Declining Populations Put Additional Pressure on Social Insurance Systems

IIS Executive Insights Life & Health Expert: Ronald Klein, Founder, Obtutus Advisory GmbH

Largest Ponzi Schemes in the World

Netflix recently aired a limited series about Bernard Madoff who fashioned the largest Ponzi scheme to date. Some estimate that the fraud amounted to approximately USD 65 billion of investor monies while others quote a much lower figure of USD 10 – 17 billion[1]. It is very difficult to arrive at the correct figure as records were fabricated and some investors were too embarrassed to admit that they had been swindled. Regardless of which number is used, it has been called the largest Ponzi scheme to date.

When asked if she knew about the Ponzi scheme, Madoff’s wife Ruth was quoted as saying that she did not know what a Ponzi scheme was. This type of scheme is named after Charles Ponzi who was born in Italy in 1882. He emigrated to the US in the early 1890s to pursue a better life. After a short stay in Canada and a few prison terms, he ended up in Boston in 1919. It was there that he discovered the International Revenue Coupon (IRC) which was basically pre-paid return postage on an international letter. Ponzi quickly realized that he could arbitrage exchange-rate differences and make a tidy sum[2]. But, instead of limiting this to his own money, he raised funds from investors and his scheme took root. Ponzi promised incredible short-term gains to investors and paid those investors with money raised from new investors. He began to invest in real estate, stocks and bonds instead of IRCs. The large payouts to older investors actually caused them to re-invest funds perpetuating the fraud. By mid-1920, the media and authorities caught onto the scheme making Charles Ponzi forever infamous.

While Charles Ponzi bears the name for this type of scheme and Bernie Madoff is purported to devising the largest Ponzi scheme to date, there are governmental programs which bear striking similarities to Ponzi schemes that have been running for decades. Social Insurance systems (Social Security in the US or Pillar I in most other countries) and other pay-as-you-go systems take money from new “investors” to pay older “investors”. Of course, these governmental systems differ in that they are mandatory, have rules for contributions and benefit payments and are enacted by politicians. However, the same issues that occur with Ponzi schemes, when there are not enough new investor monies to pay returns to older investors, apply to Social Insurance systems.

