjoyed to learn about the ChSNC professional designation that focuses on the complex financial planning for special-needs families. In addition, carriers like Mass Mutual have invested in programs like SpecialCare, which makes special-needs families a priority. This is the exception and not the rule. There is an opportunity for more insurance carriers and agencies to see the economic value of supporting families with disabled children. Furthermore, promotion of the ChSNC designation among advisors should be a priority. It is a concern that so few advisors have adequate training.

Middle class and low-income families are still underserved in the insurance industry. The financial drain of supporting a special-needs child is a hurdle to obtain comprehensive life insurance. Group life insurance through employers is a cost-effective means to get some coverage while working. For low-income families, being able to pay for funeral expense or paying off a mortgage may be their priority. MassMutual has a program called Lifebridge which offers free life insurance. It is a $50,000 death benefit and a ten-year term which pays educational expenses for beneficiaries (MassMutual's LifeBridge Program, n.d.). Funds are paid to a trust, but I was not able to determine the type of trust to confirm if disabled individuals could maintain their eligibility. P2P insurance companies are offering an alternative all-digital experience, no medical exams, fast applications and claim payouts for very little cost.

There is an opportunity for Medicaid/SSI-friendly SPIA that ties to an ABLE account. It could be based on the life of the disabled person in alignment with the Social Security life expectancy tables. The product could also have the option for an annual COLA to reduce the risk of inflation. This would keep benefit eligibility, avoid the need for a special needs trust, and provide income for the disabled person’s lifetime. There are several hurdles to build a product like this. To support a COLA, legislative changes would be needed. To avoid the maximum contribution and account value limits, a competent administrator would still be needed.

Medicaid needs a legislative overhaul. Iowa privatized Medicaid in 2016 in an attempt to curb costs. The state maintains that they are saving money; however, providers are saying they are not getting adequately reimbursed (Ramm, 2018). Another explanation could be denied services. Iowa state auditor Rob Sand reported in 2021 that illegally denied services rose 500% to 890% since privatization (Vander Hart, 2021). This means that denials are the norm and not the exception. Disabled individuals are forced to go through appeals processes and even legal battles, pay for treatments out-of-pocket, or forgo treatments.

The Medicaid and SSI asset tests are outdated and have not kept up with the rate of inflation. There have been a few unsuccessful attempts to introduce the Supplemental Income Restoration Act (SSIRA), the last effort was in 2021. The legislation proposed to raise the asset test from $2,000 to $10,000 for individuals and $3,000 to $20,000 for couples. This bill also proposed an automatic increase tied to the inflation rate (S. 2065 Supplemental Security Income Restoration Act of 2021, n.d.). Arizona and California have removed the asset test all together (University of Pittsburgh, 2021). These measures would increase eligibility, help protect recipients against extreme poverty, and keep the asset limits in line with current inflation rates.

ABLE accounts should be available in all states. It makes a big difference to have a little more financial freedom and maintain eligibility for government benefits. Ideally, there would be more consistency among states with ABLE account contribution limits. Implementation of automatic increases tied to the inflation rate would further protect account holders.

It is unlikely that there will be a shift in the legislative landscape near term. States want to have the flexibility to create their own rules. The SSIRA has stalled out for the time being. Pisani provides her experience, “I’m stunned at how much the legislators don’t even know themselves what’s going on. Medicaid is not just welfare. . .. People don’t realize that Medicaid is Home Based Community Waiver funding for people with disabilities . . .” When legislators do not understand the impact or urgency to change, much needed updates like the SSIRA can sit for years.

Parent’s Opportunities/Responsibilities

Be Formidable – A parent is the best advocate for their special-needs child. Being a strong advocate is stressful, overwhelming, and exhausting; but it is so rewarding to see your child improve. Spencer is thriving, and it was not due to chance or luck. It was due to never-ending persistence and not accepting no for an answer. Whether that was to go out of state for a diagnosis, find treatments, not let the school district close his IEP, or petition the state legislature, we continued to look for new avenues to get what we needed at each stage.

Find a Mentor – This journey is so much easier when parents can learn from someone who has done it before. Pisani advised parents to find someone who has a child 10 years older. Parents can then prepare well in advance for the next phase in their child’s life. Educate yourself about treatments, Medicaid, SSI, ABLE, etc. There are so many more resources today; a mentor can help you find them.

Plan for the Inevitable – Take the time to find a financial professional that is adequately trained to help with estate planning. Determine if a special needs trust is appropriate, consider an ABLE account, and budget for estate-related expenses. It is not a painful process when working with the right advisor.

Make Yourself a Priority – It is so easy to put yourself last when your entire focus is to support your special-needs child. To be formidable, you must take time to recharge your batteries. Lastly, ask for help. When the special-needs community sees you at the bottom of the barrel, they know what you are going through and know how pull you back up. You are not alone; community makes all the difference.

