Emerging Digital Carbon Market and Regenerative Finance (ReFi)

IIS Executive Insights Cyber Expert: David Piesse, CRO, Cymar

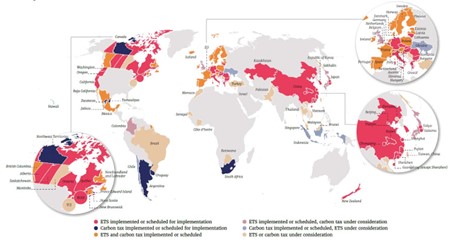

Direct carbon pricing instruments, a key policy to decarbonization, now cover almost a quarter of global greenhouse gas (GHG) emissions, according to a new World Bank 2023 report.[i]

“Carbon pricing can be an effective way to incorporate the costs of climate change into economic decision making, thereby incentivizing climate action,” says Jennifer Sara, global director for climate change at the World Bank. “The good news from this report is that even in difficult economic times, governments are prioritizing direct carbon pricing policies to reduce emissions. But to really drive change at the scale needed, we will need to see big advances both in terms of coverage and price.”

The key to successfully reducing global GHG emissions through carbon markets could be digital infrastructure that keeps verified data secure and ensures that reductions are accurately accounted and tracked.[ii]

Regenerative Finance (ReFi)[iii] is an emerging financial system focusing on the power of blockchain and Web3, combined with regenerative economics to address climate change, support conservation, and encourage financial inclusion, sustainability, and biodiversity. This addresses the circular economy[iv]to increase the supply of raw materials by recycling waste.

Overview

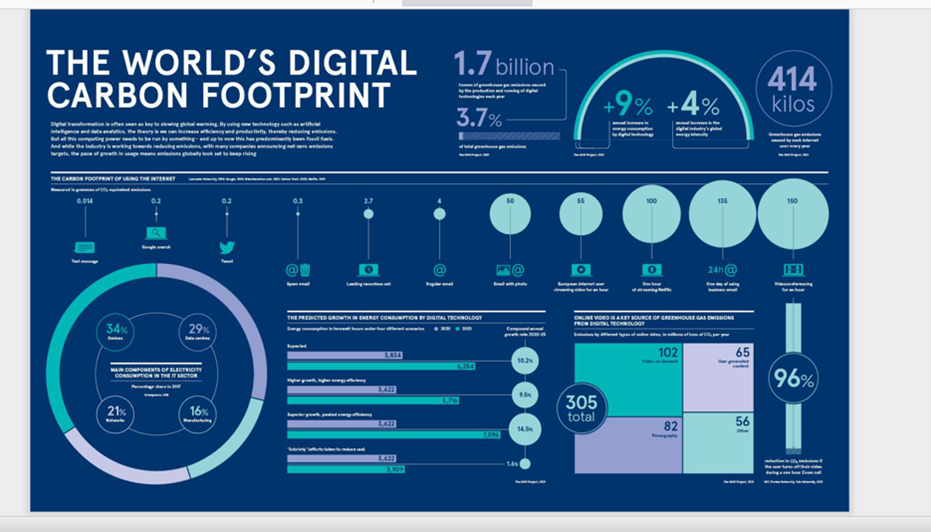

Approximately 2.5 trillion tons of carbon were released into the atmosphere since carbon dioxide (CO2) records began, with 50 billion tons of CO2eq released each year[v]. In July 2023, the planet started to see temperature rises above 1.5 degrees centigrade, which may become permanent by 2027; [vi] so digitisation of the carbon market is needed to avoid leakage. The carbon market was established in the Kyoto Protocol in 1997[vii] and ratified by the Paris Agreement[viii] in 2015.

As shown by the MIT[ix] table below, every person, company, and country has a carbon footprint that can be levied as a risk charge equivalent to the carbon amount they use, leading to carbon pricing and carbon tax. Paris Agreement signatories backed a long-term target limiting global average temperatures to “well below 2°C” and limiting warming to 1.5 degrees, with emissions to reach net zero by 2050. For this purpose, the carbon market allows carbon credits/offsets to be bought and sold based on carbon emissions avoidance or removal. These assets are realised on the balance sheet by accounting procedures that are similar to capital market financial instruments.

Although the carbon market had a shaky start through leakage, double counting[x], and weak regulation, it is becoming digitised using exponential technology based on blockchain, Web3, and ReFi to address sustainability, greener supply chains, natural regeneration for climate change at scale, addressing a circular economy, and financial inclusion.

Carbon credits (allowances) are basically permission slips for emissions. When a company buys a carbon credit from a government, the company gains permission to generate one metric tonne of CO2, carbon revenue flows to regulators, and excess credits can be sold.

Carbon offsets, generated by removing a carbon unit from the atmosphere, trade carbon revenue between companies, which others purchase to reduce their carbon footprint. Credits are mandated whereas offsets are voluntary.

Increasing global carbon markets have prompted investment. Although no national carbon market exists in the United States, some states have formal cap-and-trade programs[xi] and China has established a national emissions trading system (ETS)[xii]. Mandatory programs and consumer pressure made companies turn to a voluntary carbon market (VCM) for carbon offsets. International regulations continue to drive a strategy via carbon registry[xiii] regulation to apply a carbon tax. The World Bank carbon pricing dashboard tracks these trends[xiv].

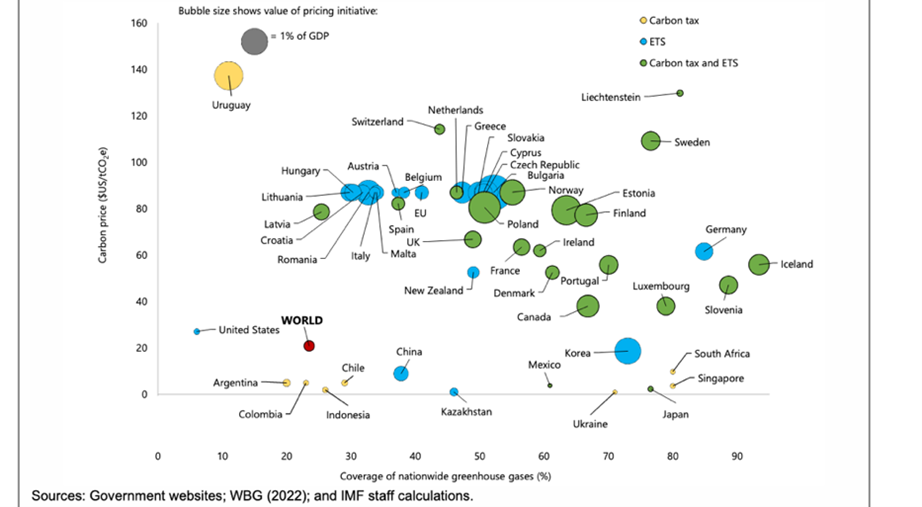

Source: The World Bank 2022: Map of carbon taxes and emissions trading systems (ETSs); State and Trends of Carbon Pricing 2022 (worldbank.org).

Carbon pricing results from externalities when market prices of goods and services do not reflect the future cost of climate change. A carbon risk charge sends a demand signal that reducing emissions means paying less carbon tax and utilizing more carbon-neutral technologies. Many carbon-intensive companies implement an internal system of shadow carbon pricing to baseline their strategy and assign an assumed price per unit of emissions factored into the organization’s decision-making process. Carbon assets and digital equivalents are intangible assets, aligned with intellectual property, IT assets, and human skills, which drive innovation. Intangible assets owned by globally listed companies were $ 74 trillion USD in 2021[xv].

The digital carbon market is the latest growth of intangible assets with opportunity over time to spawn an influential crypto currency. Valuing carbon assets on the balance sheet using International Financial Reporting Standards’ IAS 38[xvi] enables data asset exchange trading, giving enterprises the freedom to operate in economies in exchange for derisking their activities. This allows for prenegotiated free passage of open, unique development of new markets with recognition and valuation supported in tax schemes.

Carbon Market

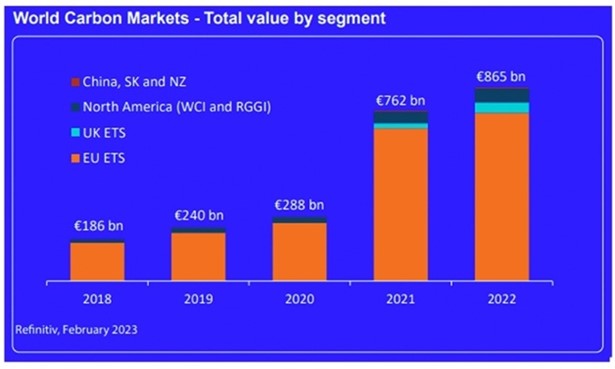

The following shows the landscape of the current carbon market from Source Sustaim[xvii].

