Has Life Insurance Really Changed in the Past 30 Years?

IIS Executive Insights Life & Health Expert: Ronald Klein, Executive Director, BILTIR

Introduction

“I am a life insurance salesman and I am proud of it.” These words were uttered at the Mutual of New York (MONY) Presidents Club meeting in 1989 by the top selling MONY agent and keynote speaker that year. It was a pretty provocative statement at a time when life insurance companies were rebranding themselves as “Financial Services” organizations and agents were calling themselves “Financial Advisors.” Even MONY, a 150-year-old mutual insurer, purchased a financial services company and rebranded itself as MONY Financial Services (which it sold a few years later and re-rebranded itself to just plain MONY).

Those were interesting times. The first George Bush was President of the US, the Iron Lady – Margaret Thatcher – was Prime Minister of the UK and Helmut Kohl was Chancellor of Germany. The name Tesla was only known to science geeks as the Serbian-American inventor known for creating the first alternating current engine and the only person that talked into a wristwatch was Dick Tracy.

Insurance agents are still not trusted

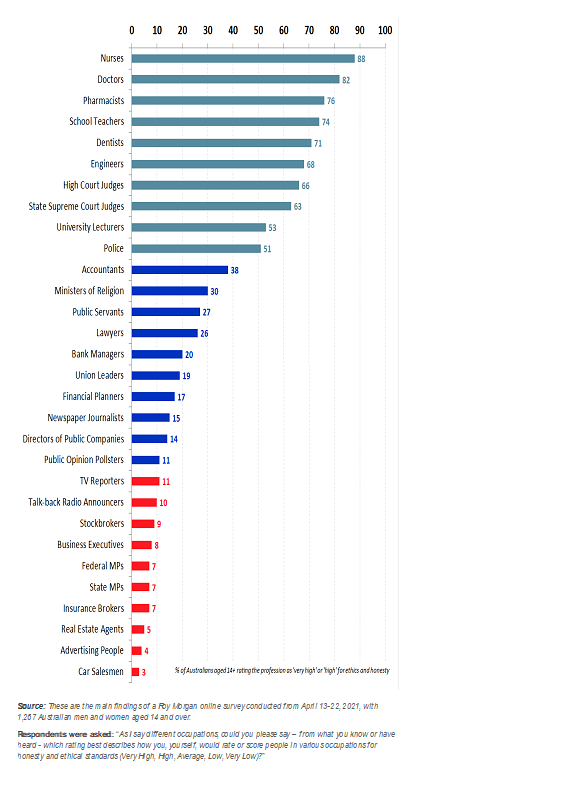

The reason that the top seller for MONY in 1989 said that he was proud to be a life insurance agent was because life insurance agents were respected about as much as used car salespeople in those days. According to a study by Roy Morgan in 2021, only 7% of Australians aged 14 and over said that insurance brokers have “high” or “very high” ethics and honesty (see Figure 1 below)[1]. This places insurance brokers only 4 percentage points above car salespeople. While a similar survey was not available for the US, it is hard to imagine a much different result for any mature insurance market. Not much has changed in 30 years.

Figure 1

Image of Professions 2021: % of Australians aged 14+ rating the profession as 'very high' or 'high' for ethics and honesty

Life insurance sales are disappointing

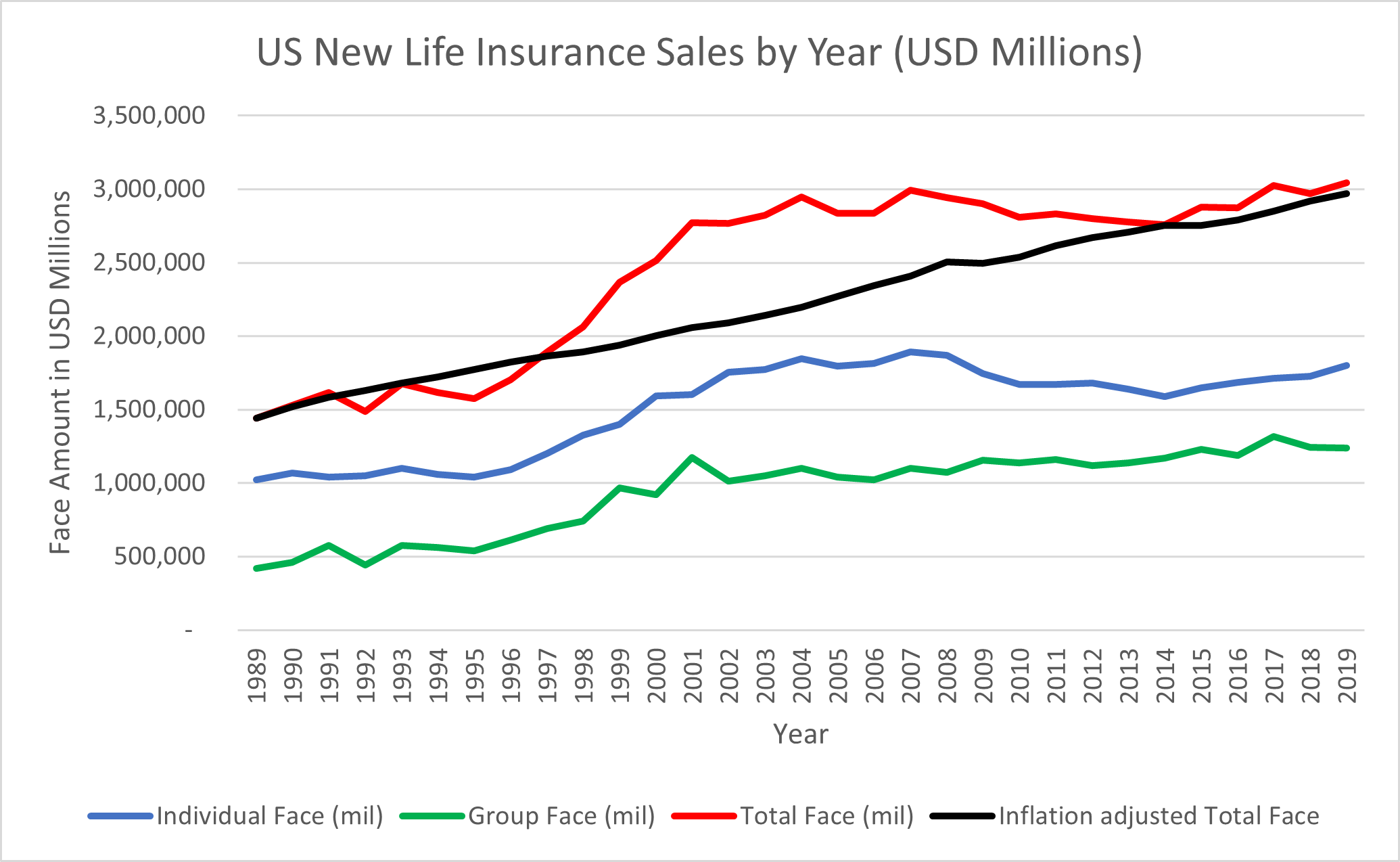

Another thing that hasn't changed in 30 years is the amount of life insurance sold. In the US, for example, the number of individual life insurance policies sold in 1989 was 14.85 million decreasing to 10.12 million in 2019[2]. While face amount grew from USD 1.0 trillion to USD 1.8 trillion over this 30-year period, it didn’t even keep up with the rate of inflation which should have seen the face amount grow to nearly USD 1.9 trillion[3]. In short, number of policies decreased and inflation-adjusted face amount remained level. Similar results would be seen in other major insurance markets.

World population increased by nearly 50% from 5.2 billion to 7.7 billion people with the US population growing by more than 30%. The growth in population alone should have caused a massive increase in life insurance sales. Gross Domestic Product (GDP) for the world has more than quadrupled during these three decades[4]. The combination of population growth, GDP growth and inflation should have had a multiplier effect on life insurance sales and yet new face amount didn't even keep up with inflation. It is very disappointing.

No wonder companies are writing about the life insurance protection gap. In its June, 2021 Sigma Resilience Report, Swiss Re Institute estimates a slight increase in the mortality protection gap for advanced markets in North America, Europe, the Middle East and Africa to USD 139 billion for 2020[5]. While most of the 6% (from 2019) worldwide increase in the protection gap came from emerging markets, it is difficult to understand how mature insurance markets lost any ground during a pandemic.

For there to be an increase in life insurance sales, there need to be products to sell and companies to sell them. However, there has been an unprecedented number of insurers exiting the individual life insurance business[6]. Companies cite extremely low interest rates since 2008 as the main reason for withdrawal from this market. It will take a lot more than a mere rise in interest rates in the future to attract investor money back into individual life insurance sales. Perhaps worksite group insurance is filling some of the void left by companies exiting the individual life insurance space?

During the same 30-year period from 1989 – 2019, group insurance face amount almost tripled to approximately USD 1.2 trillion and now represents 40% of total face amount (see Figure 2 below)2. Even adding individual life insurance sales to the faster-growing group insurance sales during this period shows totals that barely keep up with inflation. But, can this trend continue? Can group insurance sales fill the void created by individual life insurance sales?

Figure 2

Is group life insurance the answer?

In the US, group life insurance is typically offered through a traditional employer. An employee may receive a multiple of salary or a flat amount of protection. It is free of charge up to a certain amount, above which there is an imputed income charge. Family members may also be eligible for certain benefits at a cost. Perhaps employees and their families believe that group insurance policies fulfill the family life insurance needs. But what about those who do not have the luxury of group insurance benefits?

A recent Reuters article estimates that approximately 34% of the US workforce participated in the gig economy in 2017, growing to 43% in 2020[7]. While the absolute numbers are not as great, Europe has seen similar percentage increases in the growth of the gig economy[8]. In the US, gig economy workers typically have few, if no benefits including group life insurance. While there is a requirement to report all income, contribute to Social Insurance and pay taxes, there is no requirement to purchase individual or group life insurance (and the US Social Security death benefit of USD 255 will not go very far). There is also no requirement to save for retirement, other than Social Insurance.

With a greater number of workers entering the gig economy part- or full-time, it will be more difficult to cover these individuals with group life insurance benefits. And, while individual life insurance sales have problems reaching all markets, reaching this market is especially difficult. The problem, however, is not as pressing in Europe.

Europe approaches life insurance differently

The European Social Insurance systems differ from that of the US in its approach to life insurance coverage. Life insurance is covered as a continuing benefit to a spouse and minor children until retirement for the spouse (when his or her own Social Insurance payments begin) or the maturity of the minors (when they will be able to enter the workforce). Not only does this provide the necessary protection for the workforce and their families, it ensures that insurance money is spread out for the needed period of time. That is, a lump sum life insurance payment in the US can be more easily squandered away than a monthly smaller benefit.

In Switzerland, for example, even gig workers need to set up a company and must pay into the Social Insurance system (called Pillar I) and a tax deferred savings plan (Pillar II). Both Pillars I and II have minimum requirements and Pillar II contributions increase with age. Therefore, gig workers in Switzerland not only have life insurance for a spouse and children, but are also required to save for retirement. Not a bad system. Like any other system, there are ways around these requirements, but at least it covers a large percentage of gig workers.

These requirements put the onus on the employee to learn about the regulations, set up a company, search for insurance providers, fill out the necessary paperwork and do the right thing. The European Union is becoming more pro-active as the number of gig workers increases in Europe. The European Commission began a consultation period earlier this year to require employers to provide benefits to gig workers or face wide-sweeping EU legislation[9]. These companies must begin to negotiate with employee unions or employees themselves to develop suitable benefits. It appears that Europe is ahead of the US in protecting workers by strongly recommending that life insurance and retirement benefits are provided for all workers. The threat of broad EU regulation should be a huge incentive for employers of gig workers.

Requiring benefits for gig workers is addressing the cohort of individuals that insurers have been struggling to reach – the so-called middle markets. This group of individuals has not gained the attention of many insurance agents as the sums assured would not be great enough to warrant the lengthy sales process and regulatory requirements. The long-awaited technological advances to the insurance industry have not yet arrived.

The lack of insurance sold to the middle markets in the US is probably understated as large face-amount policies are currently sold to wealthy individuals to protect against estate taxes. The policies are placed into “grantor trusts” and do not become part of the deceased’s estate for tax purposes. Since protection gaps are typically estimated using averages, these large policies are included in the numerator, but benefit very few people. Even this practice may come to an end if the current administration passes legislation that it has proposed limiting this practice[10]. Ending these sales will make the protection gap figures look even worse.

There are record numbers of headline events that are taking place throughout the world highlighting the need for insurance. They include hurricanes, typhoons, droughts, floods, wildfires and volcanic eruptions. These natural catastrophes have been growing steadily causing an increase in non-life insurance sales. While many can and do cause loss of life, the number of deaths is relatively minor. Insurers use the saying that “…people can walk away from natural catastrophes, but buildings cannot.”

There are also man-made risks that are making headlines, especially cyber risks. While terrorism was once the major risk, now ransomware attacks are becoming more and more frequent with large sums of money paid to bad actors to free-up data. This has become the most talked about risk in board rooms around the world. It has led to the exponential growth in the Cyber Insurance market.

For the first time in 100 years, the world has experienced a pandemic that has killed millions of people. There is nothing more prominent in the media than COVID-19. