Embracing Sustainable Investments - Opportunities and challenges for insurers

by Joyce Liow, Internal Audit Manager, Governance & Risk Management Group, Milliman Financial Risk Management LLC

As proponents of risk management

insurers have been keenly attuned to the existential risk of climate change. In the United States, the National Association of Insurance Commissioners (NAIC) formed a Climate and Resiliency Task Force in 2020 to address aspects of climate change risks pertinent to the insurance industry and to encourage innovation in closing protection gaps.[i] In Europe, the European Insurance and Occupational Pensions Authority (EIOPA) has prioritized sustainable finance to position the insurance and pensions sector in mitigating and adapting to climate change risks.[ii] The largest life insurer in Asia, the AIA Group, made the 2022 Fortune “Change the World” Top 10 List for selling “its entire coal equity and fixed-income portfolio seven years ahead of schedule.”[iii] That same year, over 85 insurers in Africa pledged to provide USD14 billion to “manage the financial risk of climate shocks and increase the resilience of its more vulnerable communities.”[iv]

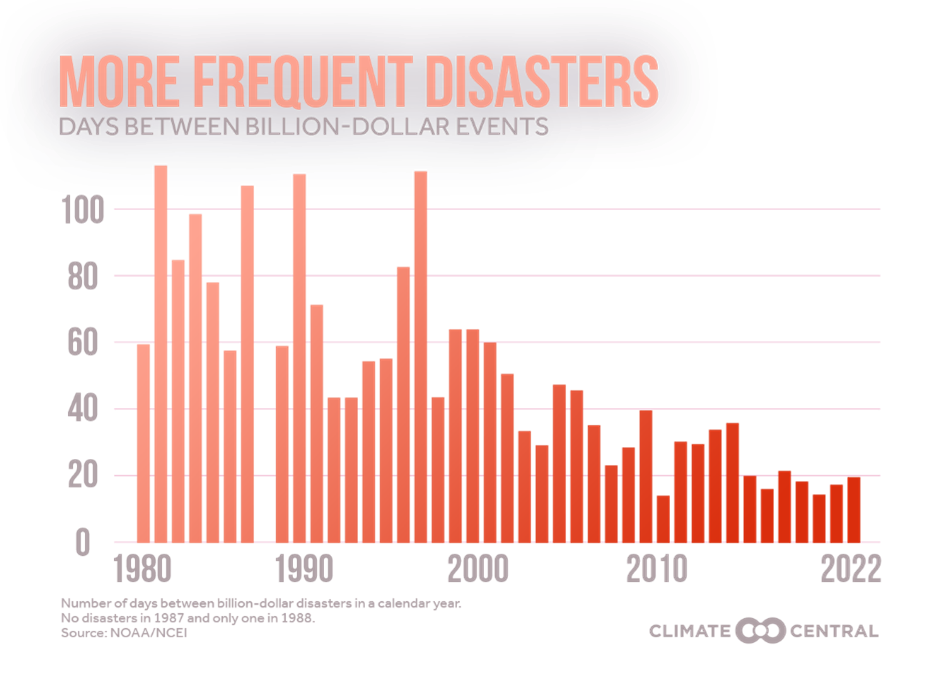

In fact, many insurers have been paying attention to the impacts of climate change for decades. Munich Re’s NatCatSERVICE loss database and its analysis of climate change’s effects on weather-related natural disasters started 50 years ago.[v] There is a renewed sense of urgency because of the increased frequency and severity of climate-change-related losses. Climate Central, a nonprofit group formed to educate laypeople on climate-related risks, analyzed U.S. data from the National Oceanic and Atmospheric Administration (NOAA) and National Centers for Environmental Information (NCEI). It found that the average time between billion-dollar disasters is now just 18 days, a precipitous drop from 82 days in the 1980s.[vi]

Figure 1: Days Between Billion-Dollar Disasters 1980-2022 Source: Climate Central (2023)

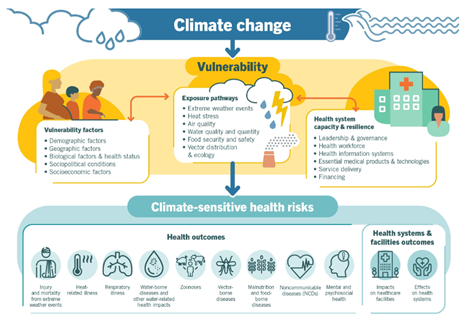

These catastrophe events may have implications not only for property and casualty (P&C) insurers, but for life and health insurers as well. Scientists estimated that in 2022 there were over 60,000 heat-related mortalities in Europe over a three-month period.[vii] The World Health Organization (WHO) has linked several poor health outcomes to climate change, including injury and mortality from extreme weather events, spread of diseases, and respiratory illnesses that impact the liability side for life insurers.[viii]

Insurers can manage climate-related risks in multiple ways, both on the liability side and on the asset side. There are new opportunities for targeted investments that promote sustainability. Sustainability is defined by the United Nations (UN) as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.”[ix] Addressing environmental needs, including climate change and biodiversity, is one component of sustainability, along with economic and social development goals.[x]

In this paper, I will share what sustainable investment is, the challenges and opportunities available to insurers in pursuing this range of investment strategies, and other actions insurers can take to help reduce risk and promote sustainability.

What is sustainable investing?