Works Cited

7.7.22 Monthly Slot and Wait List Public . (2022, July 7). Retrieved from Iowa Department of Human Services: https://dhs.iowa.gov/sites/default/files/7.7.22_Monthly_Slot_and_Wait_list_Public.pdf?072620220229

About IDEA. (n.d.). Retrieved from IDEA Individuals with Disabilities Education Act: https://sites.ed.gov/idea/about-idea/

Academy of Special Needs Planners. (2014). Free Special Needs Guides. Retrieved from Special Needs Answers: https://specialneedsanswers.com/special-needs-guides/1/10-mistakes-in-special-needs-planning/booklet-10-Costly-Mistakes.pdf/123050/27179

Applied Behavior Analysis. (n.d.). Retrieved from Psychology Today: https://www.psychologytoday.com/us/therapy-types/applied-behavior-analysis

Attias, R. (2022, June 22). Find Affordable Life Insurace for Low-Income Families. Retrieved from Effortless Insurance: https://www.effortlessinsurance.com/life-insurance-low-income-family/

CFP Professional Demographics. (2022, August 1). Retrieved from CFP Board: https://www.cfp.net/knowledge/reports-and-statistics/professional-demographics

ChSNC Chartered Special Needs Consultant. (n.d.). Retrieved from The American College of Financial Services: https://www.theamericancollege.edu/designations-degrees/ChSNC

Cruz-Martinez, G. &. (2022, June 21). What is Whole Life Insurance and How Does it Work? Retrieved from Money: https://money.com/whole-life-insurance-guide/

Data & Statistics on Autism Spectrum Disorder. (2022, March 2). Retrieved from Center for Disease Control and Prevention: https://www.cdc.gov/ncbddd/autism/data.html

Dayz, S. (2022, July 16). Iowa Autism Spectrum Parents. Retrieved from Facebook.com: https://www.facebook.com/groups/281771965255915/questions

Disability Impacts All of Us. (2020, September 16). Retrieved from Cedters for Disease Control and Prevention : https://www.cdc.gov/ncbddd/disabilityandhealth/infographic-disability-impacts-all.html

Ehrenberg, H. L. (2019, August). Special Needs Estate Planning - Seven Overloked Challenges. Society of Financial Service Professionals, 73(5), 6-12. Retrieved from https://mydigitalpublication.com/publication/?i=610649&article_id=3454341&view=articleBrowser&ver=html5

Garber, J. (2022, May 23). The Annual Gift Tax Exclusion. Retrieved from The Balance: https://www.thebalance.com/annual-exclusion-from-gift-taxes-3505637#:~:text=The%20Annual%20Gift%20Tax%20Exclusion%20for%20Tax%20Year,%20%20%2416%2C000%20%2022%20more%20rows%20

Home and Community Base Services . (2022, May). Retrieved from Iowa Department of Human Services: https://dhs.iowa.gov/sites/default/files/Comm270.pdf?072620220329

Horvath, H. (2021, December 20). How to afford raising a child with disabilities. Retrieved from Policygenius: https://www.policygenius.com/disability-insurance/news/financial-planning-child-disability/#:~:text=Autism%20Speaks%2C%20an%20autism%20advocacy%20organization%2C%20estimates%20the,the%20lifetime%20cost.%20But%2C%20you%20can%20financially%20prepare.

How much does it cost to set up a Special Needs Trust? . (2022, March 25). Retrieved from Estate Planning Lawyer News: https://www.estateplanninglawyer-news.com/how-much-does-it-cost-to-set-up-a-special-needs-trust/

IA HF215 2017-2018 87th General Assembly. (n.d.). Retrieved from LegiScan: https://legiscan.com/IA/bill/HF215/2017

IAble is here for you! (n.d.). Retrieved from IAble: https://www.iable.gov/resources/about-us

Increase in Developmental Disabilies Among Children in the United States. (2022, May 16). Retrieved from CDC: https://www.cdc.gov/ncbddd/developmentaldisabilities/features/increase-in-developmental-disabilities.html

Iowa Department of Human Services. (2022, July 7). Retrieved from 2022 Monthly Slot and Waiting List Detail: https://dhs.iowa.gov/sites/default/files/7.7.22_Monthly_Slot_and_Wait_list_Public.pdf?072620220229

Iowa Medicaid Wavier Disability Services & Waivers. (n.d.). Retrieved from Medicaidwaiver.org: http://medicaidwaiver.org/state/iowa.html

Laurence, B. K. (2022, March 11). How Much Can I have in Assets and Still be Eligible for SSI Disability Benefits? . Retrieved from DisabilitySecrets: https://www.disabilitysecrets.com/how-much-can-i-have-in-assets-and-get-disability.html

Mass Mutual Special Care. (2022). ABLE Account Basics. Springfield, MA, US.