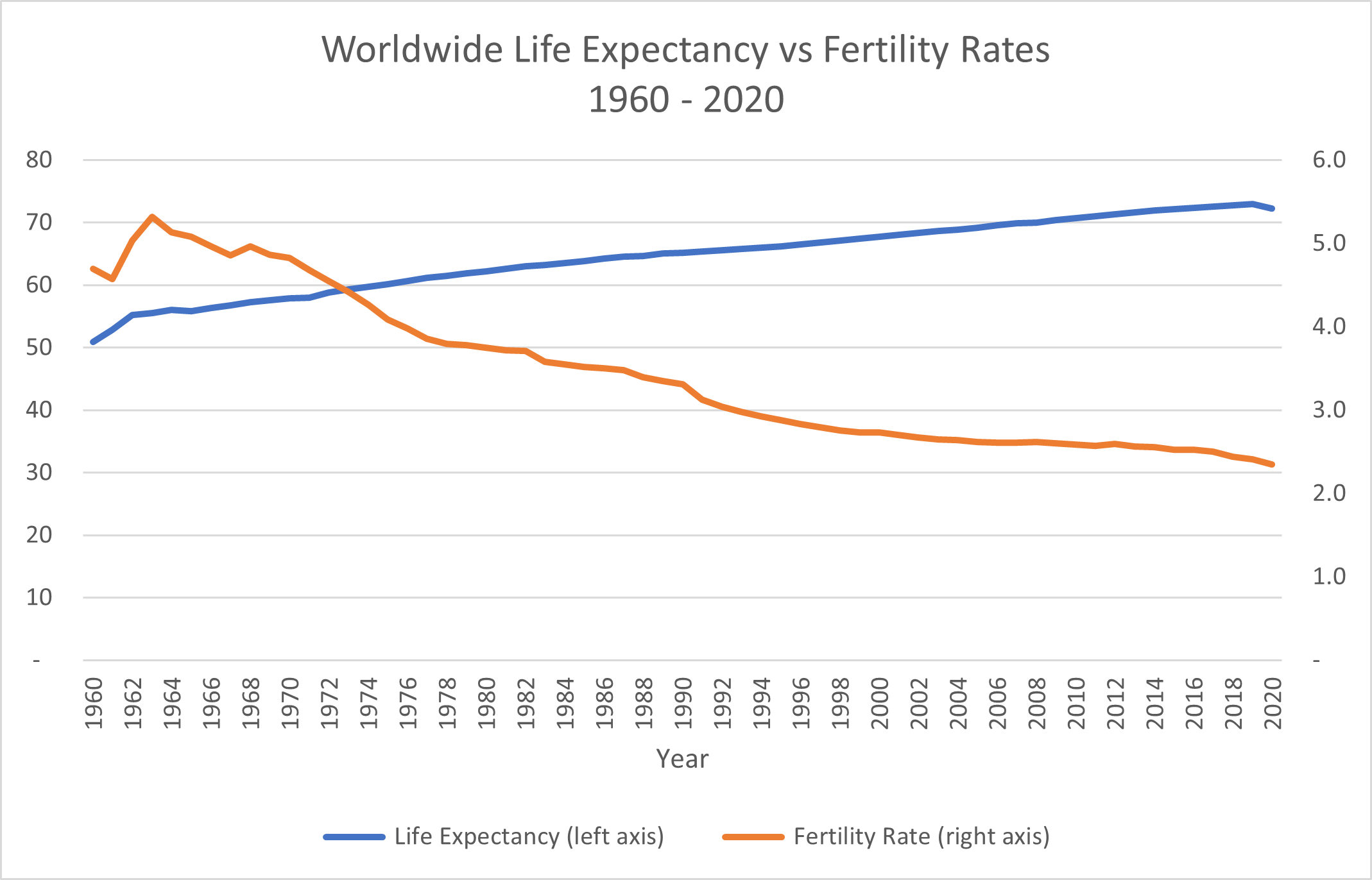

Most developed countries have been forecasting increased benefit payments and reducing contributions for decades. As life expectancies continue to rise, benefits must be paid to an ever-increasing proportion of the population for longer. Even though the pandemic caused a drop in life expectancy in 2020, the increasing trend is projected to continue for the foreseeable future. And, as fertility rates continue to decrease, there are fewer workers to support these benefit collectors leaving a widening gap between benefit collectors and workers (see Figure 1). This “predictable surprise” has caused countries to increase the age at which normal retirement benefits may be taken, increase contribution rates or both. At least one country, however, is attempting to change its own demographics to help ease the strain.

Figure 1

Source: United Nations Population Division

China Attempts to Reverse Low Fertility Rates

China is currently the second most productive county measured by Gross Domestic Product (GDP) and the largest country in the world by population (see Figure 2). Its status as most populous country may soon come to an end as for the first time since the widespread famines caused by the Great Leap Forward in the 1950s, China recorded a population decrease in 2022. Put more simply, more people in China died in 2022 than were born.

Figure 2

| Country | Gross Domestic Product (GDP) (USD Trillions estimated 2023) | 2020 Population (millions) |

| United States | 20.5 | 331 |

| China | 13.4 | 1,439 |

| Japan | 5.0 | 126 |

| Germany | 4.0 | 84 |

| United Kingdom | 2.8 | 68 |

| France | 2.8 | 65 |

| India | 2.7 | 1,380 |

| Italy | 2.1 | 60 |

| Brazil | 1.9 | 213 |

| Canada | 1.7 | 38 |

Source: United Nations, International Monetary Fund

China joins an ever-lengthening list of countries with declining populations including Japan, Greece, Hungary, Poland, Portugal and Italy. There are many theories as to why populations are in decline. Education of women, more women in the workforce, urbanization of society and economic concerns are a few of the more widely acknowledged philosophies for the dramatic drop in fertility rates. For China, however, one need not look much further than the 1979 One Child Policy. It is interesting that in the 1970s, China’s government was concerned with population over-growth therefore instituting this policy. And, just 60 years later, China is faced with a completely different crisis – population decline.

While experts were projecting population decline in China for years, few believed that it would occur this soon. The relaxation of the One Child Policy to two children in 2016 and further relaxation to three children permitted in 2021 has done little to stem the tide of fewer births per woman. Forbidding families to have children by penalties such as fines, imprisonment and forced abortion can do a lot to reduce the number of births. Increasing the number of births is not as straight forward. Many countries have tried with limited success.