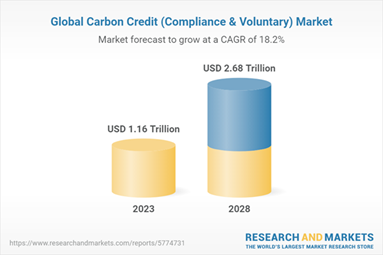

The global traded carbon credit market sector is predicted to reach $2.68 trillion by 2028 at a CAGR of 18.23 percent as shown below[xviii]

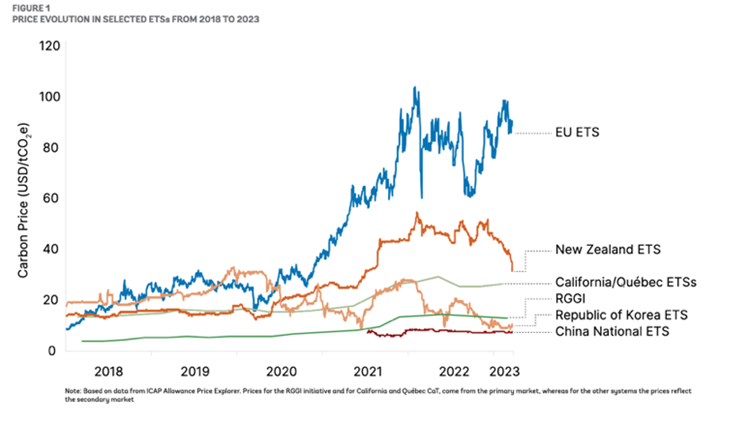

The carbon sector has a compliance or mandatory market as governments set caps on emissions for their companies using carbon credits via an ETS or cap-and-trade mechanism. By adding risk charges for carbon footprint emissions, governments can drive up carbon prices to encourage transition to new technologies. High emissions prices are the result of governments adopting more forceful climate targets by tightening carbon caps within their ETS to help achieve the carbon reductions pledged under the Paris Agreement.

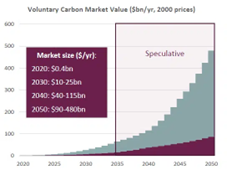

A VCM, not mandated, also exists for those who optionally choose to counterbalance their carbon emissions using carbon offsets or eliminate their carbon footprint. Consumers can purchase offsets based on a specific high-emission activity. The VCM is now worth $2 billion in 2023, [xix] but doubts are cast on the validity of some offsets[xx]. Forecasts place the value of the sector between $10 billion to $25 billion by 2030, depending on how aggressively countries pursue emission reduction targets, as shown below.

Source: carboncredits.com

Carbon markets turn CO2 emissions into a commodity by pricing. Carbon credits or carbon offsets traded on a carbon market represent the equivalent of one metric tonne of carbon emissions (CO2e). Carbon credits are issued by government ETS. Companies that reduce carbon amounts in the atmosphere, by planting trees or renewable energy investment, can issue carbon offsets in the VCM, which is global and self-regulating. These measurably decrease CO2e emissions by carbon avoidance (renewable energy projects/methane capture) or carbon removal (reforestation/direct carbon capture).

Credits issued by regulators from compliance markets can only be applied in one jurisdiction; but in the VCM, a credit produced in one country can be applied against emissions of a company in another. However, some jurisdictions created regulatory uncertainty, requiring consent from authorities for export of domestically originated carbon credits. To record the environmental claim, a carbon credit is retired through a registry and no longer tradable. The combination of both markets creates an ecosystem of buyers accessible to farmers whose operations generate carbon offsets. Carbon offset prices vary as correlated with project quality. Third-party validators (registries) guarantee each carbon offset results from real-world emission reductions. The more carbon credits are successfully retired, the less carbon enters the atmosphere. Ending retirement moves the carbon market from a consumable to a value-driven investment.

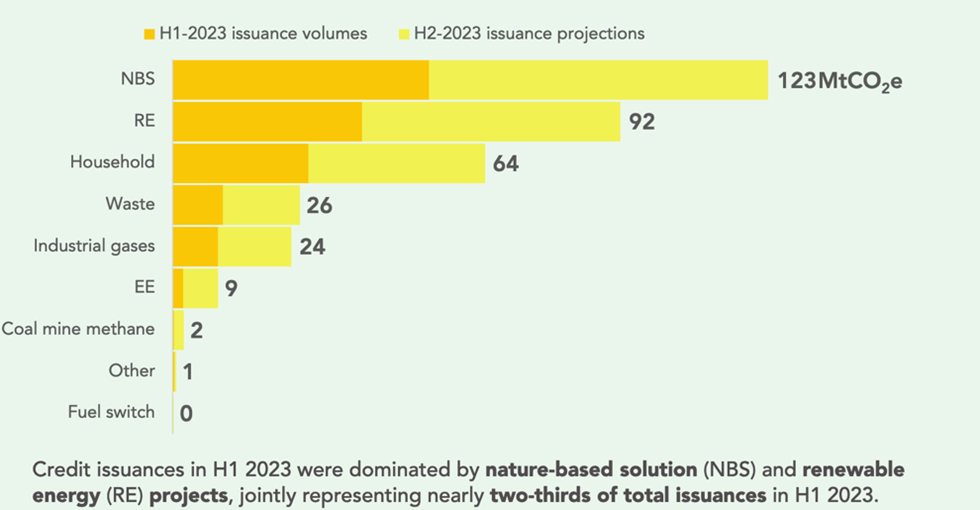

The market is further broken into nature-based solutions (NBS) and renewable-based solutions (RES). These classifications dictate the type of carbon credit traded. While household credit issuances are important and part of financial inclusion, they are outside the scope of this paper.

There are several kinds of carbon credits/offsets, but the two main types represent the NBS and RES markets, respectively. The REDD+ Result Unit™ (RRU)[xxi]is a forest carbon credit applied to reforestation/deforestation[xxii]. A Renewable Energy Certificate (REC)[xxiii]is a regulated market instrument certifying the holder owns a megawatt-hour (MWh) of electricity from clean energy sources such as solar, wind, hydropower, and electric cars. Once energy goes to the grid, the RECs produced can be sold on the market as an intangible energy commodity to carbon-intensive companies and retired. Companies using rooftop solar panels to get their energy buy RECs and in-compliance market utilities are mandated to use renewable energy sources to limit their footprint. Blue carbon[xxiv] are special carbon credits derived from marine ecosystems such as mangroves or seaweed where the offsets trade at a premium due to demand in coastal and ocean ecosystems where microorganisms produce half the oxygen on the planet. They remove harmful pollutants to build a sustainable ocean economy, meeting all 17 UN Sustainable Development Goals [xxv]. The Clean Development Mechanism[xxvi] (CDM) allows a country with emission-reduction commitments under the Kyoto Protocol to implement a carbon reduction project in other countries. Projects earn saleable certified emission reduction CER carbon credits counting toward Kyoto targets.

Governments cap carbon emissions so companies reconfigure their operations. Article 6 of the Paris Agreement[xxvii] sets out the rules for carbon markets so countries can meet their international climate obligations, known as nationally determined contributions (NDC), by purchasing carbon credits to lower emissions. The Paris Rulebook at COP27[xxviii] addressed double counting where a carbon credit is counted only once, either in the host country or another country, and blockchain registries are required to prevent leakage here.

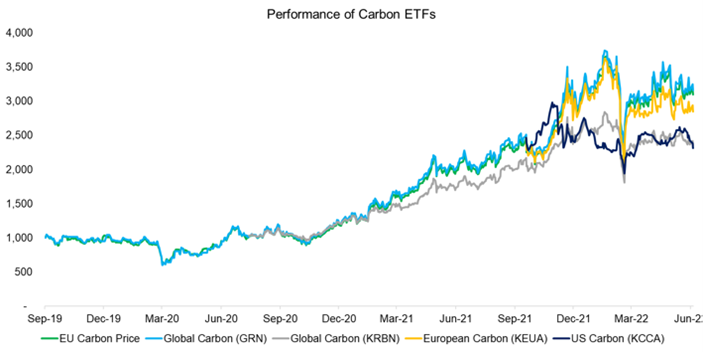

Carbon credit futures are a credit instrument allowing a buyer to offset emissions through carbon offset projects without directly investing in projects and physically deliver carbon credits in lieu. Each futures contract equals 1,000 carbon credits generated from certified projects, and two parties agree to trade the carbon credit at a specific date and price. Several carbon credit ETF instruments are available on the market, such as KraneShares Global Carbon Strategy (KRBN),[xxix] which gives exposure to the European Union Emissions Trading System (EU ETS).

Carbon Shares

Carbon shares are intangible assets which store a CO2e value that dynamically adjusts the carbon amount being sequestered in the underlying project. Environmental claims move to the next owner on sale. Carbon shares cannot be retired or grow in value and are sold at will. Retirement was developed to prevent double counting, and carbon shares record change of ownership on a public asset registry blockchain. They differ from carbon credits by having dynamic value compared to one tonne of CO2, which remains static regardless of underlying project performance.