MassMutual's LifeBridge Program. (n.d.). Retrieved from MassMutual: https://www.massmutual.com/sustainability/community-impact/lifebridge

McCarten, J. (n.d.). Strategies for Funding a Special Needs Trust. Retrieved from Special needs Alliance: ttps://www.specialneedsalliance.org/blog/strategies-for-funding-a-special-needs-trust/

Medicaid Eligibility Income Chart by State. (2022, July). Retrieved from American Council on Aging: https://www.medicaidplanningassistance.org/medicaid-eligibility-income-chart/

MedicaidLongTermCare.org. (2022, July 8). Retrieved from How Your State Impacts your Medicaid Eligiblity Requirements: https://www.medicaidlongtermcare.org/eligibility/by-state/#:~:text=State%20Medicaid%20programs%20set%20total%20countable%20asset%20limits,set%20the%20limits%20at%20%243%2C200%20and%20%2424%2C600%2C%20respectively.

Medicaid's Look-Back Period: Rules, Exceptions & Penalties. (2021, October 27). Retrieved from MedicaidLongTermCare.org: https://www.medicaidlongtermcare.org/eligibility/look-back-period/

Peer-to-Peer (P2P) Insurance. (2022, May 11). Retrieved from NAIC: https://content.naic.org/cipr-topics/peer-peer-p2p-insurance

Pisani, K. (2022, May 25). Challenges faced by special needs families . (M. Hanzelka, Interviewer)

Ramm, M. (2018, July 1). State of Iowa has no data to support Medicaid savings claim, heath care offical says. Retrieved from The Gazette: https://www.thegazette.com/health-care-medicine/state-of-iowa-has-no-data-to-support-medicaid-savings-claim-health-care-official-says/

Raypole, C. (2021, June 221). Is Applied Behavioral Analysis (ABA) Right for Your Child. Retrieved from healthline: https://www.healthline.com/health/aba-therapy#_noHeaderPrefixedContent

S. 2065 Supplemental Security Income Restoration Act of 2021. (n.d.). Retrieved from Govtrack: https://www.govtrack.us/congress/bills/117/s2065/text/is

Spotlight on Achieving a Better Life Experience (ABLE) Accounts. (2022). Retrieved from Social Security: https://www.ssa.gov/ssi/spotlights/spot-able.html

Stanford, D. (2016, September 5). Neuroplasticity and the autism spectrum. Retrieved from PsyPost: https://www.psypost.org/2016/09/neuroplasticity-and-the-autism-spectrum-44799

Stimming. (n.d.). Retrieved from Psychology Today: https://www.psychologytoday.com/us/basics/stimming

Term Life Insurance For the Next Generation. (n.d.). Retrieved from Lemonade: https://www.lemonade.com/life

Treasurer Fitzgeral Celebrates Five Years of IAble. (2022, January 27). Retrieved from IAble: https://www.iable.gov/resources/iable-news/treasurer-fitzgerald-celebrates-five-years-of-iable

Understanding Supplemental Income SSI for Children - 2022 Edition. (2022). Retrieved from Social Security: https://www.ssa.gov/ssi/text-child-ussi.htm

University of Pittsburgh. (2021, December 21). Changes to Outdated Medicaid limits could improve eligibility for vulnerable seniors. Retrieved from Medical Press: https://medicalxpress.com/news/2021-12-outdated-medicaid-limits-eligibility-vulnerable.html

US Department of Health and Human Services. (n.d.). 2016 Poverty Guidelines. Retrieved from Office of the Assistant Secretary for Planning and Evaluation: https://aspe.hhs.gov/2016-poverty-guidelines

Vander Hart, S. (2021, October 21). State Auditor: Iowa's Medicaid Privatization Increases Illegal Denials of Care. Retrieved from The Iowa Torch: https://iowatorch.com/2021/10/21/state-auditor-iowas-medicaid-privatization-increases-illegal-denials-of-care/

Warner, J. (2007, July 5). Cues May Signal Autsim in Toddlers. Retrieved from webmd.com: https://www.webmd.com/brain/autism/news/20070705/cues-may-signal-autism-toddlers

Webber, M. R. (2022, 22 2). ABLE Accounts by State. Retrieved from Investopedia: https://www.investopedia.com/state-able-accounts-5217828

What is a Special Need Trust? The Complete Guide. (n.d.). Retrieved from CPT Institute Benefits Preserved: https://www.cptinstitute.org/special-needs-trust/

Who Receives Medicaid. (n.d.). Retrieved from Iowa Department of Human Services: https://dhs.iowa.gov/ime/members/who-receives-medicaid

Will Receiving an Inheritance Disqualify a Medicaid Long Term Care Beneficiary. (2022, Feb 28). Retrieved from American Council on Aging: https://www.medicaidplanningassistance.org/inheritance/#:~:text=If%20you%20are%20a%20Medicaid%20recipient%20and%20receive,it%2C%20it%20is%20vital%20that%20you%20do%20so.