Australia’s “Baby Bonus” is an example of a failed policy meant to boost its declining birthrate. Offering an AUD 6,000 cash payment for each childbirth did increase the number of births in the short term, but fertility rates quickly dropped below the levels seen prior to the introduction of the bonus in 2004. Experts believe that couples who were considering starting families took advantage of the bonus, but still had the same number of children as they had originally planned for. Another example is Sweden which began to offer generous parental leave of nine months (now as much as 16 months) and even a “Speed Premium” which incentivized mothers to have multiple children. These programs have limited short-term success, but even fertility rates in Sweden are below the replacement rate of 2.1 births per female. Not only do these programs put stress on schooling as there is typically an influx of children in one year but not the next, but they are very expensive. It left many countries wondering if the short-term success exhibited by these programs was worth the cost.

Even with the benefit of case study after case study in countries such as Australia, Sweden, Hungary, France and Germany, China has introduced programs and is considering other programs aimed at increasing fertility rates. These include less widely used plans such as subsidized invitro fertilization treatments, paying college students for sperm donations and allowing unwed mothers to register babies, as well as more standard plans such as paid maternity leave and child subsidization payments. All have met with very limited success.

Many women of child-rearing age have lived through the One-Child Policy and are just not mentally prepared to have children. Others cite the expense of raising a child in China. Still others bear the sole burden of caring for an elderly parent. In any case, a recent survey showed that over 60% of 18–25-year-olds say that they are not interested in having children[3]. This should be worrying for the Chinese government.

Declining Population May Hurt Growth

What makes China even more unique is that there is a net migration from the country. Other countries such as the US and Germany can effectively battle low fertility rates with relatively robust immigration policies. China’s reluctance to allow immigration just exasperates the issue. And this brings us back to the projections that China will become the largest economy in the world by 2030 or before in terms of GDP. Attempting to increase fertility rates is expensive. Having fewer young adults entering the workforce can lower overall country output. And most importantly, caring for an ever-increasing aged population with fewer workers will be extremely costly to the government. In other words, the Ponzi scheme will begin to crumble.

Seeing this problem on the horizon, China began to take steps to mitigate the pending social insurance issues. It created a fund in 2000 with government money from state-owned enterprises to protect aging citizens. This fund has been growing steadily and monies are invested in Chinese companies. Last year China began to allow contributions into individual retirement accounts and also relaxed regulations to allow pension insurers to provide private annuities. China also has room to increase its normal retirement age having one of the lowest age requirements in the world. It is expected that a plan to raise retirement age to 65 gradually by year 2055 will be announced later this year. Currently, men can retire at age 60 and women at age 55 with earlier retirement available for blue-collar workers.

Increasing the age to receive government retirement benefits is not just a financial issue. There is a “contract” between younger and older citizens of a country. The young “agree” to support the old understanding that when the young retire, they will be cared for in a similar manner. This social contract is becoming political as the percentage of retirees in many countries is projected to increase dramatically. In China, for example, it is estimated that the percentage of the population over age 65 is approximately 13%. This should grow to nearly 30% by 2050[4]. Having a large percentage of a country’s population unhappy with retirement benefits will certainly cause political unrest. Just ask President Emmanuel Macron of France. He recently pushed through an increase of retirement age from 62 to 64 and has been met with widespread strikes and protests.