When carbon is removed from the atmosphere and sequestered, the CO2e value per share rises; but if carbon is released back into the atmosphere, the value declines. It is transparent how much carbon is removed by each company at a point in time because a digital measurement, reporting, and verification (MRV) process dynamically adjusts the share carbon value, preventing companies from adjusting climate claims. Carbon shares and carbon credits are environmental claims bought in the VCM and of high quality, adopting the principles of additionality[xxx], durability, and measurability. Quality varies by certification standard and project type. Carbon shares suit nonstatic carbon value climate projects such as NBS, and carbon credits suit static solutions such as direct air capture (DAC).

Carbon Pricing

The Network for Greening the Financial System (NGFS)[xxxi] modelling allowing for inflation shows carbon prices need to be $69 by 2030 and $276 by 2050 to achieve the Paris Agreement. McKinsey estimates 15 times demand growth for carbon assets by 2030 [xxxii]. Governments introduce carbon pricing via carbon tax or ETS. A carbon tax prices carbon emissions associated with production/consumption of goods and services, raising the price in ratio to less carbon-intensive alternatives. There is no guarantee the tax will be enough to cut emissions, unlike the ETS which imposes a cap which is reduced by a percentage yearly to achieve a long-term target of emissions cuts.

Although the price of carbon emission allowances in EU ETS have reached US $85 to US $110[xxxiii], the price in other ETS jurisdictions is lower. Countries without a tax or ETS mean the three-quarters of global emissions are starting from zero. Globally, the average carbon price is $3 per tonne[xxxiv] so the price needs to be greater than $75 per tonne[xxxv] to meet the Paris Agreement.

Carbon pricing is a political matter so ETS and carbon taxes can both be applied by trading off mitigation and tax revenue to address competition. The following chart by IMF shows the 2022 global carbon pricing.

A levy on importation of carbon-intensive products, known as Carbon Border Adjustment Mechanism (CBAM),[xxxvi] has been introduced in Europe (and soon, Australia) to address the problem of “carbon leakage,” whereby companies located in one country lose market share to more carbon-intensive products exported by firms located elsewhere. The CBAM penalises importers of carbon-intensive goods from less compliant countries.

Under a carbon tax, the government sets a price emitters pay for each tonne of carbon emitted. Consumers must switch fuels or adopt technologies to reduce emissions or pay more tax, either on emissions or on goods/services such as fuel. Carbon tax can be levied at any point in the energy supply chain and the tax rate rises over time to reflect future climate change damage. Indirect carbon pricing policies such as fossil fuel subsidies are included in the models as looking at both direct and indirect policies in combination, which gives the overall carbon price analysis. Fossil fuel subsidies erode the incentive provided by positive carbon prices. Overall carbon price incentives today are insufficient to deliver on the Paris Agreement.

Carbon Market Insurance and Risk Management

Carbon markets are evolving and susceptible to fraud, cyber risk, and other perils which undermine the climate change goal. Physical risk of wildfire to trees and uncompleted renewable energy projects have cast doubt on the quality of the carbon assets involved and whether they counted towards CO2 reduction/removal.

For insurers, lack of consistent project result data, past claims leakage, and need for regulation have hindered coverage. The VCM has produced low-quality carbon projects that have not delivered results. Digitisation of the carbon market by applying blockchain technology with regulatory reporting and measurement will ensure projects meet specific standards. With mitigation and risk assessment in place, carbon credit insurance provides buyers with a level of protection around project quality, giving confidence in increasing carbon pricing as required by the Paris Agreement.

Carbon credits vary in quality, and credits may be invalidated so insurance will protect commitments to emissions reduction against loss of carbon offsets on the balance sheet with cover for third-party negligence and fraud. Protection products need to wrap around digital carbon platforms to obtain the smart capacity required for (re)insurance risk transfer. Independent verification from recognised registries (such as ISO 14064[xxxvii]) will direct buyers towards high-quality projects. Captives can address uninsured risk by investing in carbon offsets, acting as the underwriter to address sustainability behaviour of a parent company by providing underwriting credits to reduce premiums while putting money back into the captive owner for carbon usage.

As the VCM grows demand for risk transfer solutions, third-party services, structured products, and capital are required. Long-term investors such as pension funds and institutional investors look for long-term yields to match risk appetite. Insurers can invest in carbon removal projects, balance their liabilities, and meet their net-zero goals. The risk/return profile is akin to bond investments to de-risk the cash flow volatility.

NBS cover for carbon credits based on the CO2 projects will sequester over time and can be deemed uninsurable as the carbon removal/avoidance has not occurred and these assets can be subject to permanence risk, where previously approved credits return CO2 to the atmosphere due to wildfire. Both RES and NBS are subject to natural catastrophe risk, which requires reinsurance via capital markets such as insurance-linked securities (ILS) in the form of catastrophe bonds that cover low-probability, high-impact events. Investors cover losses from earthquakes, floods, typhoons, and wildfire in exchange for a monthly coupon payment.

ILS transfers risk but does not build resilience; so as natural catastrophes increase, there is a need to create resilience (green) bonds[xxxviii], leveraging upfront investments to reduce insurance premiums and mitigate against events quantifying potential loss savings. Covers can be renewable energy construction infrastructure or natural, as blue carbon restoration. To get a forward-looking climate-exposure assessment of insured assets to different hazards and climate scenarios, predictive analytics and third-wave AI need to be part of the insurance underwriting data. Carbon credits and offsets can be integrated into reinsurance vehicles. Ariel Re launched a catastrophe bond (Titania Re Ltd.)[xxxix] including a carbon offset feature, where the reinsurer purchases carbon offset options from a qualified provider to generate carbon credits to pay claims in the event of a qualified catastrophe event.

World Bank Multilateral Investment Guarantee Agency (MIGA)[xl] provides political risk insurance to aid investment and protect carbon offset projects. Some developing nations regulate or restrict trading of credits generated within their borders. As for IP, carbon title rights refer to the ability to claim carbon credits/shares representing CO2 avoided/removed through projects. MIGA protects buyers against governments breaching agreements that allow buyers to export pre-approved credits or not respect double-counting.

Traditional insurance for the carbon market is not scalable across geographically expansive domains and access to real-time climate data from remote sensing is foundational. Parametric insurance, where bespoke pre-agreed contracts replace indemnity policies, will be predominant in the digital carbon market, with multiple claims triggers that can be verified by a third party in conjunction with smart contracts on the blockchain.

Given the complexity of the market, disputes will arise. When using smart contracts, a question arises whether technology drives the law, and this varies by jurisdiction. Arbitration is the solution, with smart contract coded rules which activate United Nations Commission on International Trade Law (UNCITRAL)[xli]or the UK Jurisdiction Taskforce[xlii] with dedicated digital arbitration rules. Within regulatory frameworks, blockchain-powered parametric insurance will become a strategic tool for climate resilience. Insurance can cover and assess risks along the value chain of an offset project to the supply of carbon credits.

There is a growing insurance market emerging in the VCM. Parhelion[xliii] covers environmental integrity risks against permanence risk and loss due to credit offset invalidation. Kita[xliv] covers delivery risk associated with forward purchases of carbon removal credits and if pre-purchased, removal credits underperform in achieving carbon removal targets. Volante Global[xlv] provides cover for buyers in case credit offsets get invalidated by a relevant authority providing the funds to purchase replacement offset credits. Lloyds of London and the Insurance Task Force (ITF)[xlvi] are initiating carbon credit insurance through the London market. Oka, The Carbon Insurance Company,[xlvii] protects the integrity and validity of credits.

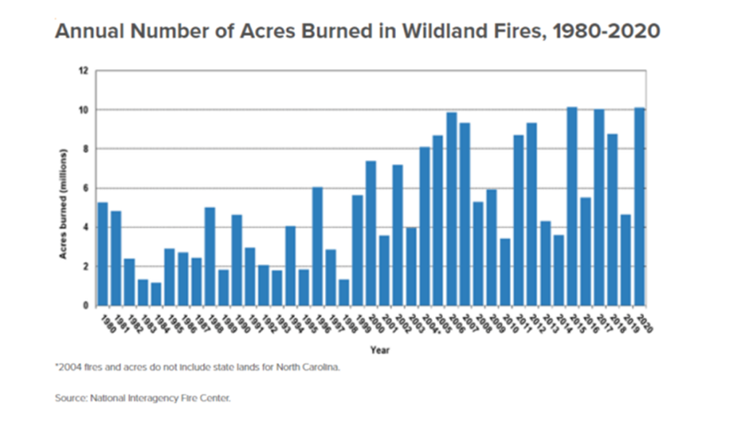

Wildfire Risk

UN Environment Programme (UNEP) data[xlviii] shows wildfires increasing rapidly and the August 2023 Hawaii event[xlix] bears this out. If modelling is done solely on historical data without predictive analysis, then the faster net emissions increase, the greater the permanence risk, adding to a protection gap of uninsured catastrophe losses that Swiss Re estimates at $1.2 trillion[l].

Businesses are surrounded by vegetation and vulnerable to business interruption from wildfire. Parametric insurance can pay out on measurement of event intensity/location based on wildfire footprint reaching the area and consuming the asset. Remote sensing data from drones and satellites are part of the parametric contract trigger design. GC FireCell [li] is a parametric wildfire cover indexed to wildfire data published in real time through NASA’s Fire Information for Resource Management System (FIRMS)[lii]. Technology allows real-time fire ignition detection response to identify high fire-risk areas to predict potential future fires and assess the carbon credits at risk. Alerts can be from satellite detection or power outages.

Wildfires are releasing CO2 into the atmosphere, undermining carbon offset projects and exposing vulnerabilities in the VCM around reliability of buffer pools[liii], government self-insurance programs for large forestry projects for a 100-year guarantee on forest carbon claims. This is a reserve where 20 percent of carbon credits are deposited to cover claims; but there are significant gaps in wildfire risk cover.

Buffer pools are under-capitalised, but a solvent buffer pool means mitigation of permanence risk. Carbon credits are retired from the buffer pool to cover wildfire, drought, disease, insect infestation, and financial risks. Wildfires have depleted nearly 20 percent of the buffer pools in less than a decade, equivalent to at least 95 percent of carbon credit reserves[liv]. Buffer pools cannot guarantee the environmental integrity of forest offsets program for 100 years and need to be replaced by reinsurance programs to provide a more reliable way of ensuring carbon credit permanence.

Use of Causal and Predictive Modelling

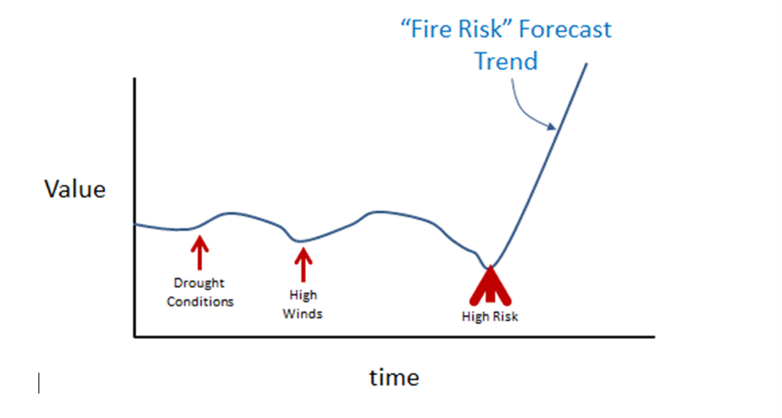

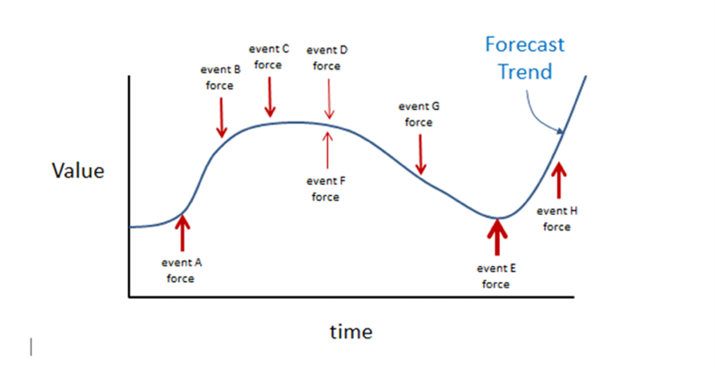

Because wildfire poses a serious threat to climate change efforts, the use of causal and third-wave AI is needed to get the best accuracy in forecasted predictions. Individual events such as strong winds and drought conditions convey forces that increase the value of a future fire risk trend. When these individual events occur simultaneously as a risk structure, the increase in fire risk is far greater than the sum of the events. Causal knowledge is an understanding of the relationship between a cause and its effect using AI for the explanation. The trees in the risk area are the underlying portfolio of carbon credits where satellite data can show the depletion of carbon credits in real time by dynamic modelling as the wildfire takes hold.

Source: Vulcain AI/Eumonics[lv]

Registry and Regulatory Standards

The VCM value is growing and needs tighter regulation without stifling innovation. Regulators are enacting stricter guardrails for private sector climate action. Several regulatory bodies are involved, such as the U.S. Commodity Futures Trading Commission (CFTC)[lvi], UK Climate Change Committee (CCC)[lvii] and the International Organization of Securities Commissions (IOSCO)[lviii]. Regulatory uncertainty has affected the VCM, exacerbated by the Ukraine War, inflation, and interest rate rises post pandemic; plus, there is no clarity on Article 6 at COP27 in Glasgow.

A positive outcome is measuring a quality credit. Since carbon credits do not expire and can be traded multiple times, secondary market players have been buying vintage credits and holding to sell at a higher price, thereby slowing the retirement process. Rating agencies, using baseline emission factors, are assessing carbon projects’ quality by providing carbon scores based on whether a project is reporting accurately, over-reporting, or over- crediting on emissions reductions. Permanence risk is rated to look at the likelihood the carbon will not remain intact for an atmospherically significant time period. There is no carbon stored by RES projects, so rating does not apply as there is no reversal risk. Carbon offset registries issue credits based on defined certification protocols and track the retirement of credits to ensure that two purchasers cannot claim the same verified carbon reduction.

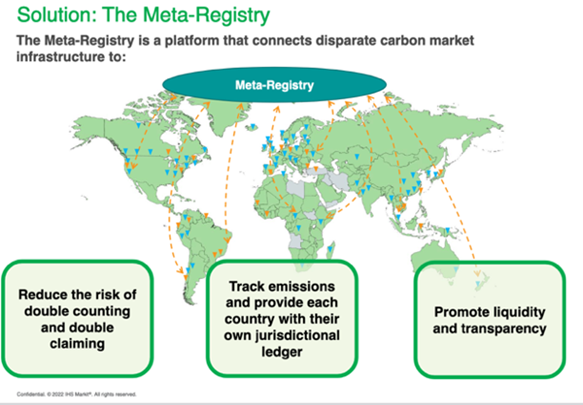

A SourceMaterial [lix] investigation in 2023 reported that 90 percent of rainforest carbon[lx] sold in the past was worthless, which rekindled fears around voluntary carbon markets risks. Verra [lxi], Gold Standard, [lxii] and American Carbon Registry [lxiii] are the largest certifiers of carbon projects; but other registries are emerging in the renewable energy space such as Global Carbon Council (GCC),[lxiv] which provides alternatives where other registries will not touch, such as grid-connected projects. Verra approves three out of every four carbon credits globally and publishes methodologies. Gold Standard will not issue credits from avoided deforestation. Verra-consolidated REDD+ methodology will be published soon, awaiting approval from the Integrity Council for the Voluntary Carbon Market (ICVCM)[lxv]. As there are many registries, a meta registry[lxvi] concept has emerged to integrate the function.

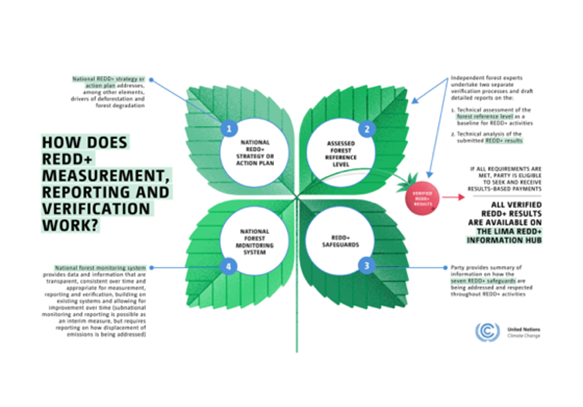

Reducing Emissions from Deforestation and forest Degradation (REDD+) is a platform and registry created by United Nations Framework Convention on Climate Change (UNFCCC) and operated by IHS Markit Ltd.[lxvii] Developing countries receive payment in exchange for protecting their forests and each credit represents removal and verification of one tonne of CO2, certified by the UNFCCC. Deforestation accounts for 20 percent of global carbon emissions and reversing it is critical to achieve the Paris Agreement goals. REDD+ credits help finance activities that protect land from deforestation.

The Paris Agreement 5th Article[lxviii] is dedicated to REDD+, meaning carbon credits from REDD+ activities can be sold to other countries to offset their emissions for NDC. All results are registered and serialized within the REDD+ Registry and issued to the master account of the government as RRUs with unique serial numbers to avoid double counting. Countries can trade RRUs on the REDD+ Exchange operated by Xpansiv CBL,[lxix] the world’s largest carbon exchange.

Planetary Carbon Standard (PCS)[lxx] is a simplified version of existing carbon standards. It verifies and validates carbon sequestration of deforestation/reforestation projects and renewable energy projects, from small to large scale. Internationally recognized baseline standards underscore PCS, which has been accepted by the Sri Lanka government and endorsed by the Sri Lanka Climate Fund, UN, and the ISO14064 standard.

Carbon credit registries and standards bodies are collaborating to improve the VCM. Verra and Gold Standard have embraced benefits of tokenized carbon credits. The World Economic Forum (WEF) initiated the Crypto Sustainability Coalition[lxxi], which studies blockchain-based technologies to address climate change. Colombia's EcoRegistry and Malaysia-based Verdana[lxxii] teamed up to create the first digital carbon registry in Asia Pacific with MRV function embedded in the platform. VCMI[lxxiii], an international non-profit organization co-funded by the UK government, issued its Claims Code of Practice (“VCMI Claims Code”), which assists stakeholders to assess the credibility of corporate carbon-credit purchases. The ICVCM created a set of voluntary standards to introduce global core carbon principles (CCPs). High-value projects will be issued a CCP stamp which can be used by insurers as a warranty.

High Quality of Carbon Projects

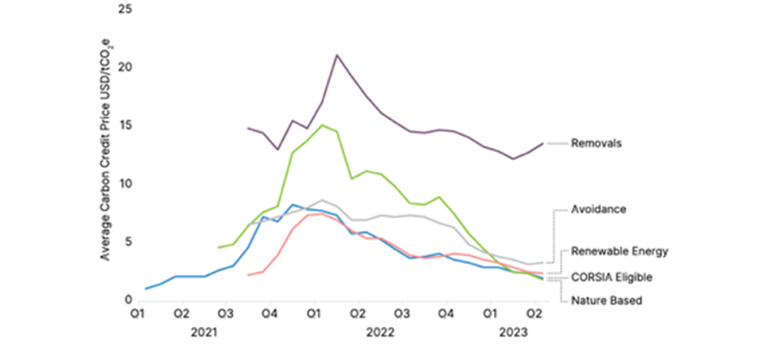

The quality of carbon credits is hard to measure as historically the market has had inadequate risk management services and limited data. Verification methodologies need strengthening for clearer demand signals for market confidence. Standard contracts and procedures offered by digital platforms consolidate trading activity and promote liquidity on exchanges by helping companies purchase large quantities of carbon credits at a daily market price. Companies disclose overall emissions and a reduction strategy before entering the carbon market. Project size, type, and location are key pricing factors, and quality price premium is assessed through the certifying registry. The chart below shows the current prices of carbon credit contracts at the time of writing this paper. Removal projects get the highest price and the aviation Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is seen on this chart. In the coming months there should be more sector-based carbon credits appearing here.

Source: S&P Global

No global standard exists for assessing quality, so buyers navigate different registry standards. Projects often reside in a different location to the registry, with project documents governed by project jurisdiction laws and contractual arrangements with the registry. ESG regulations often dictate that regulated entities disclose credits they retire. High-integrity carbon credits can be digital assets, on or off registry, and contain the actual data evidencing the emissions reduction/removal subject to jurisdiction digital asset regulations.

An on-registry buyer who receives the purchased credits deposited into the registry buys full title to the carbon credits; but this may vary if bought through intermediaries. Registries rarely give title guarantee to purchased carbon credits. Vital KPIs govern principles applied for quality measurement. Additionality occurs when a project would not have occurred in the absence of the VCM. Measurability is the amount of CO2 removed from the atmosphere. Durability or permanence is the time that CO2 is sequestered and has not been reversed by wildfire or project non-completion. Scores from these KPIs will be used to avoid moral hazard and adverse selection in insurance underwriting. Certified projects are posted on the carbon registry. In a reforestation project, the CO2 amount sequestered increases so a dynamic accounting approach shows how much carbon is removed and stored over time. Carbon storage has a time value, so emissions cannot be deleted by offsetting as removal from the atmosphere may be temporary. The Paris Agreement requires 28 gigatons of CO2 [lxxiv] to be removed from the atmosphere by 2030, so when the CO2e was removed must be measured.

Measurement, Reporting, and Verification ((MRV)

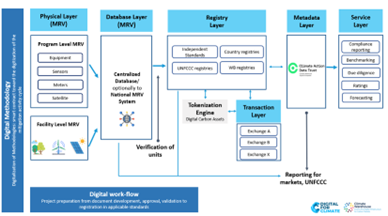

MRV is critical to project quality and many carbon schemes rely on manual reporting as data is collected, calculations done and verified through audits as required. Digital MRV (dMRV) automates the process using verification of reforestation data using LiDAR satellite or drone imagery. The European Space Agency says satellite data can reduce the time and cost of carbon credit verification by 50 percent[lxxv] using advanced monitoring tools to detect and respond to changes in emissions in real time such as ClimateTrace[lxxvi], PlanetWatchers,[lxxvii]and AbsolutClimo[lxxviii]. Audits on NBS can be sporadic due to lack of resources, leading to errors and omissions. By running dMRV, errors can be detected or avoided with Internet of Things (IoT) data collection. MRV describes the entire procedure that climate projects go through to measure the amount of CO2e removed from the atmosphere and report that to an accredited third party to verify or reject. For carbon shares, a verified report results in adjustment of the CO2e value per share.

Digital Carbon Marketplace

Scalable, digital ecosystems of carbon credits platforms integrating together will help businesses reduce carbon emissions and ensure projects meet specific standards. A global open marketplace allows companies and individuals to buy, sell, trade, and manage carbon credits, providing carbon footprint certification, monitoring, and dMRV. This creates digital assets classes and enforces the data integrity/identification features of blockchain technology.

Data points lead to a baseline of carbon indices used in pricing. Registries (validators) are an essential part of the ecosystem, matching interested parties generating and retiring carbon credits. MRV can be directly encoded on tokens represented on a blockchain solution, with metadata for traceability and provenance across the network. The diagram shows a reference architecture from the World Bank integrated using API connections.

Source: World Bank. 2023. End-to-End Digital Ecosystem for Carbon Markets. Chart. World Bank, Washington, DC.

Carbon credits are added to the blockchain as digital tokens distributed to digital carbon credit market after validation. Buyers and sellers of carbon credit will use a decentralized exchange platform on blockchain to trade carbon credits. Price is determined by tokenomics driven by supply and demand. Tokens are retired via a “buy and burn'' model by sending the tokens via a smart contract to a defined blockchain address using a private key with visibility to the collective of validators and other stakeholders. The stakeholders who successfully burn tokens are issued non-fungible tokens (NFT) as a carbon removal certificate. Environmental reports will be generated showing a ledger of carbon emissions and carbon credits.

A circular economy requires companies to contribute to a sustainable production model, keeping raw materials longer in production cycles, recycled with less waste and ensuring the continual supply of raw materials. VCM Web3 projects have begun to leverage ReFi and tokenized carbon is used as collateral in decentralized finance (DeFi) debt markets.

Tokenized carbon is a digital representation of real-world carbon credits on the blockchain and Toucan Carbon Bridge[lxxix] is being used to build the tokens. Early adopters on the demand side will hold tokenized carbon and help make net-zero claims based on retirements of on-chain carbon. Carbon will also become a yield-bearing financial instrument and interest earned on carbon credit deposits.

ReFi promises to take the benefits of decentralized finance (DeFi)/Web3 by integrating sustainability and inclusivity into a financial platform. Transactions are publicly recorded on the blockchain and accessible to everyone, regardless of financial background. ReFi represents a shift to serve all participants while paying attention to the environment by building a regenerative component to make business carbon neutral and carbon positive. Protocols like Toucan, Flowcarbon,[lxxx] and Nori [lxxxi] are working to build the Web3 carbon market along with Carbonis,[lxxxii] a carbon credits platform helping businesses reduce carbon emissions via a global marketplace.

Tokenization of carbon offsets provides a single source of truth on the accuracy of carbon credits. As smart contracts, carbon credits can be integrated into games, metaverse experiences, DeFi applications, and trading platforms. It will take time for standards to be adopted in the digital VCM; but addressing the quality of the carbon credits/offsets must be verifiable now through standardized criteria in the registries. Smart contracts can be standardized for this purpose based on meeting core carbon standards and enabling quantification and fractionalization of credits for ease of trading. The credits embedded as smart contracts can ensure that credits are only used for the purposes intended and not reused multiple times, artificially inflating the numbers of credits in the market.

The World Bank’s Climate Warehouse Program[lxxxiii], the Singapore government, and the International Emissions Trading Association[lxxxiv] developed the Climate Action Data Trust[lxxxv] (CAD Trust), an open-source global platform aggregating carbon credit data to support the transparent accounting of carbon and implementation of Paris Agreement NDCs. A decentralised metadata platform that links, aggregates, and harmonises all major carbon credit registry data using blockchain technology to create a decentralised record of carbon market activity avoids double counting and enfolds trust in carbon credit data.

Carbon as a Currency

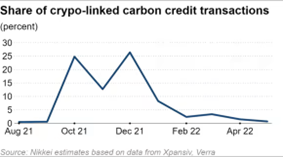

A digital currency linked to the physical assets of nature and renewable energy will create digital asset value while removing carbon from the atmosphere. This by definition is a limited supply store of value circulating widely in a secure registry. Like Bitcoin, carbon credits are investments, tradeable and limited edition. Cryptocurrencies originally did not have underlying assets that guarantee their values but now Stablecoins exist, pegged to fiat currency or gold. Carbon credits have intrinsic value and cryptocurrency traders have entered the carbon credit market. KlimaDAO[lxxxvi], a decentralized autonomous organization, takes carbon credits converted into digital tokens and converts them into Klima cryptocurrency where each coin represents 1 tonne of CO2. Klima lost value during the cryptocurrency crash, but the arbitrage opportunity increased the sale of carbon credits. The U.S. has put forward plans for a Digital Asset Mining Energy (DAME) tax[lxxxvii] requiring all crypto miners to pay 30 percent of their electricity costs to reduce digital asset mining. This crackdown on electricity usage opens up a new market for carbon cryptocurrency and green mining.

The Carbon Neutrality Blockchain (CNB),[lxxxviii] launched on the LBank crypto exchange[lxxxix] in October 2022, mirrors Bitcoin with a maximum supply of 21 million coins with a difference of being closely pegged to climate change. The price is above $3,000, and the crypto downturn shown below has not affected the CNB asset. Bitcoin comes with an enormous carbon footprint, so there is a chance CNB will get a lot of attention in the market. Treedefi[xc] is a token on the Binance exchange and has a development platform and use fees to plant trees and sell them as NFTs. Save Planet Earth[xci] is a cryptocurrency and has partnered with Phantasma[xcii], a blockchain that offers carbon neutral smart NFTs and uses the PCS registry standard.

Blockchain enables digital identity for people, data, and devices. Digitized tokens can have know your customer (KYC) and anti-money laundering (AML) properties, added to digital wallets and traded like currency without intermediaries. Parties can verify source and quality of the carbon credits using cryptographic methods such as encryption to ensure peer-to-peer renewable energy trading and post-quantum immunity to allow for quantum technology. On the retail side, carbon labelling is a standard approach to informing customers of their carbon footprint before they purchase online, on airline tickets, or in stores. Lune[xciii] has an API that exposes CO2 emissions calculations to customers, and Carbonis has a carbon label solution.

Cybersecurity

An externality is an event that occurs as a cause of another event occurring. Cyber and climate change are intangible risks, both with the potential to create positive and negative externalities, especially if they occur simultaneously. These externalities are far-reaching due to the connected Internet, Internet of Things, and digitisation reaching the tipping point. There are many forces engaging the correlation of the two largest risks we know today.

Source: Vulcain AI/Eumonics[xciv]

This interconnectedness implies that one company failing to govern cyber risk can have a negative impact on others and down the supply chain relationships. Both carbon and cybersecurity demonstrate similar characteristics in terms of negative externalities and the reason to include cyber risk quantification as part of the carbon market framework. The increasing importance of carbon credit ratings and sustainability metrics is closely tied to the need to quantify and capture the negative externalities of the carbon footprint of any economic activity.

There is the same need for responsible cyber risk quantification to capture the negative externalities created by "high-carbon" cybersecurity activities and actions. The link between climate change and cybersecurity is causal. Like all critical infrastructure, the green energy sector can be severely impacted by cyber attacks. In 2021, the world’s largest manufacturer of wind turbines, Vestas Wind Systems[xcv], was affected by a cyber incident. Carbon markets rely on technologies vulnerable to cyber attacks. Electronic vehicles, for example, require a network of charge points, which, connected to the grid, can lead to cyber risk, so it is important to know where the liability lies in a breach. Cyber integrity and data integrity are part and parcel of the digital carbon market.

Frequent extreme climate events put critical digital systems in physical danger, such as damaging underwater communication cables and off-site servers. The resulting disruption to internet connectivity opens up new security gaps and increases risks of attacks. This environment can also lead to state-sponsored attacks on critical infrastructure. Mitigation leading to a better security posture enables a growing insurance industry to supplement the risk in the same way as carbon credit insurance.

As the digital VCM develops, smart contract failure and data integrity breaches could result in the theft of carbon credits in an international cyber-attack, with the credits sold to legitimate dealers having to be replaced from a government reserve. Cyber poses a major threat to the sustainability of ETS meant to prevent climate change and implementation of cyber integrity by design is essential in the digital carbon marketplace.

Industry Sectors and the VCM

Selling carbon offsets can be a significant revenue stream such as Tesla, which sells carbon credits in the form of RECs to legacy car manufacturers[xcvi]. Giving this precedent success at selling carbon credits, the mining industry can get offsets from farmers. The Taskforce on Scaling Voluntary Carbon Markets (TSVCM)[xcvii] is very supportive of this initiative.

Agriculture accounts for 14 percent of global related CO2[xcviii] as high levels of carbon emissions are released during farming and nitrous oxide fertilizer is responsible for 50 percent of agriculture emissions. While carbon offsets are sold by farmers for emission- reducing initiatives with carbon sequester in the soil, there is little action reducing nitrous oxide and many registries do not require on-the-ground measurements of nitrous oxide emissions in their protocols.

Mining accounts for 4 percent to 7 percent of global related CO2[xcvix] and produces many metals critical for energy transition, such as nickel. Most of the industry’s emissions are produced by fossil fuel. The carbon footprint can be reduced by using on-site clean electricity from sustainable sources. Electric vehicles use nickel and often production is from coal-fired plants.

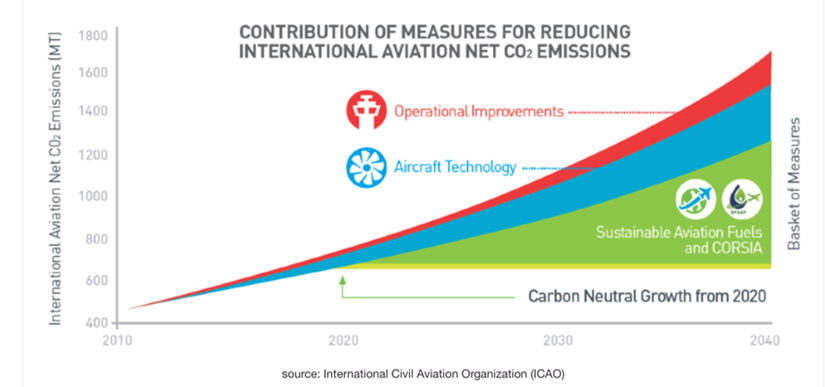

Aviation accounts for 2 percent of global energy related CO2[c]. The aviation sector collaborated on an international agreement to reduce carbon emissions known as Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)[ci] which permits carbon offsets trading via the global carbon market. The EU is regulating an increase in the amount of sustainable aviation fuel (SAF)[cii] usage.

The shipping sector is responsible for 3 percent of global CO2 emissions[ciii] and can start a decarbonisation program by utilising the VCM and purchasing deforestation credits from farmers. Shipping emissions will be regulated including the EU-ETS, which commences in 2024, where vessels will need to report emissions by law. The IMO could impose a global carbon tax, but it will take time to decarbonize with net-zero fuels like hydrogen or ammonia. The shipping industry can look to implement a CORSIA equivalent as a baseline.

The Partnership for Carbon Accounting Financials (PCAF)[civ] is an association of banks seeking to harmonise carbon accounting across the industry.

The textile industry is responsible for 10 percent to 20 percent of CO2 [cv]emissions and the raw materials from farm to factory are already in the carbon market. Green supply chains are a priority.

Increasing cost of carbon credits have impacts on steel, cement, oil and gas, and mining, which are vulnerable to the economic implications of carbon pricing. The steel industry accounts for 7 percent of global CO2[cvi] using coal and the cost of carbon credits will increase the cost of production. The cement industry accounted for 8 percent of global CO2[cvii] and needs to adapt to alternative fuel sources such as biomass. Most CO2 emissions come from energy.

World Markets and Carbon Capture and Storage (CCS)

Abu Dhabi is the first jurisdiction to licence, certify, and regulate commoditised carbon credits. Built on an ACX digital carbon trading platform,[cviii] this includes a futures market, clearing house, and custodian service. Indonesia, which launched its carbon exchange in 2023[cix] with caveats around the export and trading of carbon credits, is implementing an ETS/carbon tax pricing around coal-fired plants and working towards launching a carbon exchange. The U.S. leads the way in CCS and derisking new projects. China is competing with emerging CCS with cooperation between oil, mining, and steel companies, with the agricultural sector plus carbon storage locations. Cocoa farmers in Ghana are improving yields and mitigating climate change by adopting climate-smart practices while curbing deforestation. The EU ETS has implemented Carbon Contract for Differences (CCfDs)[cx] where companies reducing CO2 emissions will receive grants especially for replacing fossil fuels with hydrogen. Energy-intensive industries are compensated by climate protection agreements for a period of 15 years to cover production conversion costs to hedging against carbon price volatility and regulatory risk. Japan Blue Economy Association’s (JBE’s) J Blue Credits[cxi] scheme is focussed on the creation of offsets from seaweed sequestration. This leads to blue carbon initiatives, including the establishment of seaweed beds in several regions. Singapore facilitated trading on global voluntary exchange platforms with the Air Carbon Exchange (ACX) and Climate Impact X (CIX)[cxii], a daily on-exchange liquidity window with firm bids and offers to serve as a pricing session to pool daily liquidity from Asia, Europe, and the Middle East to help benchmark prices from projects across the Americas, Africa, and Asia that support global REDD+ market volumes. Malaysia has the Bursa Carbon Exchange (BCX)[cxiii], a subsidiary of the stock exchange of Malaysia, and the first Shariah-compliant carbon exchange. The Malaysian government is considering a carbon tax for transformation in energy systems. The Vietnam Ministry of Natural Resources and Environment is establishing a national carbon registration system for all businesses and organisations generating carbon credits in 2023[cxiv].

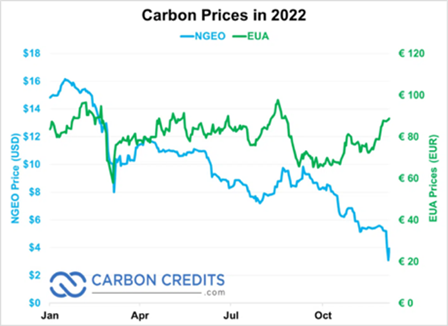

On the registry side, Verra is creating a stand-alone methodology for tropical peatlands and wetlands[cxv] that will be linked to its consolidated (REDD+) guidelines. The registry previously took out these ecosystems from the draft consolidated REDD+ methodology, triggering concerns about the economic feasibility of peatland carbon projects. Tropical peatlands contain vast amounts of carbon and are particularly prominent in Indonesia, Democratic Republic of Congo (DRC), Malaysia, and the Peruvian Amazon. The International Sustainability Standards Board (ISSB)[cxvi] 2023 unveiled global frameworks for corporate sustainability reporting with parent the International Financial Reporting Standards Foundation (IFRS)[cxvii] an accounting regulator to verify carbon offsets. Carbon prices can be checked online[cxviii] and here is a summary of 2022.

Carbon stocks allow investors to support the transition to a low-carbon economy and mitigate the effects of climate change. Streaming and royalty companies are businesses that provide financing for the development of projects in exchange for future cash flows. Devvio [cxix] is an advanced blockchain-based ESG platform generating carbon credits for corporate clients.

Carbon Exchange Traded Funds (ETF), with diversified holdings and tracking of a specific index, are a low-risk way to invest in carbon markets and diversifying portfolios.

Conclusion

Digitisation and blockchain/Web3 have come to the rescue of the fledging carbon market at a tipping point post-pandemic where there is global reset. With less than seven years to carbon neutrality to achieve the Paris Agreement goals, there needs to be a massive pivot in technology and capital to get things on track. ReFi and quantum technology seem to be answering the call. Jurisdictions are introducing new carbon pricing instruments and these signals for climate mitigation are critical to driving investment. Carbon pricing must grow in terms of coverage and price to meet the goals. The UN considers carbon neutrality by 2050 the most urgent mission[cxxi] because of the severity and urgency of the climate issue. Although countries have committed to carbon neutrality, barriers exist at the corporate and multi-tier supply chain levels. Insurance guarantees are essential and there is a need to evaluate high-quality projects to warrant the cover. Carbon footprint tax schemes will soon extend to individuals. The carbon offset will become a crypto currency that is backed by physical assets, uses green crypto mining, and has reserve capabilities like Bitcoin. Broad adoption is likely due to the link to climate change. There is a level playing field being created through ReFi, an inversion finance mutuality model linked to sustainability well suited to Shariah-based finance and financial inclusion sectors, which house the 2 billion underbanked communities threatened by natural catastrophes.

The integration of financial inclusion to international markets is long overdue. Implementation of carbon tax schemes are a challenge to low-income markets so governments will need to get carbon pricing right. Challenges are the fragmented nature of the markets in creating demand signals and developing new layers of integration to the carbon initiatives. Scale and predictability are critical, with the ability to develop commercial incentives that match the policy and strategy goals of the sovereign nations to create a lubricant to solutions rather than minefields to future development.

Participation with intangible value allows engagement with national markets that may require years to engage, allowing exchange of value over a larger time frame. Incentives to developed markets must be made by governments to de-risk and offer businesses to support the transfer of carbon market intangible capability by recognizing value and benefits within their tax schemes and pooling the risk.

References

[i] https://www.worldbank.org/en/news/press-release/2023/05/23/record-high-revenues-from-global-carbon-pricing-near-100-billion

[ii] https://www.worldbank.org/en/news/feature/2022/05/24/countries-on-the-cusp-of-carbon-markets

[iii] https://cointelegraph.com/learn/what-is-regenerative-finance-refi#:~:text=Regenerative%20finance,%20explained,social%20responsibility,%20sustainability%20and%20regeneration

[iv] https://www.linkedin.com/pulse/circular-economy-hydrocarbon-waste-eliot-sorella?published=t

[v] https://ourworldindata.org/greenhouse-gas-emissions

[vi] https://climate.copernicus.eu/july-2023-sees-multiple-global-temperature-records-broken

[vii] https://unfccc.int/kyoto_protocol

[viii] https://unfccc.int/process-and-meetings/the-paris-agreement

[ix] https://www.mit.edu/

[x] https://lune.co/blog/what-is-double-counting-in-carbon-offsetting-and-why-is-it-important/

[xi] https://www.c2es.org/content/cap-and-trade-basics/#:~:text=In%20a%20cap%2Dand%2Dtrade,market%20establishes%20an%20emissions%20price.

[xii] https://www.lse.ac.uk/granthaminstitute/explainers/how-do-emissions-trading-systems-work/

[xiii] https://carbonbetter.com/story/carbon-offset-registries/

[xiv] https://carbonpricingdashboard.worldbank.org/

[xv] https://brandirectory.com/reports/gift-2021

[xvi] https://www.iasplus.com/en/standards/ias/ias38

[xvii] https://www.sustaim.earth/carbon-market-map

[xviii] https://finance.yahoo.com/news/global-carbon-credit-market-2023-104800429.html#:~:text=The%20global%20carbon%20credit%20market,global%20corporations%20to%20lower%20emissions.

[xix] https://carboncredits.com/real-voluntary-carbon-market-value-is-2-billion/

[xx] https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

[xxi] https://blackstoneenergy.com/reddresultunits/

[xxii] https://www.fao.org/redd/overview/en/

[xxiii] https://www.epa.gov/green-power-markets/act

[xxiv] https://terrapass.com/blog/what-are-blue-carbon-credits/

[xxv] https://sdgs.un.org/goals

[xxvi] https://unfccc.int/process-and-meetings/the-kyoto-protocol/mechanisms-under-the-kyoto-protocol/the-clean-development-mechanism#:~:text=UNFCCC%20Nav&text=The%20Clean%20Development%20Mechanism%20(CDM,reduction%20project%20in%20developing%20countries.

[xxvii] https://www.worldbank.org/en/news/feature/2022/05/17/what-you-need-to-know-about-article-6-of-the-paris-agreement

[xxviii] https://www.wri.org/paris-rulebook

[xxix] https://kraneshares.com/krbn/

[xxx]https://www.offsetguide.org/high-quality-offsets/additionality/

[xxxi] https://www.ngfs.net/en

[xxxii] https://www.mckinsey.com/capabilities/sustainability/our-insights/a-blueprint-for-scaling-voluntary-carbon-markets-to-meet-the-climate-challenge

[xxxiii] https://www.reuters.com/markets/carbon/europes-carbon-price-hits-record-high-100-euros-2023-02-21/

[xxxiv] https://silverado.org/news/global-carbon-pricing-Silverado/

[xxxv] https://www.reuters.com/business/cop/exclusive-cop27-imf-chief-says-75ton-carbon-price-needed-by-2030-2022-11-07/

[xxxvi] https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

[xxxvii] https://www.iso.org/standard/66453.html

[xxxviii] https://gca.org/what-are-resilience-bonds-and-how-can-they-protect-us-against-climate-crises/

[xxxix] https://www.reinsurancene.ws/ariel-re-obtains-125m-of-cover-with-third-titania-re-cat-bond/

[xl] https://www.green.earth/news/multilateral-investment-guarantee-agency-to-protect-carbon-offset-projects-against-political-risks

[xli] https://uncitral.un.org/en/texts/arbitration/contractualtexts/arbitration

[xlii] https://blog.jusmundi.com/evaluating-the-uk-jurisdiction-taskforces-digital-dispute-resolution-rules-1-0/

[xliii] https://www.ccarbon.info/the-role-of-insurance-in-scaling-the-carbon-markets/

[xliv] https://www.kita.earth/carboninsuranceproducts

[xlv] https://volanteglobal.com/products/carbon-offset-credit-insurance/

[xlvi] https://a.storyblok.com/f/109506/x/c0c3181f7e/smi-itf_products-and-services-showcase.pdf

[xlvii] https://carboninsurance.co/

[xlviii]https://www.unep.org/news-and-stories/press-release/number-wildfires-rise-50-2100-and-governments-are-not-prepared

[xlix] https://www.nbcnews.com/news/us-news/maui-wildfires-death-toll-identifying-remains-rcna100632

[l]https://www.swissre.com/dam/jcr:eec7ffb5-c5a9-483e-8e7b-588f56899c40/2019-business-report-doc-en.pdf

[li] https://www.marshmclennan.com/content/dam/mmc-web/insights/publications/2023/april/GC%20FireCell%20Product%20Sheet.pdf

[lii]https://www.earthdata.nasa.gov/learn/find-data/near-real-time/firms

[liii] https://www.sylvera.com/blog/carbon-credit-buffer-pools

[liv] https://www.frontiersin.org/articles/10.3389/ffgc.2022.930426/full

[lv] https://www.eumonics.com/

[lvi] https://www.cftc.gov/

[lvii] https://www.theccc.org.uk/

[lviii] https://www.iasplus.com/en/resources/global-organisations/iosco#:~:text=The%20International%20Organization%20of%20Securities,about%20100%20other%20similar%20bodies.

[lix] https://www.source-material.org/about-us/

[lx] https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

[lxi] https://verra.org/

[lxii] https://www.goldstandard.org/

[lxiii] https://americancarbonregistry.org/

[lxiv] https://www.globalcarboncouncil.com/

[lxv]https://icvcm.org/

[lxvi] https://news.ihsmarkit.com/prviewer/release_only/slug/2021-10-28-first-global-carbon-credit-meta-registry-launches

[lxvii] https://en.wikipedia.org/wiki/IHS_Markit

[lxviii] https://www.ecosystemmarketplace.com/articles/redd-in-the-paris-climate-accord-a-summary/

[lxix] https://xpansiv.com/cbl/

[lxx] https://www.planetarycarbonstandard.com/

[lxxi] https://www.weforum.org/press/2022/09/new-crypto-sustainability-coalition-to-investigate-potential-of-web3-technologies-in-fighting-climate-change/?ref=blog.toucan.earth

[lxxii] https://www.qcintel.com/carbon/article/ecoregistry-verdana-create-asia-pacific-digital-carbon-registry-14122.html

[lxxiii] https://vcmintegrity.org/

[lxxiv] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/world-must-cut-28-gigatons-of-carbon-in-8-years-to-meet-climate-goal-un-says-67252932

[lxxv] https://factoryfocus.substack.com/p/why-satellite-data-is-the-key-to#:~:text=One%20of%20the%20most%20significant,verification%20by%20up%20to%2050%25.

[lxxvi] https://climatetrace.org/

[lxxvii] https://www.planetwatchers.com/

[lxxviii] https://absoluteclimo.com/

[lxxix] https://docs.toucan.earth/toucan/bridge/carbon-bridge

[lxxx] https://www.flowcarbon.com/

[lxxxi] https://nori.com/

[lxxxii] https://medium.com/@carbonis/why-should-you-come-to-carbonis-platform-to-understand-carbon-credits-and-your-first-place-of-278f49fa607f

[lxxxiii] https://www.theclimatewarehouse.org/

[lxxxiv] https://www.ieta.org/

[lxxxv] https://climateactiondata.org/

[lxxxvi] https://www.klimadao.finance/

[lxxxvii] https://www.whitehouse.gov/cea/written-materials/2023/05/02/cost-of-cryptomining-dame-tax/

[lxxxviii] https://cnb.world/

[lxxxix] https://www.lbank.com/

[xc] https://treedefi.com/

[xci] https://www.saveplanetearth.io/

[xcii] https://phantasma.io/

[xciii] https://lune.co/

[xciv] https://www.eumonics.com/

[xcv] https://www.infosecurity-magazine.com/news/wind-turbine-giant-offline-after/

[xcvi] https://carboncredits.com/tesla-carbon-credit-sales-reach-record-1-78-billion-in-2022/#:~:text=Tesla%20has%20sold%20carbon%20credits,company%27s%20sales%20in%20years%20past.

[xcvii] https://www.iif.com/tsvcm

[xcviii] https://www.worldfuturecouncil.org/how-does-agriculture-contribute-to-climate-change/#:~:text=Modern%20agriculture%2C%20food%20production%20and,have%20an%20even%20larger%20impact.

[xcix] https://www.mckinsey.com/capabilities/sustainability/our-insights/climate-risk-and-decarbonization-what-every-mining-ceo-needs-to-know#:~:text=Mining%20is%20currently%20responsible%20for,gas%20(GHG)%20emissions%20globally.

[c] https://www.iea.org/energy-system/transport/aviation#:~:text=In%202022%20aviation%20accounted%20for,of%20the%20pre%2Dpandemic%20level.

[ci] https://www.icao.int/environmental-protection/CORSIA/Pages/default.aspx

[cii] https://ec.europa.eu/commission/presscorner/detail/en/ip_23_2389

[ciii]https://unctad.org/news/transport-newsletter-article-no-99-fourth-quarter-2022#:~:text=The%20maritime%20sector%20presently%20accounts,volume%20is%20transported%20by%20sea).

[civ] https://carbonaccountingfinancials.com/

[cv] https://climateseed.com/blog/secteur-du-textile-impact-environnemental-et-réglementation#:~:text=With%201.7%20million%20tons%20of,major%20contributor%20to%20global%20warming.

[cvi] https://www.iea.org/reports/iron-and-steel-technology-roadmap#:~:text=The%20iron%20and%20steel%20sector%20directly%20accounts%20for%202.6%20gigatonnes,emissions%20from%20all%20road%20freight.

[cvii] https://www.cbsnews.com/news/cement-industry-co2-emissions-climate-change-brimstone/

[cviii] https://acx.ae/

[cix] https://www.reuters.com/business/sustainable-business/indonesia-plans-launch-carbon-exchange-h2-2023-2023-05-05/#:~:text=JAKARTA%2C%20May%205%20(Reuters),net%2Dzero%20emissions%20by%202060.

[cx] https://henrike-hahn.eu/files/upload/aktuelles/dateien/Study_CCfD_Henrike-Hahn_6.2022.pdf

[cxi] https://www.sumitomocorp.com/en/jp/news/topics/2022/group/20221130#:~:text=The%20JBE%20Association%20is%20conducting,as%20well%20as%20the%20sea.

[cxii] https://www.climateimpactx.com/

[cxiii] https://bcx.bursamalaysia.com/web

[cxiv] https://www.regulationasia.com/vietnam-to-develop-domestic-carbon-market/#:~:text=discuss%20your%20options.-,Vietnam%27s%20Ministry%20of%20Natural%20Resources%20and%20Environment%20is%20in%20charge,develop%20a%20domestic%20carbon%20market.

[cxv] https://verra.org/request-for-proposals-development-of-a-vcs-tropical-peatlands-methodology/

[cxvi] https://www.ifrs.org/groups/international-sustainability-standards-board/

[cxvii] https://www.ifrs.org/

[cxviii] https://carboncredits.com/carbon-prices-today/

[cxix] https://www.devv.io/

[cxx] https://www.sciencedirect.com/science/article/pii/S092134492200372X#:~:text=Due%20to%20the%20severity%20and,warming%20(Chen%2C%202021).

9.2023

About the Author:

David Piesse is CRO of Cymar. David has held numerous positions in a 40-year career including Global Insurance Lead for SUN Microsystems, Asia Pacific Chairman for Unirisx, United Nations Risk Management Consultant, Canadian government roles and staring career in Lloyds of London and associated market. David is an Asia Pacific specialist having lived in Asia 30 years with educational background at the British Computer Society and the Chartered Insurance Institute.

The author would like to thank Dr. William Tien of Axis Technologies Group for his input to this paper. Useful links are State and Trends of Carbon Pricing[cxxi] , Carbon Markets 101cxxi] , Climate Focus,cxxi] and Quantum Community Intelligence.[cxxi]

View More Articles Like This >