Sustainable investing is the “range of practices” where investors aim to “achieve financial returns” by allocating investments towards companies or causes that promote “long-term environmental or social value.”[xi]

The insurance industry has been at the forefront of adopting sustainable investing as it relates to climate change goals, compared to other institutional investors such as pension funds and private banks. According to the 2023 Global Climate Survey conducted by Robeco, an international asset manager focused on sustainable investment strategies, 39% of insurers (compared to 21% of other institutional investors) made a public commitment to achieving net-zero greenhouse gas emissions from their investment portfolios by 2050 or are in the process of doing so.[xii]

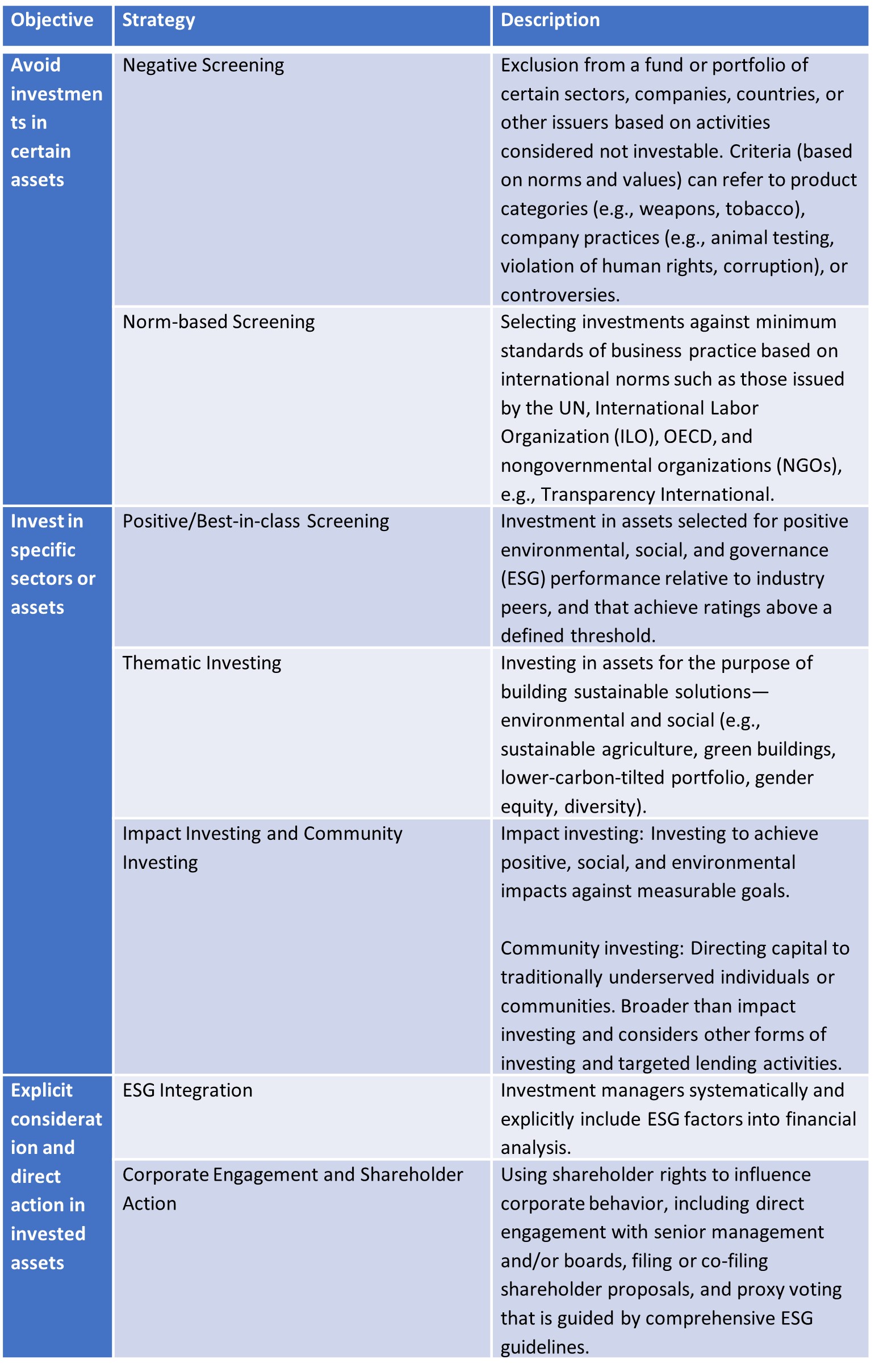

Sustainable investing is widely seen as being categorized in the seven categories shown in Figure 3 below.[xiii] While negative screening is easier to implement, there is no best way or a maturity level scale for engaging in sustainable investing. The deciding factor will be the insurer’s capabilities and aspirations. The following sections on challenges and opportunities may be helpful in shaping that decision.

Figure 3: Overview of Sustainable Investing Strategies Based on the Global Sustainable Investment Review (2020)

Is it worth it? – Challenges in sustainable investing.

Mixed financial returns: Despite the enthusiasm, sustainable investments have exhibited mixed financial returns. In 2017, researchers from the Bucharest University of Economic Studies analyzed the performance of funds that met a set of criteria to be classified as socially responsible investments (SRIs) over a 10-year period from 2006 to 2016. They found that these investments do not outperform non-SRI funds. The silver lining, however, was that, in a bear market, the risk of a loss was not that high.[xiv] A similar 2019 study of ESG investments during the period 2003 to 2017 by Goethe University Frankfurt concluded that: “Investing into a portfolio that is long in ESG-active firms and short in ESG-inactive firms delivers a highly significant negative abnormal return of between -28 and -31 basis points per month.” These researchers explained that ESG-inactive firms earn better returns for their investors because financial markets penalized companies with low ESG scores by demanding higher returns.[xv] While Harvard Business School professors did find evidence that firms with superior performance on material sustainability issues outperformed other firms based on future projections,[xvi] the conclusion is dependent on the ability of investors to identify material sustainability issues. This ability may be hindered by the challenges posed by greenwashing.

Greenwashing: First coined in the 1980s, greenwashing refers to the practice of businesses representing themselves as more engaged in sustainability efforts than they are.[xvii] In a May 2022 paper published by professors from the London School of Economics and Columbia Business School, there is evidence that self-proclaimed ESG funds engaged in substantial greenwashing. The ESG funds’ portfolio firms have more violations of labor and environmental laws, pay more fines for these violations, and emit more carbon dioxide per unit of revenue.[xviii]

Legal challenges from policymakers and politicians: As the Robeco 2023 Global Climate Survey has shown, more than half of North American investors are concerned that adopting sustainable investing policies would place them in the crosshairs of policymakers and politicians.[xix]

That concern materialized in May 2023 when a coalition of 23 U.S. attorney generals sent a letter to the Net Zero Insurance Alliance (NZIA), a UN-backed alliance formed to reach the net zero carbon emissions goal by 2050, suggesting that the alliance and its members’ target setting protocol and other actions may have violated federal and state antitrust laws. An exodus of members from the NZIA ensued and the alliance lost around 60% of its members across the globe.[xx] In July 2023, the UN ditched the requirement for NZIA members to set or publish targets.[xxi]

Regulatory disincentives: Dobiac, Bonnet, Yan, and Resovac (2022) pointed out that, due to capital regulations such as solvency rules, insurers may be disincentivized to invest in sustainable asset classes as those assets tend to be less liquid than traditional assets. There is also a lack of regulatory guidance to assist investors in identifying differences in the treatment of sustainable investments.[xxii]

Despite the challenges, insurers now are facing stronger demands from both internal and external stakeholders to consider climate in their investment portfolios as reported in Robeco’s 2023 Global Climate survey.[xiii] With USD 9.7 trillion in cash and invested assets as of 2020,[xiv] insurers have the power to change the trajectory of climate change through the combined value of the assets under management, or by directing asset managers to align the investments to their vision and mission. As Harvard Business School professors Porter, Serafeim, and Kramer wrote in 2019, “The purpose of investing is to create a virtuous cycle by allocating capital to those companies that create the greatest societal returns…This virtuous circle drives present returns as well as future growth and opportunity. When investors ignore their own social responsibility…they are eroding the impact and legitimacy of capitalism as a vehicle for advancing society.”[xxv] Many insurers believe they have a social responsibility to invest in sustainability and slow down climate change. The next section is where opportunity meets that responsibility.

Getting a piece of the action – Opportunities in sustainable investing.

Global climate finance flows have increased at a 7% compound annual growth rate (CAGR) since 2011, reaching USD 665 billion in 2020. Significant opportunities remain for growth because the estimated investment needs in the coming decades to avoid the worst impacts of climate change is USD 4.3 trillion.[xxvi]

Climate adaptation and resiliency: One of the gaps, is in climate adaptation and resiliency investments. These are investments to ensure that physical assets are built to withstand and adapt to changing climate conditions.[xxvii] While such investments tend to be infrastructure investments that have longer time horizons, life and annuity insurers are the rare breed that have primarily long-term investments. Almost 90% of global climate finance went towards climate mitigation, for example, renewable energy generation, and low carbon transport. [xxviii]

Investing in climate adaptation and resiliency not only helps protect the physical assets that may make up the liability side of insurers’ balance sheets, but it also may help with mitigating the risk of stranded investment assets should there be sudden and unpredictable change in climate conditions. The Organization for Economic Cooperation and Development (OECD) environment policy paper on climate-resilient infrastructure included an example of how alternative energy investments can get stranded. In a dry climate scenario, the value of hydropower generation in Africa could be reduced by USD 83 billion.[xxix]

Advancements in sustainable investment research: While sustainable investment is a relatively new field compared to traditional investment assets, there have been significant advancements in identifying investment strategies that do generate alpha or excess returns earned on investments. Robeco, for example, is a pure-play ESG investment advisor that has been in the market for 25 years. Most recently, in a July 2023 paper, it revealed a range of alternative signals that could better assess the ESG profile of companies that correlate with positive future stock returns.[xxx] Robeco has adopted machine learning for more comprehensive and efficient analysis of available data to draw linkages between the signals and expected stock returns. Other big names have also thrown their resources into ESG investment research, including Bloomberg, Morningstar, and MSCI with the MSCI ESG Ratings.[xxxi]

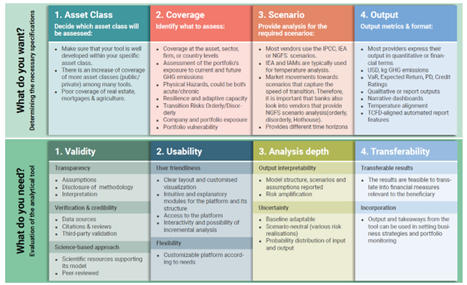

Wider availability of tools and resources: Since 2015, investors have seen an increase in the number of coalitions and enablers forcused on helping financial institutions explore sustainable investing practices with a focus on climate change, for example the Climate Action 100+, and the Coalition for Climate Resilient Investment.[xxxii] For many of these organizations, the goal is to provide actionable advice and tools. For example, the Climate Policy Initiative published the “Framework for Sustainable Finance Integrity” in 2021 to “deliver meaningful sustainability and net zero results; contribute to a clear pathway for more coordinated action; create metrics against which to track progress; and reinforce the multiplier effect these actions will have on the real economy.”[xxxii] The UN Environment Program (UNEP) Finance Initiative’s Climate Risk and Task Force on Climate-Related Financial Disclosures (TCFD) program developed the Climate Risk Tool Dashboard to assist financial institutions understand and use climate risk tools and disclose major market trends in physical risk and transition risk tools.[xxxiii] They have even provided a road map (see Figure 4) for how to choose a climate tool. Insurers can also look forward to the upcoming publication of the full suite of recommendations from the Taskforce on Nature-related Financial Disclosures (TNFD) in September 2023.[xxxiv] TNFD members hold more than USD 20.6 trillion in assets under management and hail from more than 180 countries. Their recommendations aim to “build a risk management and disclosure framework that can be used by organisations of all sizes in all jurisdictions to identify, assess, manage and disclose nature-related dependencies, impacts, risks and opportunities.”[xxxv] These tools and resources help counter the effects of greenwashing and provide foundational knowledge for insurers to explore sustainable investing.

Figure 4: A Practical Road Map for Financial Institutions Looking to Select a Climate Tool Source: UNEP finance initiative (2023)

Better disclosures and enforcement: Perhaps the biggest advancement in sustainable investing is the tried-and-true method of encouraging investments by having more meaningful and standardized disclosures. In January 2023, the Corporate Sustainability Reporting Directive (CSRD) became law in the EU. This directive “requires all large companies and all listed companies (except listed micro-enterprises) to disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment”.[xxxvi]

The U.S. Securities and Exchange Commission (SEC) is also anticipated to issue the Climate Change Disclosure rules in October 2023.[xxxvii] Though the rules were delayed by about a year, the SEC continued enforcement actions. In November 2022, the SEC charged Goldman Sachs for failing to follow its ESG investments policies and procedures. Goldman Sachs agreed to a USD $4 million penalty for the transgression.[xxxviii] These actions help with assessing the sustainability performance of companies, leading to better evaluations of the investment opportunities in these companies, and reinforcing the optimism for investor confidence in sustainable investing.

Pathways to sustainability for insurers – MAPFRE case study

A recent 2023 GlobalData poll of insurers asked them what was the most important thing to do to combat climate change. Most respondents cited investment exclusions from carbon-emitting industries (30.2%), but stopping underwriting for carbon-emitting industries (22.1%), creating carbon-offsetting policies (22.1%), and reducing the carbon footprint of the insurer itself (15.7%) are statistically significant alternatives.[xxxix] Sustainable investing is but one tool in the insurer’s arsenal.

Petra Hielkema, chairperson of EIOPA, encouraged insurers to “develop innovative insurance products that incentivize climate-related risk prevention, for instance through offering lower premiums to policyholders implementing climate related adaptation measures.”[xl] This point was echoed by the California Department of Insurance in its 2022 Sustainable Insurance Road Map, which suggested insurers can provide products that “provide green-rebuild coverage, providing a pathway to building back stronger, more energy-efficient, and lower-emission buildings and vehicles”; and/or “promote fuel efficiency by offering lower premiums for low-emission vehicles”, among other solutions.[xli]