The Insurance Industry Can Help

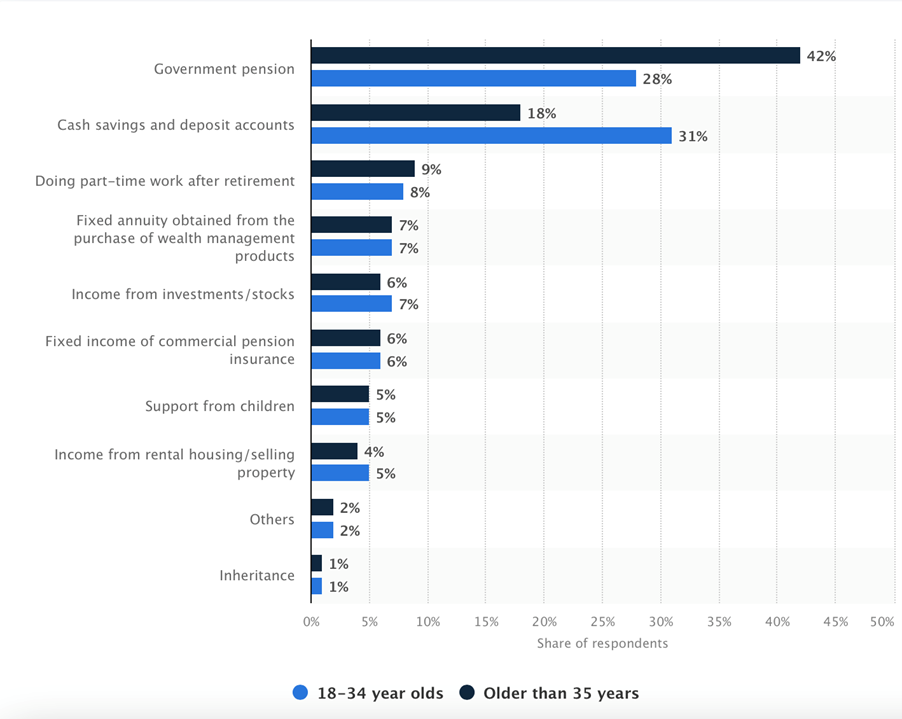

Even with mitigating policies, the demographics of China will begin to put more and more pressure on the financial output of the country expected to be the largest worldwide economy in the next few years. This shows that well thought out retirement systems are critical to the prosperity of a country. One would think that with the current pressure on social insurance systems in China, individuals would plan for their own retirement. However, a recent survey conducted last year showed that participants over age 35 expect 42% of retirement income to come from social insurance and only 7% from a private annuity (see Figure 3). The younger group expects to rely less on government pensions and more on personal savings, but still only 7% foresee purchasing an annuity. This is a huge opportunity for the insurance industry. The first opportunity is to educate the population about the benefits of private annuity income and the second is to educate the population about the frailty of the social insurance system. This opportunity does not only apply to China but to all major countries.

Figure 3

Key Sources Expected for Retirement Income in China, 2022

Source: https://www.statista.com/statistics/1077947/china-expected-sources-for-retirement-income/

Conclusion

Increased life expectancies and low fertility rates are putting extreme pressure on social insurance plans in most countries. With a continued increase in life expectancies projected, the problem will only get worse unless fertility rates rise dramatically. However, encouraging women to have babies has proven difficult and expensive. The expense of social insurance programs and plans to increase fertility will begin to lower financial growth of the major worldwide GDP-leading countries. China is the largest country to begin to experience population decline. This could inhibit its projected takeover as the world’s leading economy.

If more individuals could plan for their own retirement, it would take pressure off of social insurance systems. This would give politicians more tools to sure up social insurance for those who need it most. The insurance industry is the only industry which has the ability to guarantee lifetime income for retirees. Education about the importance of planning early is key. Government officials in China understand this and are beginning to take steps to allow insurers to offer vital products to individuals. The insurance industry should take advantage of this opportunity and highlight its value to society. With only 7% of retirement income expected to be received from private annuities, there is much work to be done. It is crutial that the insurance industry gets to work to educate people in China and around the world about the importance of planning for one’s own retirement. Only then will countries be able to reduce the financial, social and political pressures caused by declining populations.

4.2023

[1] https://finbold.com/guide/bernie-madoff-ponzi-scheme/

[2]https://internationalbanker.com/history-of-financial-crises/charles-ponzi-1920/

[3] https://www.nytimes.com/2023/02/26/world/asia/china-birth-rate.html?searchResultPosition=1

[4] https://www.visualcapitalist.com/cp/chinas-aging-population-problem-1950-2100/

About the Author:

Ronnie is founder of Obtutus Advisory GmbH, an expert witness, contributor to the International Insurance Society and Advisor with Achaean Financial. He has over 40 years of insurance and reinsurance experience having worked and lived in 3 countries. Ronnie is Co-Chair of the Programming Committee for the ReFocus Conference and served on the Board of Directors of the Society of Actuaries. Before this, Ronnie worked as the Head of Life Reinsurance for Zurich Insurance Group in Zürich, Head of Life Reinsurance for AIG in New York and Global Head of Life Pricing for Swiss Re in London. Ronnie began his career at Mutual of New York. A little-known fact is that Ronnie holds a patent (US20060026092A1) for the first Mortality Bond issued called Vita when he was with Swiss Re.

View More Articles Like This >