Metaverse Risks and Opportunities

IIS Executive Insights Cyber Expert: David Piesse, CEO, DP88

Definitions

Metaverse – A three-dimensional shared space with connected virtual worlds (multiverses), inside the INTERNET, resembling the physical world with digital representations of people, places and assets animated and populated by avatars under human or AI control.

Avatar - The digital representation of a person/object within the metaverse, corresponding to identification linked to users’ own identity and is equivalent to the real world.

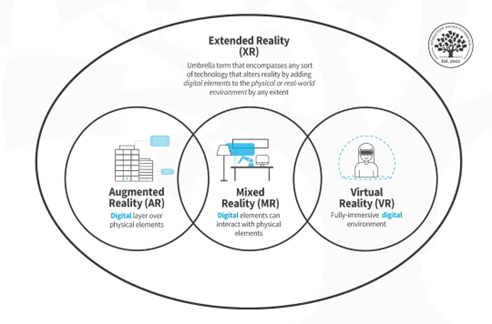

Virtual Reality (VR) – total immersion in the digital world via a wearable VR device.

Augmented Reality (AR) – interaction of the real world to the digital / virtual world by overlaying of information from the real world to the virtual world in conjunction with VR,

Mixed Reality (MR) - Combines VR and AR allowing total immersion in the metaverse with users interacting with physical and virtual objects via various devices.

Extended Reality (XR) – overarching term combining VR, AR, MR in any manner that alters reality by adding digital elements to the real world.

Digital Twin - A XR virtual representation of an object as an aspect of real life representing all physical objects, processes, people, relationships, devices and behaviours often related to Internet of Things (IOT) in the industrial real world and now merging with the metaverse.

Blockchain - A key facilitator of metaverse transactions to ensure the accountability, integrity and cybersecurity of the underlying digital asset, datasets and networks.

Non-Fungible Tokens (NFT) - are unique virtual assets fuelling metaverse growth. It can represent avatars, video, images, gaming objects or crypto currencies and more. NFT ownership is recorded on the blockchain so the digital assets they represent can be traded.

Smart Contract – self executing contract with terms and conditions written directly into lines of code and make up the NFT structure. Capable of triggering meaningful events.

DAO – decentralized autonomous organization - a fully digital company on the blockchain

International Insurance Society (IIS) and the Metaverse

The IIS participated in the Pacific Insurance Conference (PIC)[i] Metaverse Experience Focus Group prior to the 2022 PIC conference and the metaverse immersion was sponsored by AIA[ii] in Hong Kong. The author, who was involved in virtual world pioneering in 2009, was peer immersed in the metaverse followed by exit interviews on the impact to insurance and highlighted the differences between 2009 and the new metaverse era beginning today.

Overview

The metaverse is built by multiple creators, companies large and small, building a next generation internet evolving from video games to a full 3D immersive presence and identifying fresh economic opportunities. There will be one metaverse but multiple platforms (multiverses) where services must be interoperable to avoid silos or “walled gardens”. It is early days, but policy makers need to be inside the ecosystem and ahead of the metaverse development in regulation to avoid arbitrage issues, legal and cybersecurity risks.

The western world leads the development of the metaverse, but North Asia via Korea, Japan, Hong Kong and Taiwan provide strong contributions. Mainland China is developing a metaverse with Chinese characteristics, but geopolitics will determine the interoperability. India is rapidly developing several multiverses. Key takeaways are the confluence of metaverse and IOT reforming how we prevent disease, manufacture and industrialise plus metaverse availability on mobile devices and the cumulative effect on financial inclusion.

The metaverse concept is not new and emerged in the 2D Web 2.0 cycle in 2004 when the internet first merged as a platform. Virtual worlds such as Second Life[iii] and Wonderland (SUN Microsystems)[iv] operated in 2009 and pioneers such as Claus Nehmzhow[v] who launched applications such as the 3D Avatar School in the educational space.

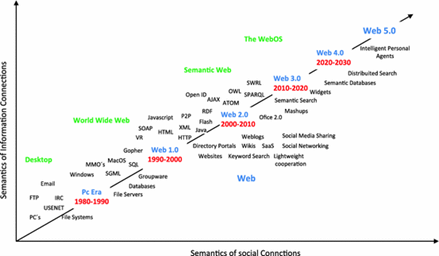

Internet development changes in reading web pages, plus advances in network connected computers, leads to innovation on a global scale creating the 3D metaverse Web 3.0 where users glide seamlessly between datasets and networks. Web 5.0 evolves via wireless connectivity across all mobile devices (Web 4.0) as shown in the Myeltcafe timeline diagram.

The XR Association[vi] is creating rules for an open metaverse and promoting responsible development and adoption of an XR ecosystem of device manufacturers, technology platforms, network providers and end users as shown below.

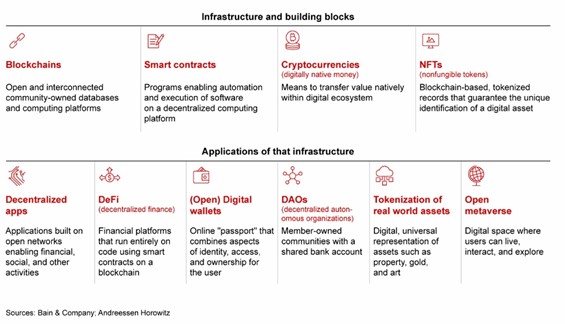

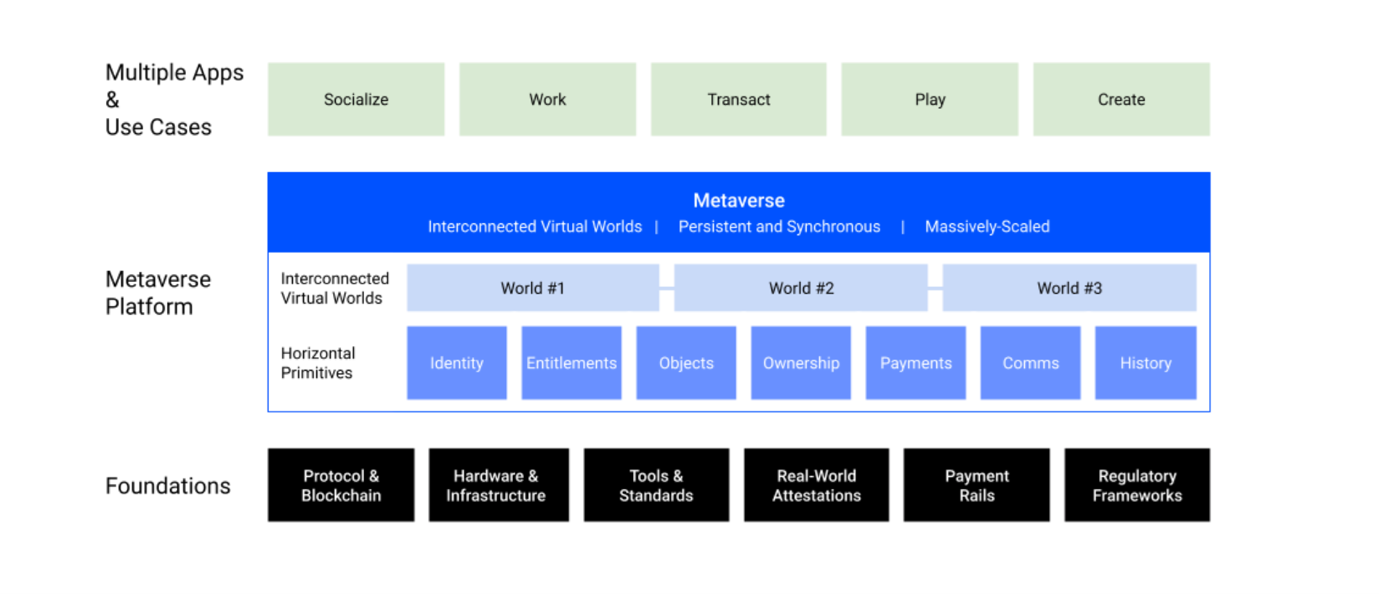

The foundation for the metaverse exists in 2022 and it is at a very nascent stage. The existing components including network connectivity, mobile sensors and motion devices all combine to an integration of everything digital often called the omniverse (all multiverses). Business sectors are reformed into an online culture namely entertainment, home working, seafarers, education, medicine, disaster management, 3D construction, tele robotics and the main focus of this paper financial services. The building blocks shown below already exist and can be combined to further innovate the metaverse in a decentralized fashion.

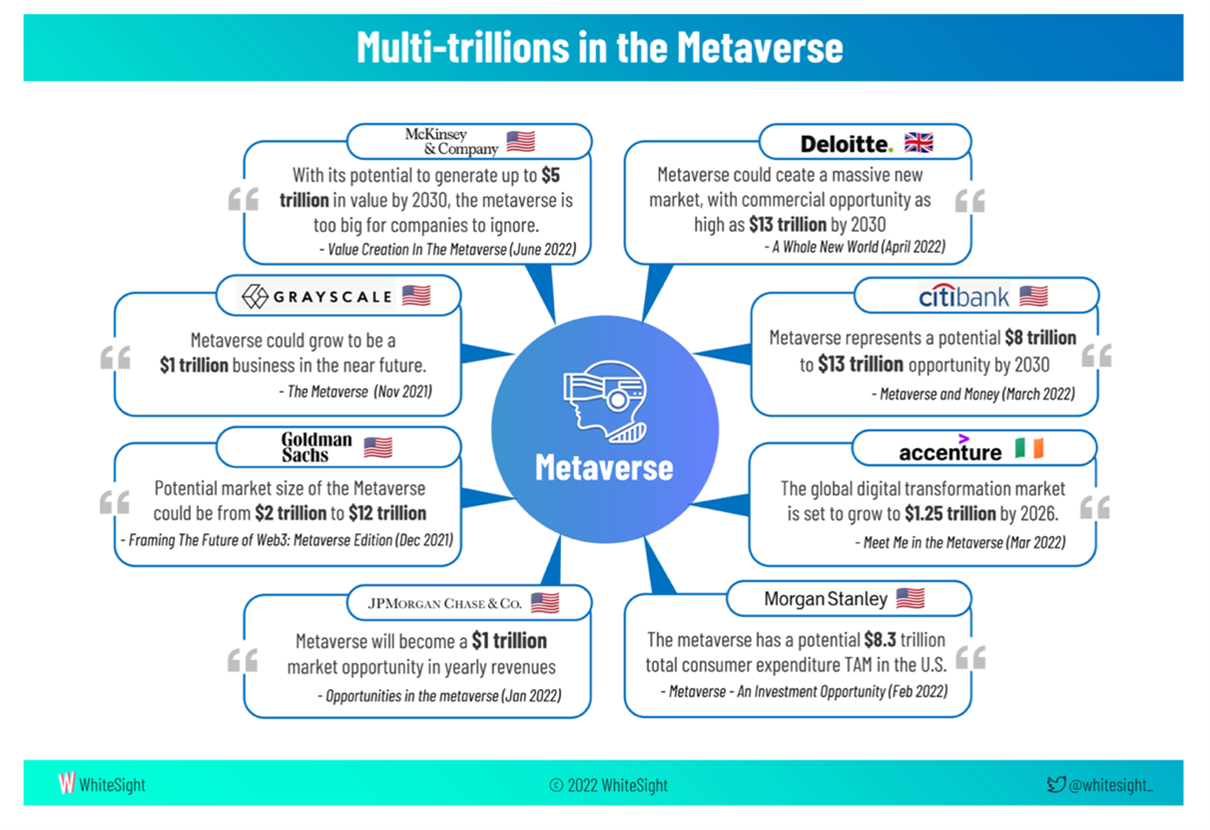

Statistics from Influencer Marketing Hub[vii] predict that the metaverse will be a $800 billion market by 2024 rising sharply because of the digitisation surge during the pandemic and in parallel a $300 billion MR hardware device market. META (Facebook) recently invested $10 billion[viii] in the metaverse citing global job creation. Citi have said the metaverse is a $8-13T market made up of 5 billion users[ix]. Deloittes say that metaverse could pump $1.4 trillion a year into Asia GDP by 2035[x]. The infographic by Whitesight[xi] below expand on the opportunity.

The main drivers in the transformation are Generation Z (Gen Z) as early adopters and digital assets becoming mainstream. Gen Z, (born 1997-2012), are 30 % of the world population accounting for 27 % of the workforce by 2025 (Zurich[xii]). As digital natives they were immersed in a society where content access was widely available, e-commerce the norm plus childhood experiences of online gaming. Financial services are now engaging, and this is no longer a game as cryptocurrency transactions interoperate between traditional payment companies. The metaverse is the extension of customer-based loyalty models opening new marketing and distribution opportunities by accessing large sets of data spawning new digital assets and services for consumers across the board.

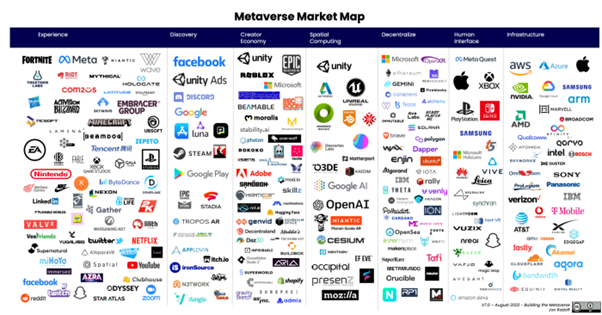

The ecosystem is growing rapidly as seen by the latest market map available.

Digital Identity

As digital assets are owned in the metaverse it is paramount to have digital identity and KYC (know your customer) as in the real world. This is a prerequisite in the metaverse where the use of blockchain extends identity to data and devices as well as people and eventually reach self-sovereign identity where all users own and control their data in a decentralized social media world. Tokenisation is the basis of a new economy in the metaverse as digital tokens are used for holding and purchasing assets with identity authenticated on a blockchain and assets can be traded for fiat money in the form of cryptocurrency. An avatar has a unique digital entity that can be embedded in metaverse protocols and access the applications within.

Internet of Things (IOT) and the Metaverse

It is important to establish the correlation in the commercial world of digital twin technology to the avatars in the Web 3.0 XR environment. IOT networks have billions of smart devices attached to the internet by wireless to share data resources and interact/respond with machines, sensors and people. Operational for years, data ingestion flows from the devices, so the confluence of IOT and metaverse is significant, accelerated by pandemic digitisation and the value is 3D Modelling in a 3D virtual space. Deloitte predicts this market to hit 16 B by 2023[xiii],with annual growth of 38%. Digital twins are dynamic, real-time, data-driven replicas of physical assets, processes, networks and systems, used to predictively model behavioural outcomes based on scenarios in virtual worlds with real world data input.

Digital twins make capital intensive projects “capital light” by prototyping, analysing and simulating activities in virtual environments to predict results and mitigate bottlenecks. XR usage brings more presence and when combined with haptic technology (touch) completes the immersion process. With natural and man-made catastrophes increasing, the accuracy of models needs to be improved by AI (Artificial Intelligence) and 3D modelling, extracting data from the real world accurately, secured, provenanced in real time. This has relevance in the industrial world where critical infrastructure, smart cities and factories are now composed of smart devices, digital twin technology and VR devices are already used to view a port or a factory floor as a digital space to make better decisions. The blockchain enabled streamlined data flow supports data-based decisions to supply chains for upstream and downstream visibility. Integration of IOT and metaverse is based on strong development of cloud computing integrity and configuration standards via localised EDGE[xiv] computing operating close to the devices and source of the data. Digital twin avatars perform tasks rendered as AI-powered 3D holographic images. Companies can simulate industrial activity and streamline processes to produce more with fewer natural resources usage, reduce environmental industrial waste and limit industrial accidents.

Metaverse Challenges

Contagion from fallouts as FTX Crypto Exchange (November 2022)[xv] will have a short-term effect on metaverse developments but as financial events have past proved they lead to better regulation unaffecting the long term. The metaverse provides a profile of the next generation internet, much broader than any one crypto exchange or cryptocurrency. NFT’s that survive the current crypto winter will rebound in a bull market as regulatory standards take hold.

Challenges will be met by evolution and not revolution. Bandwidth is a fundamental challenge as the expansive data content generated imbues fast, low latency connections. XR devices need to mature as the current headgear equipment is bulky, costly and unsuitable for mobile devices. Unlike video games, the overall metaverse experience continues endlessly, having no limits, and interoperability is required to connect the thematic multiverses. The business sector delineation blurs spurring legal challenges around IP rights plus regulatory issues with arbitrage and data privacy. Without regulation, boundaries are defined by software providers. Interactions between avatars and the market players will cause legal friction in proxies, ownership, contract enforcement and tort law. Avatars perform activities done by humans in the real world, so the legal status of avatars needs definition, specifically around the algorithms that drive them. Company directors face liability risks from employee mental /physical health from long online exposure, geopolitical, social, addictive behaviour, cybersecurity and reputation as liability permeates across real and virtual worlds.

Virtual Land Ownership

Virtual land ownership is a current driving force and the metaverse is truly the global digital real estate, creating a new land asset grab represented by numerous decentralised gaming platforms such as Sandbox[xvi] and Decentraland[xvii]. Major corporate brands buy plots of digital land in these multiverses to open store fronts for e-commerce, sell products/services and to transact banking business. Virtual land parcels can be purchased with bitcoin, NFT’s or fiat currency. The purchase, selling and trading virtual real estate and gaming assets will pass $1.9 billion in sales in 2022, according to virtual land analyst MetaMetriks[xviii]. Providing insurance coverage for digital property is challenging as little historical data exists to calculate risk and determine value. Virtual land can be rented out and or sold as plots via public offerings. Apart from 3D modelling of virtual land for better physical real estate environmental development, skeptics abound on the future of virtual land purchase.

Payments in the Metaverse?

In Web 2.0 payments were made online for example by PayPal[xix] or Stripe[xx]and web 3.0 will use a variety of payment rails to transact business and monetize. However no single payment system will be widely adopted in open metaverse as most payment systems work with both fiat currencies and cryptocurrencies. Many metaverse platforms are closed with their own proprietary currency tokens residing on blockchain technology, making interoperability between platforms difficult hence a need to transform to an open approach. Gaming prototyped the metaverse and the selling of digital goods to the players was done with fiat currency via the credit/debit card systems or cashing out game tokens to fiat as an off ramp. Cryptocurrency via NFT’s will likely be the long-term payment method due to advantages of blockchain, promise of real time lower cost cross-border transactions and more secure both in terms of cybersecurity plus personal data privacy. Adoption of BNPL (buy now pay later) services is happening in the virtual world where users buy digital goods with fiat and cryptocurrency to spread the cost over time interest-free. Digital exchanges are teaming up with the property metaverse to buy virtual land and other assets using BNPL XRPayNet[xxi] is an example of emerging payment system in the metaverse.

Banking and the Metaverse

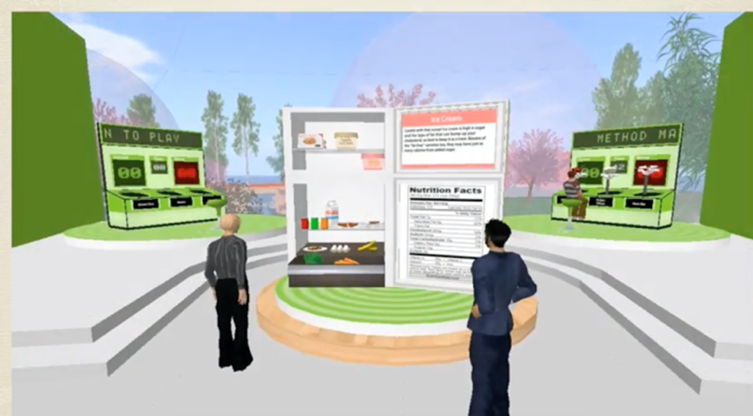

Using a VR device or laptop, users can access virtual banking services in the metaverse including operations that a bank clerk can control plus a visual way of conducting bancassurance providing education on the value of insurance. Both user and employee avatars can consult with one other as is shown in this example from the Moonland[xxii] metaverse as a service platform being applied in the banking space.

These products and services are sources of new revenue and growth for banks, via a new distribution channel, creating digital assets and wealth management. Traditional banks are joining the metaverse development and modifying existing processes to improve user experience and cultivate trust in the virtual world. NFTs are most likely the future of money so introducing digital mutual funds around is a good strategy given proper compliance, provenance of the NFT metadata and identity of the avatars involved. New entrants in the metaverse space may have no previous ownership of a financial services organization and could be a FINTECH company or large tech giant getting a banking licence, white labelling services and embedded finance solutions. Lessons learnt suggest that no bank should exist in the virtual world alone but entrants with expertise in cryptocurrencies and decentralised finance can be successful in both worlds. The Whitesight infographic shows the landscape.

Metaverse and Insurance

Businesses operating in the metaverse need protection against financial loss, event cancellations, cyber events and litigation costs to ensure that they can prepare against damages caused by their products/services. Insuring avatars and associated personal digital assets is a real time opportunity where they interact in a social hub. Proving financial loss is challenging and insurers must master blockchain technology and data driven techniques.

Detractors ask if the metaverse is a long-term unknown risk. Like other intangibles such as cyber, understanding the risk will take time but industry must aim at a better outcome than cyber, to cover the risks with the right limits. Capital market reinsurance vehicles will play a larger role in metaverse risks and insurers need to adjust their predictive analytics to work with significant volumes of data to develop premiums and products to accurately assess risk and loss. The emphasis should be on risk mitigation as in the real world.

A market map does not exist yet. In January 2022 Michael Mainelli and Simon Mills released a paper called “The Metaverse & Insurance – Pixel Perfect”[xxiii]covering many relevant issues. AXA entered the Sandbox in Hong Kong[xxiv], AIA[xxv], and Heungkik Life[xxvi] companies created a metaverse presence and other will rapidly join in 2023. YuLife[xxvii] has been designed for the gaming and life insurance metaverse experience from the outset.

Virtual healthcare insurance is emerging adjusting health policies to add riders for physical and mental harm due to prolonged user immersion. Telemedicine shows uptick demand and XRHealth[xxviii] offers metaverse-based virtual services that avatars can access 24X7 integrated with employee benefits.

Removal of physical constraints enables embedded insurance coverage, purchased via non-insurance products/services at real time point of sale providing brand awareness and education channel for younger generations. Swiss RE note a protection gap of $1.42T[xxix] so insurers in the metaverse using open API’s[xxx] can embed their products into broader ecosystems engaging with digital natives and the digital assets created in the process are vital for alternate asset investments especially for life insurance companies.

An avatar is a NFT which is a smart contract which triggers events so use of blockchain will hasten adoption of parametric insurance covering policyholders against specific events paying an instant pre agreed claim amount based on a set of data proven criteria, eliminating exclusions, deductibles, long claim process and reducing basis risk. Augmentation by humans is advised using AR. This contingency insurance can be applied to event cancellation or business interruption from cyberattack, market value loss of digital assets, reputational risk or loss of attraction of a platform. As crypto assets/NFTs are subject to high price volatility a risk management framework must be established to ensure key performance indicators such as solvency margin ratio and reserving are preserved. Cyber insurance has to be embedded with recovery services. In the industrial sector interactive digital twins are insurance touchpoints to engage in risk, pricing and claims adjustment. XR headsets carry out property assessments by overlaying new damage information over pre-damage images to verify claims. Property and casualty underwriters can examine assets without needing to be on site reducing costs. Extended warranty for smart devices is a key line of capital light business.

Metaverse for Health and Wellness

Digital transformation is ubiquitous in the healthcare sectors and an early use case for the metaverse. Wearable devices measure impact of health conditions in real time and data can be collected by a nurse avatar in a powerful crossroads of AI and XR. The metaverse offers an educational gamification approach to disease prevention and diet where loyalty tokens are earned and utilised to keep people active. Self-sovereign identity is key for patient health data and creating a data driven and consumer centric healthcare sector. In web 2.0 healthcare companies used the platforms to educate customers on healthy eating and wellness in general and this will continue in web 3.0.

Classification of Metaverses

A metaverse can be closed or open depending on ownership and technology approach. A closed metaverse is owned by large companies, built on web 2.0, and hosted on a centralized server. An open metaverse is mutually owned and controlled by its users, built on web 3.0, and hosted on a decentralized network. In the current landscape companies such as Meta and Google are closed based on retail, but Decentraland and The Sandbox are open based on gaming where the user has control over their data and allowing creation of new digital assets. Closed metaverse users cannot create new assets and ownership corresponds to the provider therefore opening up of infringement of IP rights.

The metaverse today is mostly centralized but will transform gradually to encompass decentralized finance (DeFi) where users access financial services for lending/borrowing, trading and investments using cryptocurrencies and NFTs, without needing to interact with a central institution. The centralized model is fully funded and owned by shareholders, who control direction, profits and interdiction thus casting a wider net to adoption. No knowledge of DeFi is required lowering the entry barrier. Subject to the right regulation, blockchain benefits of identity, data integrity and security posture are gained in decentralization where governance would be controlled by a DAO, owned fully by the users of that multiverse where funds are be allocated through voting mechanisms. Users who created or gained assets have control over rights resulting in IP friction and freedom of movement across a diverse variety of virtual worlds requiring a robust digital identity of avatars. User experience is not changed by decentralization which will take time and a hybrid solution will emerge. The question is should the metaverse provider own the data or should users all control their own data. Regulation must mature in areas of data privacy and IP rights and the issue is going to be interoperability between multiverses. The Open Metaverse Foundation[xxxi] is actively covering open metaverses adoption.

Metaverse Legal Issues, NFTs and Intellectual Property (IP)

Existing IP law will stand in the metaverse with extensions needed due to the potential volume and exploitation of data. As the internet before new rules need to be created around the outcomes of emerging technology rather than the technology itself. IP laws protect people/companies by granting exclusive rights over copyright, patents etc with IP rights based on intangible aspects but ownership tied to physical assets. Nothing changes in the virtual world as permission is required to use real world IP. Changes centre on NFT based avatars which have unique identity, ownership, provenance, hold thematic data determining value, and can be rented out, sold or traded. Most IP infringement cases taking place in the metaverse are licence agreements held in NFT smart contracts. When the NFT is sold, IP rights ownership is transferred from buyer to seller but normally for Web3.0 marketplaces the originator of the NFT grants a licence to the purchaser, to use/reproduce the digital asset without transfer of ownership. In the virtual world each multiverse platform requires clarity with regard to the rights granted especially when new assets are created by anonymous avatars. Regulations are required around avatar identity, algorithms and bias. Creating new digital assets is workable as long as ownership/provenance is verifiable on blockchain. A digital asset can be accessed by multiple avatars either simultaneously or at different times presenting legal challenges. Data privacy laws can be breached with no specific boundary or restrictions are imposed on data leaving the country of origin. Sensors from the XR devices are more invasive with collection of biometric data and civil cases are emerging when one avatar wrongs another which could become criminal such as assault, battery or even harassment by the haptic gloves. Safety bubble technology can be activated to prevent avatar close contact along with block and mute functions. Internet access is no longer a distance between user and screen but full face to face engagement via avatar where facial expressions and body language can be expressed by embodiment.

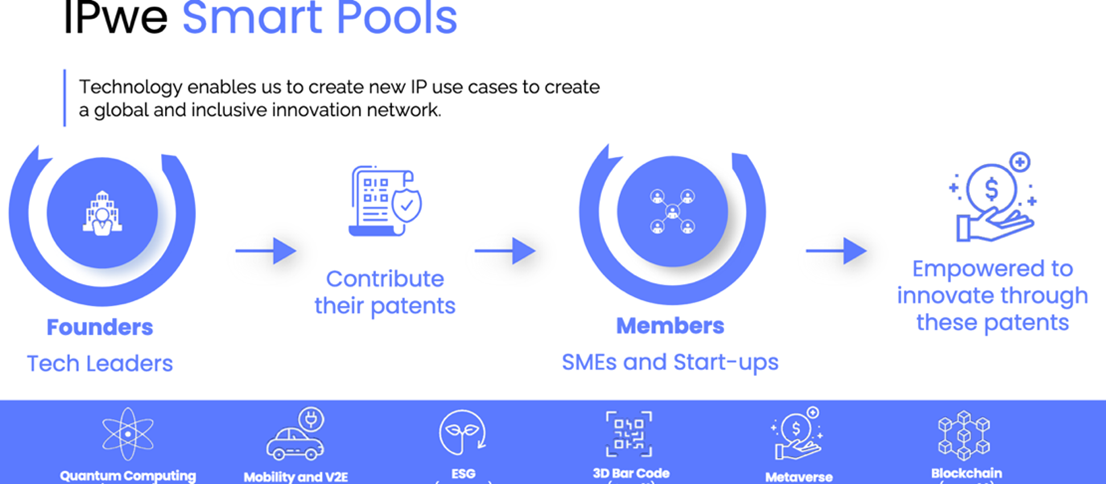

An innovation worth mentioning is the development of a Metaverse Smart Pool by IPWE[xxxii] which is designed to permit metaverse creators to make innovations available or pooled to other participants, including large corporations, that can be built on and improved upon. It strikes a balance between open innovation and a fair return for innovators who are able to encourage adoption and generate a return on their innovation efforts.

Metaverse Cybersecurity Concerns

As vast amounts of sensitive data are generated the metaverse must adopt a zero-trust model with strict identity checks and ongoing authentication to mitigate bad actors. Blockchain decentralization is the best way to protect and restore identities back to the rightful owner in the case of NFT theft, avatar identity theft, VR/AR device manipulation, data integrity breach and phishing on NFT sales to steal assets. Cold wallets are used for recovery of private keys. Cryptocurrency holders generally use VPNs when accessing the metaverse, and it can be almost difficult to trace the sources of fake identities. This table shows the risks:

|

Metaverse Players |

Reinsurance and Insurance Risks |

|

Platform owner/providers e.g., META, Decentraland |

Cybersecurity Crimes, Data Theft, Legal Fee, Reputation, Business Interruption, IP Theft, Fraud, Smart Contract Failure, Litigation from other players, Ransomware. |

|

Third Parties e.g payment platforms |

IP Theft, Fraud, Ransomware, Theft of Data, Legal Fees |

|

Sites and Owners – e.g., web site owners |

Cybersecurity Crimes, Data Theft, Legal Fees, Reputation, Business Interruption, Litigation from other players. |

|

Metaverse Users/Avatars |

Fraud, Data Theft, Personal Injury, Damage to Home Contents, Mental Health, Identity Theft |

|

Advertisers – AdTech |

Data Privacy, Ransomware, Publisher Brand Protection |

Appropriate cyber insurance needs to be given across the board. Programmatic advertising buys digital space automatically in real time based on data analysis. Avatars now have eye tracking sensors and there are many ways to access data commonly known as ad-tech. Advertisers are going to need cyber insurance in the metaverse. Overall, there is going to be the need for an “all risks” approach to cyber and its mitigation before risk transfer. Concern has been addressed on issues child safety and state sponsored terrorism activities. If the metaverse achieves its financial potential, then current cryptocurrency crimes will exacerbate. Audits of each platform needs to be done to ensure the proper security postures and smart contracts are in place. AI tools exist to scan smart contract code to determine Ponzi scheme structures for example. Cybersecurity issues must be fully addressed and mitigated for the metaverse to succeed and cannot rely on (re)insurance alone.

REGULATORY VACUUM IN METAVERSE

Data privacy breach is a prime concern and can generate huge fines and reputational risk for participants. Governments should not regulate new technology with existing laws and strike a proper balance between innovation and protecting the public. They need to look at the data layers used in AR, so they understand the differences between the 2D web pages on a device screen to 3D virtual world immersion. Metaverse systems operate via blockchain technologies, many in the public blockchain which have no regulatory oversight although that should reform in 2023 as regulators and policymakers see the metaverse as a major development issue such as anti-money laundering, KYC, the use of DeFi, crypto assets and property rights all need addressing not to mention state sponsored cyber-attacks. Technology is being built in parallel with governance principles, so government policy makers need to respond ex ante and not react to risks after they have emerged. While the metaverse presents revenue and growth potential, development and adoption threaten to precede any regulation. SEC[xxxiii] in USA are intensifying their focus on the intangible world and caution will be needed after recent events such as FTX and Three Arrows[xxxiv] (3AC) which can detract from the broader opportunity. A one-size-fits-all strategy regulating the metaverse is unfeasible so self-regulation must arise using metaverse governance from responsible parties which is a stop gap and not the true roadmap to regulation. Unless there is a global agency set up to regulate the metaverse, which seems unlikely in the short term, then a multi-layered regulation will be required by platform, region, country and individual stakeholders.

FINANCIAL INCLUSION

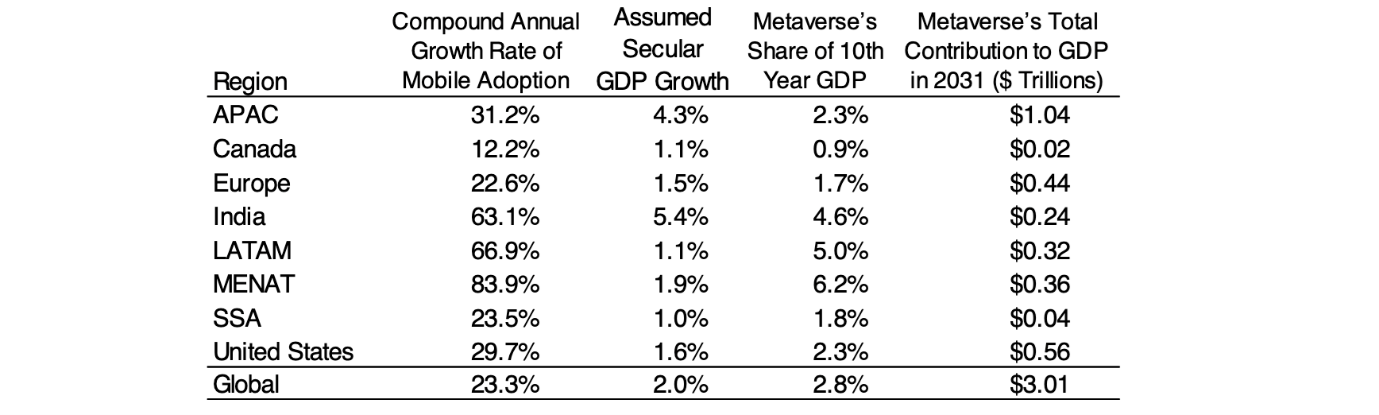

Economic development is key and The Analysis Group[xxxv] statistics below based on their report “The Potential Global Economic Impact of the Metaverse”[xxxvi] gives a good indication of how the metaverse can address including more financially underserved people. If the technology becomes available on mobile devices, the number of users could grow to nearly 5 billion or about 60 percent of the estimate of the world’s population at the time encompassing peer to peer lending, healthcare adoption and insurance at village level.

It is paramount the metaverse benefits developing economies and not just wealthier nations. Emerging economies such as Africa have less advanced infrastructure compared to the West but capable of leapfrogging such as M-Pesa[xxxvii] mobile money. Low orbit satellites will connect the mobile phones but much of the world rural population is still financially excluded from traditional financial services and will benefit from the metaverse experience. Remittance companies such as Western Union, Paypal and counterparts around the world have signed up for metaverse trademarks[xxxviii]. Wells Fargo were early adopters of virtual worlds in 2009 with Stagecoach Island[xxxix]. Adoption by remittance companies will have impact when both diaspora and rural communities access a mobile based metaverse. India has launched Kiyaverse[xl] a banking multiverse that can evolve to rural India via mobile devices. Financial inclusion requires community forums, mostly led by women. Meta[xli] established a community forum relationship with the Deliberative Democracy Lab[xlii] from Stanford to look how virtual experiences can be managed in communities. Financial services offered to rural communities in the past have not worked due to lack of trust with central organizations, so community based, peer to peer finance offers a major solution to a real-world problem.

Future of Metaverse depends on Interoperability

Collaboration is required via live portals so smart objects, avatars, wallets and blockchain components can be moved across virtual worlds securely. In web 2.0 avatars teleport from one web site to another but in Web 3.0 this becomes seamless. Unique sovereign identity of people, devices and data is paramount here as one user may have multiple avatars all requiring unique identification. The ability to do 3D predictive modelling across the metaverse is key to better decision making. As we are discussing combining multiple ecosystems, some closed, data sharing becomes the mitigating factor for decentralizing the metaverse to enable data integrity and provenance. The Metaverse Standards Forum (MSF)[xliii], was founded in June 2022 to foster the development of interoperability standards for an open and inclusive metaverse and accelerate their development and deployment through practitioners.

Work Practices

The hybrid work world of the future is about dividing time between home and office and now also spending time in metaverse meetings with virtual characters teleporting instantly to meetings in hologram form., This promises to bring new levels of social connection and mobility, while creating imaginative and creative new ways for people to collaborate and work online Following the pandemic Microsoft are adapting their Teams product into Mesh[xliv] for collaborative work which can be integrated with other apps to promote interoperability. This is based on holoportation[xlv] (3D models of people) and presence and device agnostic removing need for XR devices. A positive innovation from the pandemic.

Shariah Considerations relating to the metaverse (Islamic Finance)

The principle in Shariah is that “everything is permissible unless there is a clear prohibition”. Demographically the world Muslim population is expected to rise at twice the rate of non- Muslims over the next two decades[xlvi]. The Shariah metaverse will emerge with Shariah experts who understanding the Shariah boundaries and provide governance.

Building of a Shariah-compliant metaverse is focused on experiences of mutual benefit and education. Games and activities on the metaverse will follow a governance so not to impact Shariah obligations. Designing avatars and concepts should not be composed of anything unlawful to see in Shariah as what is permissible to do in the real world applies in the Shariah virtual world.

This means any transaction involving interest charges (Riba), uncertainty in asset ownership (Gharar) and prohibited goods being traded (e.g., pork, alcohol) cannot be presented in an Islamic multiverse. This will present an interoperability challenge for Islamic banking and insurance (Takaful) but in same way present a large opportunity for financial inclusion due to the mutual nature of the sector.

How will Metaverse impact ESG (Environmental, Social, Governance)?

Virtual space simulation helps businesses track and report environmental impact, engage with customers on social issues with avatars and promote governance models to increase transparency and communication. The obvious environmental challenge is increased data centre usage which run the persistent virtual worlds from the energy consumption standpoint. Intel stated that the metaverse will expand collective computing power 1000X[xlvii] increasing the carbon footprint.

Social is the biggest gain as metaverse is centred around connecting people with the ability to work remotely as avatars but connecting as a team virtually in a collaborative approach without geographical constraints resulting in less travel thereby reducing carbon emissions.

Governance, outside of the metaverse governance itself, is going to be most prominent in the industrial sector for workplace safety with the digital twin technology enabling better decisions and data integrity using blockchain. Also, the virtual and buildings can better manage the wastage of building material prior to the actual construction.

The ESG challenge is the trade-off between increased computing power and less carbon footprint by reduced travel. New innovative cloud computing models are emerging based on leveraging idle time of existing computers to address this issue which also encompasses the bitcoin mining. The EY[xlviii] paper on Metaverse and ESG lays out important principles.

The Quantum Era

The Metaverse (Web 3.0) will come to maturity in the quantum era predicted by 2030. This is a new era of parallel processing computing designed to meet the challenges of processing vast quantities of data being analysed for good purposes such as vaccine development, protein folding, manufacturing and finance. These quantum computers will play a huge role in helping the metaverse operate a fully immersed, interactive, user experience. With such advancements comes new cybersecurity posture challenges and threat of manipulation and misuse. This means regulation and advanced post quantum security methods will need to be introduced early to protect the privacy and security of the metaverse. The cryptography in use today can be broken by quantum computers so post quantum standards are being built by NIST[xlix] now which will allow organizations to transition to this new era which could take up to a decade to complete. Quantum-resistant security methods are certain to be at the forefront of plans to safeguard the metaverse however it develops in the future.

CONCLUSIONS

Virtual worlds are not new but the difference the metaverse brings is connecting people with immersive 3D presence and the foundations exist to make this evolve. There are unknown questions on what the full social impact will be consumer protection and regulation manifestation. As the metaverse is the next generation mobile internet and it will take time for standards to emerge but organizations such as the Metaverse Standards Forum, XR Association and WEF[l] are examining interoperability. Composed of a digital ecosystem built on 3D technology, real-time collaboration software and blockchain-based decentralized finance tools, the metaverse needs to embrace lower cost mobile devices across faster internet connections to encompass spatial computing into the industrial and developing worlds.

Applications need to emerge to integrate the silos of the numerous multiverses into one ecosystem. This catalyses a move from the centralized metaverse that exists today to a decentralized, open omniverse experience where avatars operate in multiple locations dispelling any notion of a digital casino for the rich who own the data. This creates financial inclusion scenarios that do not replace the real world but closely emulate it. North Asia plays a significant role as they have strong experience in gaming, broadband and chip technology. Japan played a leadership role in the web 2.0 cycle with talking avatars and South Korea are embracing the metaverse at a municipal level. Combined with development in the West and rest of world, new products will emerge with wearable devices, life like avatars, and holograms. The metaverse needs to be multicultural and attributable from the outset with strong digital identity across the board, immutability and non-repudiation. This is a global phenomenon combined with a technological and generational mentality shift.

Generation of digital twin 3D modelling from simulation of smart cities, industrial sites, critical infrastructure, hospital healthcare management, cyber risk scenarios and natural disasters is a game changer for risk management. In current economic climate there will be some distancing from cryptocurrency and NFT’s but eventually the virtual economy will outpace the real world, once governments regulate open and competitive platforms, getting to grips with challenges, especially IP issues. Similar to autonomous cars there are many digital moving parts leading to liability issues, so data integrity/provenance is necessary to manage the data across the multiple cloud computing platforms to prove who is liable forensically.

The greatest value of the mature metaverse will be the connecting of people with content streaming. Early platforms a decade ago lost attraction because of cyber security and inadequate payment issues. Money is a belief system, and the way money is looked at in the future metaverse may progress to a fully functioning economy. There is always a possibility that this could be another hype bubble that bursts but given the alignment of many key factors it is likely that this is going to be a development that no government or country can ignore.

Investment into FINTECH including specific technology around all the business sectors will guide the direction of the metaverse. Portfolio platforms such as MetaverseLife[li] give investors early exposure to metaverse assets and platforms. Coinbase[lii] published a self- explanatory diagram of a future metaverse as shown below integrating components.

In summary the metaverse is a man-made online, virtual world that exists as a parallel universe to the real world, where people can interact with each other by creating digital images of themselves using avatars that play, work and trade. It is starting to be the focus of businesses to use virtual worlds to engage with customers, employees and partners. Digital assets require digital identity and ownership, so identity is a key construct in the metaverse especially when traversing many multiverses.

Appointments of Chief Metaverse Officers[liii] are emerging to dovetail with the maturing metaverse technology. However digital literacy is going to be required by all stakeholders to ensure cross cultural capabilities and diversity of social spaces are part of the metaverse by design to make it a complete social business model with trust-based rules and regulations.

The author would like to thank Claus Nehmzow[liv] of Alcus Ltd. and Linda Chan from Galaxy Labs for their discussions leading up to the writing of this white paper.

[i] https://www.pacificinsuranceconference.org/event/a4318cbd-e84b-4beb-9df0-93edceb45efe/summary

[ii] https://www.aia.com.hk/en

[iii] https://secondlife.com/

[iv] https://www.leadingvirtually.com/wonderland-a-tool-for-online-collaboration/

[v]https://www.scmp.com/article/965444/3ds-new-dimension-learning-language

[vi] https://xra.org/

[vii] https://influencermarketinghub.com/metaverse-stats/amp/

[viii] https://www.theverge.com/2021/10/25/22745381/facebook-reality-labs-10-billion-metaverse

[ix]https://www.fool.com/investing/2022/05/03/wall-street-says-the-metaverse-is-an-8-13-trillion/

[x] https://www-cnbc-com.cdn.ampproject.org/c/s/www.cnbc.com/amp/2022/11/14/metaverse-could-pump-1point4-trillion-a-year-into-asias-gdp-deloitte.html

[xi] https://www.whitesight.net/

[xii] https://www.zurich.com/en/media/magazine/2022/how-will-gen-z-change-the-future-of-work

[xiii] https://www2.deloitte.com/content/dam/insights/us/articles/3773_Expecting-digital-twins/DI_Expecting-digital-twins.pdf

[xiv] https://www.accenture.com/ae-en/insights/cloud/edge-computing-index

[xv] https://www.investopedia.com/what-went-wrong-with-ftx-6828447

[xvi] https://www.sandbox.game/en/

[xvii] https://decentraland.org/

[xviii]https://metametriks.xyz/

[xix] https://www.paypal.com/hk/home

[xx] https://stripe.com/en-gb-hk

[xxi] https://xrpaynet.com/

[xxii] https://www.moonland.world/

[xxiii] https://www.zyen.com/news/press-releases/metaverse-insurance-pixel-perfect/

[xxiv] https://www.axa.com.hk/en/article/the-sandbox-partnership

[xxv] https://www.digfingroup.com/metaverse-finance/

[xxvi] https://www.atlas-mag.net/en/article/an-insurance-company-joins-the-korean-metaverse

[xxvii] https://yulife.com/

[xxviii] https://www.xr.health/

[xxix] https://www.artemis.bm/news/inflation-to-drive-insurance-protection-gap-to-new-high-in-2022-swiss-re/

[xxx]https://www.ia.org.hk/en/aboutus/task_force/activities_meetings/files/Open_API_presentation_for_FTF_meeting.pdf

[xxxi] https://www.openmv.org/

[xxxii] https://ipwe.com/

[xxxiii] https://www.sec.gov/

[xxxiv] https://www.pymnts.com/cryptocurrency/2022/u-s-regulators-probe-failure-of-three-arrows-capital/amp/

[xxxv] https://www.analysisgroup.com/

[xxxvi]https://www.analysisgroup.com/Insights/publishing/the-potential-global-economic-impact-of-the-metaverse/

[xxxvii]https://www.vodafone.com/about-vodafone/what-we-do/consumer-products-and-services/m-pesa

[xxxviii] https://nftnewstoday.com/2022/10/26/paypal-and-western-union-continue-the-metaverse-trademark-fe

[xxxix] https://www.engadget.com/2007-11-15-wells-fargos-stagecoach-island.html

[xl] https://www.kiya.ai/metaverse/

[xli] https://about.fb.com/news/2022/11/improving-peoples-experiences-through-community-forums/amp/

[xlii] https://cdd.stanford.edu/

[xliii] https://metaverse-standards.org/

[xliv] https://learn.microsoft.com/en-us/mesh/overview

[xlv] https://en.m.wikipedia.org/wiki/Microsoft_Holoportation

[xlvi]https://www.pewresearch.org/religion/2011/01/27/the-future-of-the-global-muslim-population/

[xlvii] https://singularityhub.com/2021/12/17/the-metaverse-will-need-1000x-more-computing-power-says-intel/?amp=1

[xlviii] https://www.ey.com/en_jo/digital/metaverse-could-creating-a-virtual-world-build-a-more-sustainable-one

[xlix] https://quantumxc.com/blog/quantum-technologys-impact-on-the-metaverse/

[l] https://initiatives.weforum.org/defining-and-building-the-metaverse/home

[li] https://www.etoro.com/smartportfolios/metaverselife

[lii] https://www.coinbase.com/

[liii] https://nftnewstoday.com/2022/10/01/whats-a-chief-metaverse-officer/

[liv] https://www.flickriver.com/photos/9802442@N08/4100036105/

12.2022

About the Author:

David Piesse is CEO of a family office, DP88, specialising in InsurTech initiatives in Asia - www,DP88.com.hk. David has held numerous positions in a 40-year career including Global Insurance Lead for SUN Microsystems, Asia Pacific Chairman for Unirisx, United Nations Risk Management Consultant, Canadian government roles and staring career in Lloyds of London and associated market. David is an Asia Pacific specialist having lived in Asia 30 years with educational background at the British Computer Society and the Chartered Insurance Institute.