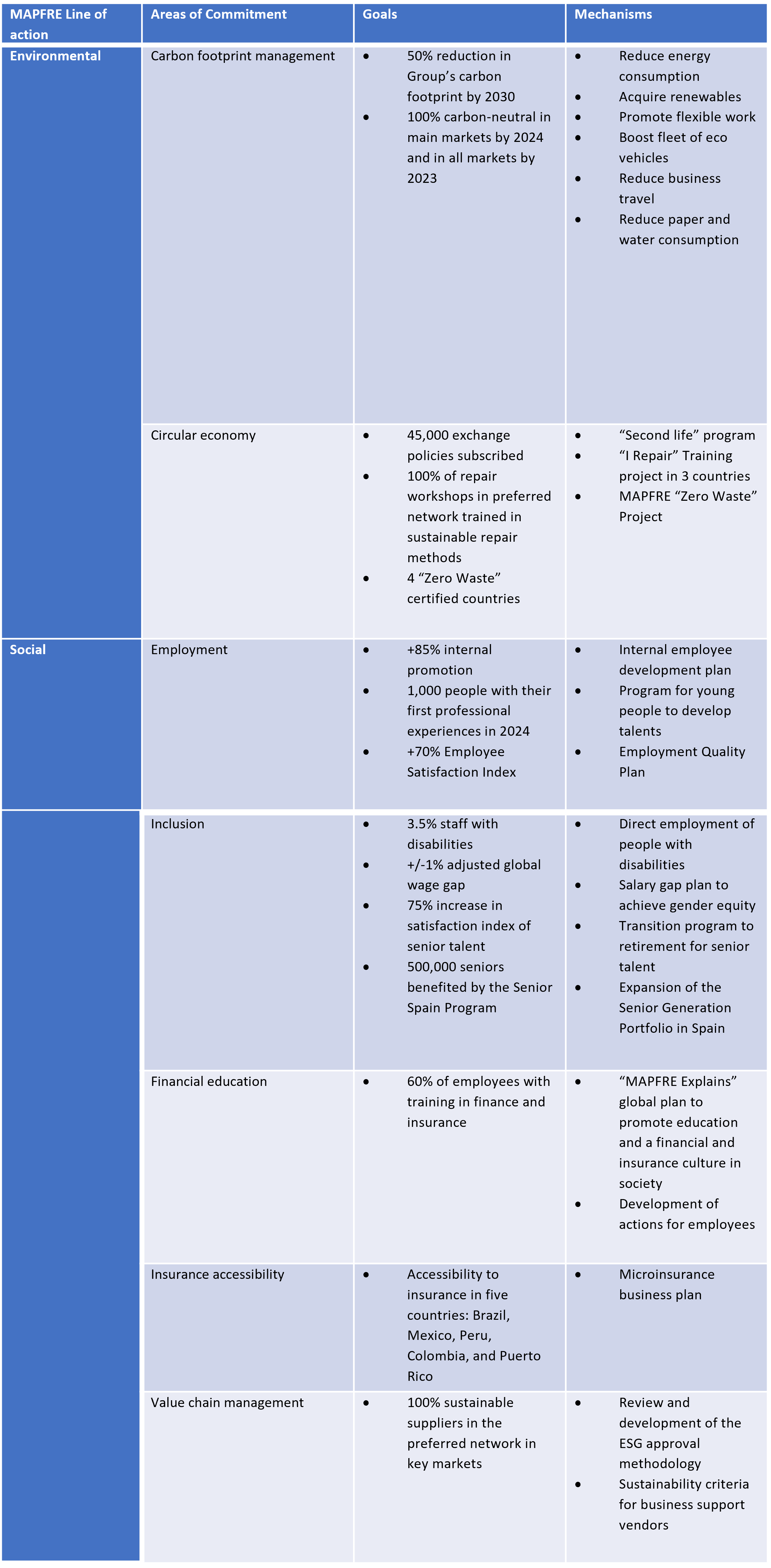

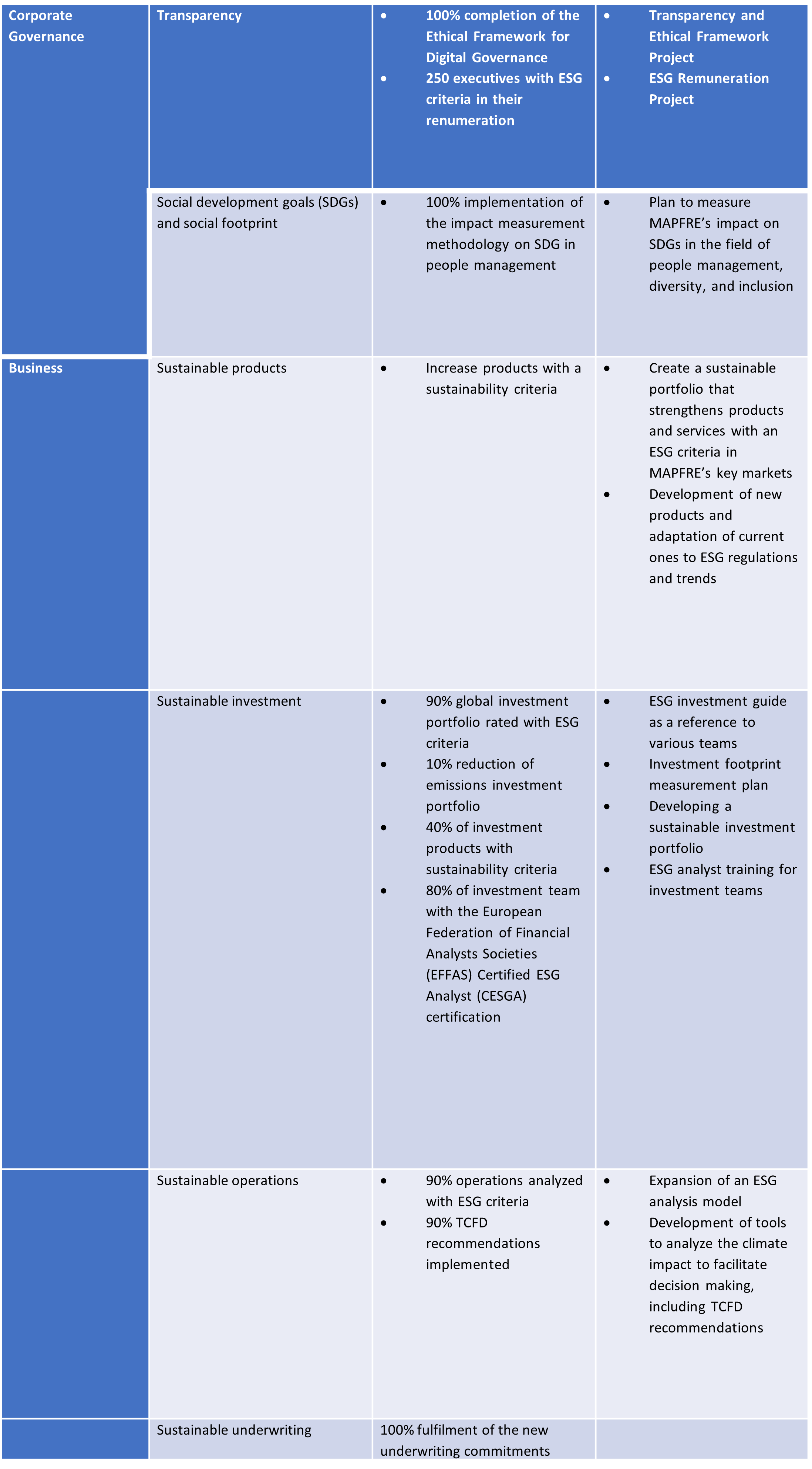

These are not high-minded statements without practical applications. In this section, I present MAPFRE’s sustainability plan as an example of how insurers can forge a pathway to sustainability. MAPFRE is the largest Spanish-owned insurer and the largest multinational insurance company in Latin America, with more than 30,000 employees worldwide. It has adopted an ambitious sustainability plan for 2022 to 2024.[xlii] Its initiatives are spread over four fronts—environmental, social, governance, and business—that address the needs of internal and external stakeholders. A table of the plan is included in Appendix A. MAPFRE has boldly committed to the following new underwriting commitments, which are publicly available as part of its “Environmental Commitments in Investment and Underwriting” publication.[xliii] These commitments state that MAPFRE:

- Will not insure construction of new infrastructure that exclusively serves thermal coal mines or thermal coal power plants (exceptions possible based on MAPFRE’s ESG analysis).

- Will not insure companies with 20% of income from coal energy.

- Will not insure companies with power expansion plans of more than 300 megawatts (MW) based on coal.

- Will not insure new mining companies that derive 20% or more of their revenues from the extraction of or annual coal production above 20 million tons.

- Will stop holding insurance programs related to coal-fired power generation plants and exploitation of thermal coal mines in the OECD from companies that have not implemented commitments to the energy transition and decarbonization in their portfolio by 2023. From 2040, this commitment will also apply to other countries where MAPFRE operates.

- Will not insure any new projects related to the extraction or transportation of tar sands. MAPFRE commits that by 2030 its portfolio will not have any insurance project related to the extraction or transportation of tar sands.

- Will not insure new individual offshore/onshore projects developed in the Arctic, for gas, oil extraction, and transportation.

- Will not insure coal, gas, and oil companies that do not commit to an energy transition plan that allows global warming to be maintained at around 1.5⁰C.

1⁰C increase = USD $1.6 million decrease in earnings for a median-sized firm.

MAPFRE’s plan covers a wide swath of social development goals (SDGs). The inclusion of the plan in this paper is not intended to give the impression that only bold, ambitious plans matter. Sustainability is still a nascent field with a plethora of new and potential opportunities. The risk of exploring sustainable investment is minuscule compared to the potential cost of doing nothing. An international team of researchers from Arizona State University and Nanyang Technological University have analyzed economic data across various industries from 1970 to 2016 and found that a 1⁰C increase in temperature is associated with a USD $1.6 million decrease in earnings for a median-sized firm.[xliv] Such an impact across all companies globally would be an ecological and economic catastrophe.

Conclusion

For insurers to move forward with sustainable investing, they must first set achievable objectives, carefully consider the pace at which they can be achieved, and then commit to maintaining them at a meaningful level. Doing so in conjunction with public and private organizations, local and global, can help with assessing risks and building a sustainable investment portfolio. This can help ensure financial stability and mitigate sustainability-related risks globally.

Back in 2017, Pricewaterhouse Coopers, a leading professional services firm, predicted that 2050 was the year that global gross domestic product (GDP) growth could reach 130%, aided by technology-driven productivity improvements.[xlv] Instead, SwissRe’s 2021 models predict that, in 2050, global GDP is projected to shrink by 11% as temperatures rise, and extreme weather events such as floods, heat waves, and wildfires become more frequent, leading to dwindling crops[xlvi]to feed a growing population.[xlvii] Though the difference in economic outlook within this four-year span from 2017 to 2021 may be drastic, it also underlies another point—that much can change within a short period. Perhaps if insurers expedite their adoption of sustainable investing, the collective impact on climate resiliency, on achievement of other environmental and social goals, and, eventually, on the economy, then the future global GDP could be coaxed back into a growth scenario. The abovementioned Swiss Re research paper on climate change had the most succinct conclusion, worth repeating here, “No action is not an option.”[xlviii]

DISCLAIMERS:

The information, products, or services described or referenced herein are intended to be for informational purposes only. This material is not intended to be a recommendation, offer, solicitation, or advertisement to buy or sell any securities, securities-related product or service, or investment strategy, nor is it intended to be to be relied upon as a forecast, research, or investment advice.

The products or services described or referenced herein may not be suitable or appropriate for the recipient. Many of the products and services described or referenced herein involve significant risks, and the recipient should not make any decision or enter into any transaction unless the recipient has fully understood all such risks and has independently determined that such decisions or transactions are appropriate for the recipient. Investment involves risks. Any discussion of risks contained herein with respect to any product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved. Investing in foreign securities is subject to greater risks including currency fluctuation, economic conditions, and different governmental and accounting standards.

The recipient should not construe any of the material contained herein as investment, hedging, trading, legal, regulatory, tax, accounting, or other advice. The recipient should not act on any information in this document without consulting its investment, hedging, trading, legal, regulatory, tax, accounting, and other advisors. Information herein has been obtained from sources we believe to be reliable, but neither Milliman Financial Risk Management LLC (Milliman FRM) nor its parents, subsidiaries, or affiliates warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties.

The materials in this document represent the opinion of the authors at the time of authorship; they may change and are not representative of the views of Milliman FRM or its parents, subsidiaries, or affiliates. Milliman FRM does not certify the information, nor does it guarantee the accuracy and completeness of such information. Use of such information is voluntary and should not be relied upon unless an independent review of its accuracy and completeness has been performed. Materials may not be reproduced without the express consent of Milliman FRM. Milliman Financial Risk Management LLC is an SEC-registered investment advisor and subsidiary of Milliman, Inc.

Appendix A – MAPFRE Sustainbility Plan

[i] Task Force, Climate and Resiliency (EX). Executive Committee Task Force on Climate and Resiliency National Association of Insurance Commissioners June 2023 Progress Report, June 27, 2023. Accessed July 14,2023 https://content.naic.org/sites/default/files/draft-annual-progress-report-summary-2022.pdf.

[ii] https://www.eiopa.europa.eu/browse/sustainable-finance_en. “SUSTAINABLE FINANCE ACTIVITIES 2022-2024: EIOPA’S PRIORITIES TO ADDRESS SUSTAINABILITY RISK,” January 31, 2023. Accessed July 14, 2023. https://www.eiopa.europa.eu/system/files/2021-12/eiopa-sustainable-finance-activities-2022-2024.pdf.

[iii] Staff, Fortune. “AIA Group.” Fortune, October 10, 2022. Accessed July 14, 2023. https://fortune.com/company/aia-group/change-the-world/.

[iv] Furness, Virginia, and Simon Jessop. “African Insurers Take up Climate Change Fight with $14 Bln Pledge.” Reuters, November 10, 2022. Accessed July 14, 2023. https://www.reuters.com/business/cop/african-insurers-take-up-climate-change-fight-with-14-bln-pledge-2022-11-09/.

[v] “Climate Change and Its Consequences | Munich Re.” Accessed July 14, 2023. https://www.munichre.com/en/risks/climate-change.html.

[vi] “2022 U.S. Temperatures and Billion-Dollar Disasters | Climate Central,” January 9, 2023. Accessed July 14, 2023. https://www.climatecentral.org/climate-matters/2022-u-s-temperatures-and-billion-dollar-disasters.

[vii] Ballester, Joan, Marcos Quijal-Zamorano, Raúl Fernando Méndez Turrubiates, Ferran Pegenaute Perez, François R. Herrmann, Jean-Marie Robine, Xavier Basagaña, Cathryn Tonne, Josep M. Antó, and Hicham Achebak. “Heat-Related Mortality in Europe during the Summer of 2022.” Nature Medicine, July 10, 2023. https://doi.org/10.1038/s41591-023-02419-z.

[viii] World Health Organization: WHO. “Climate Change and Health.” Www.Who.Int, October 30, 2021. https://www.who.int/news-room/fact-sheets/detail/climate-change-and-health.

[ix] “Sustainability | United Nations.” Accessed August 17, 2023. https://www.un.org/en/academic-impact/sustainability.

[x] “Take Action for the Sustainable Development Goals - United Nations Sustainable Development.” United Nations Sustainable Development, May 31, 2023. Accessed August 17, 2023 https://www.un.org/sustainabledevelopment/sustainable-development-goals/.

[xi] Business Insights Blog. “What Is Sustainable Investing? | HBS Online,” July 14, 2022. Accessed July 17, 2023. https://online.hbs.edu/blog/post/sustainable-investing.

[xii] Robeco.com - the Investment Engineers. “Robeco 2023 Global Climate Survey: Keeping the Faith,” April 3, 2023. https://www.robeco.com/en-int/insights/2023/03/robeco-2023-global-climate-survey-keeping-the-faith.

[xiii] Global Sustainable Investment Review 2020, July 28, 2021. Accessed June 7, 2023, https://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf. https://www.dbresearch.com/PROD/RPS_EN-PROD/PROD0000000000524510/Sustainable_finance_%E2%80%93_coming_of_age.pdf?undefined&realload=0L6Cfo8zgm4vgfk3l/hZt/kfZHr8MlO6gkFrDah~JB9AjVzp9dULLE8w3eXZxUh0.

[xiv] Arp, Ann-Katrin & Kiehne, Jan & Schüler, Timm. (2020). Green Asset Management -A Revolution?.

[xv]Bannier, Christina E.; Bofinger, Yannik; Rock, Björn (2019) : Doing safe by doing good: ESG investing and corporate social responsibility in the U.S. and Europe, CFS Working Paper Series, No. 621, Goethe University Frankfurt, Center for Financial Studies (CFS), Frankfurt a. M., https://nbn-resolving.de/urn:nbn:de:hebis:30:3-480587

[xvi] Khan, Mozaffar N., George Serafeim, and Aaron Yoon. "Corporate Sustainability: First Evidence on Materiality." Harvard Business School Working Paper, No. 15-073, March 2015.

[xvii] KPMG. “ESG: Addressing Greenwashing in Financial Services,” April 8, 2022. Accessed July 14, 2023. https://kpmg.com/xx/en/home/insights/2022/04/esg-addressing-greenwashing-in-financial-services.html.

[xviii] Raghunandan, Aneesh, and Shivaram Rajgopal. “Do ESG Funds Make Stakeholder-Friendly Investments?” Social Science Research Network, May 27, 2022. https://doi.org/10.2139/ssrn.3826357.

[xix] See xii

[xx] Webb, Dominic. “NZIA Says US Attorneys General Concerns Based on ‘Mistaken Interpretation’ of Its Activities.” Responsible Investor, July 4, 2023. https://www.responsible-investor.com/nzia-says-us-attorneys-general-concerns-based-on-mistaken-interpretation-of-its-activities/#:~:text=The%20Net%20Zero%20Insurance%20Alliance,the%20NZIA%20and%20its%20members%E2%80%9D.

[xxi] Wilkes, Tommy. “UN Climate Alliance Scraps Emissions Rules for Insurers after Exodus.” Reuters, July 6, 2023. Accessed July 17, 2023. https://www.reuters.com/sustainability/un-climate-alliance-scraps-emissions-rules-insurers-2023-07-05/.

[xxii] Dobiac, Josh, Clement Bonnet, Clara Yan, and Denis Resovac. “Sustainable Investing for Insurers.” Us.Milliman.Com, May 24, 2022. Accessed May 4, 2023. https://us.milliman.com/en/insight/sustainable-investing-for-insurers.

[xxiii] Robeco.com - the Investment Engineers. “Investors Continue Climate Change Efforts despite Headwinds,” April 21, 2023. Accessed July 24, 2023. https://www.robeco.com/en-int/insights/2023/03/investors-continue-climate-change-efforts-despite-headwinds.

[xxiv] “Facts + Statistics: Life Insurance | III.” Accessed July 24, 2023. https://www.iii.org/fact-statistic/facts-statistics-life-insurance.

[xxv] Porter, Michael E, Mark Kramer, and George Serafeim. “Where ESG Fails.” Institutional Investor, November 20, 2019. https://www.institutionalinvestor.com/article/b1hm5ghqtxj9s7/Where-ESG-Fails.

[xxvi] Climate Policy Initiative [B.Naran, J.Connolly, P.Rosane, D.Wignarajah, E.Wakaba, B.Buchner]. 2022. Global Landscape of Climate Finance: A Decade of Data 2011-2020., Accessed July 24, 2023.

[xxvii] Mullan, Michael, Lisa Danielson, Berenice Lasfargues, Naeeda Crishna Morgado, and Edward Perry. “Climate-Resilient Infrastructure.” OECD ENVIRONMENT POLICY PAPER NO. 14, 2018.

[xxviii] See xxvi.

[xxix] See xxvii.

[xxx]Robeco.com - the Investment Engineers. “Next-Gen Quant Evolution: Using New Signals in Existing Strategies,” July 24, 2023. Accessed July 28, 2023. https://www.robeco.com/en-me/insights/2023/07/next-gen-quant-evolution-using-new-signals-in-existing-strategies.

[xxxi] MSCI. “ESG Ratings.” Accessed August 17, 2023. https://www.msci.com/our-solutions/esg-investing/esg-ratings.

[xxxii]Climate Policy Initiative, Nicole Pinko, Angela Ortega Pastor, Bella Tonkonogy, and June Choi. “Framework for Sustainable Finance Integrity - CPI.” CPI, October 28, 2021. Accessed July 24, 2023. https://www.climatepolicyinitiative.org/wp-content/uploads/2021/10/Framework-for-Sustainable-Finance-Integrity.pdf.

[xxxiii] “The 2023 Climate Risk Landscape – United Nations Environment – Finance Initiative,” March 2023. Accessed July 24, 2023. https://www.unepfi.org/themes/climate-change/2023-climate-risk-landscape/.

[xxxiv] Taskforce on Nature-related Financial Disclosures. “Introduction to the Framework.” Accessed August 17, 2023. https://framework.tnfd.global/introduction-to-the-framework/.

[xxxv] See xxxiv.

[xxxvi] Finance. “Corporate Sustainability Reporting.” Accessed July 24, 2023. https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en.

[xxxvii] Ramonas, Andrew. “SEC Eyes October for Climate Disclosure Regulations Release.” Bloomberg Law, June 13, 2023. Accessed July 24, 2023. https://news.bloomberglaw.com/esg/sec-eyes-october-for-climate-disclosure-regulations-release.

[xxxviii] “SEC.Gov | SEC Charges Goldman Sachs Asset Management for Failing to Follow Its Policies and Procedures Involving ESG Investments,” November 22, 2022. Accessed July 23, 2023. https://www.sec.gov/news/press-release/2022-209.

[xxxix] GlobalData. “Insurers Need to Keep Targets to Combat Climate Change, Says GlobalData,” July 24, 2023. Accessed July 25, 2023. https://www.globaldata.com/media/insurance/insurers-need-keep-targets-combat-climate-change-says-globaldata/.

[xl] Hielkema, Petra. “The Role of Insurers in Tackling Climate Change: Challenges and Opportunities.” European Insurance and Occupational Pensions Authority, April 2023. Accessed June 15, 2023. https://www.eiopa.europa.eu/system/files/2023-04/climate-change-insurance-needs-petra-eurofi-magazine_stockholm_april-2023-4.pdf.

[xli] California Department of Insurance. “California Sustainable Insurance Roadmap,” November 2022. Accessed July 24, 2023. https://www.insurance.ca.gov/01-consumers/180-climate-change/upload/CA-Sustainable-Insurance-Roadmap-2022.pdf.

[xlii] MAPRE Sostenibilidad Presentación July 2022, translated with Google Translate on 7/23/2023

[xliii] MAPRE “COMPROMISOS AMBIENTALES EN INVERSIÓN Y SUSCRIPCIÓN”, translated with Google Translate on 7/23/2023. https://www.mapfre.com/media/MAPFRE-COMPROMISOS-AMBIENTALES-EN-INVERSION-Y-SUSCRIPCION.pdf

[xliv] Hugon, Artur and Law, Kelvin, Impact of Climate Change on Firm Earnings: Evidence from Temperature Anomalies (January 24, 2019). Available at SSRN: https://ssrn.com/abstract=3271386 or http://dx.doi.org/10.2139/ssrn.3271386

[xlv] PricewaterhouseCoopers. “The World in 2050: The Long View How Will the Global Economic Order Change by 2050?” PwC, February 2017. Accessed July 26, 2023. https://www.pwc.com/gx/en/research-insights/economy/the-world-in-2050.html#downloads.

[xlvi] “The Economics of Climate Change | Swiss Re,” April 21, 2021. Accessed July 26, 2023. https://www.swissre.com/institute/research/topics-and-risk-dialogues/climate-and-natural-catastrophe-risk/expertise-publication-economics-of-climate-change.html.

[xlvii] United Nations. “World Population Projected to Reach 9.8 Billion in 2050, and 11.2 Billion in 2100 | United Nations.” Accessed July 26, 2023. https://www.un.org/en/desa/world-population-projected-reach-98-billion-2050-and-112-billion-2100.

[xlviii] See xlvi.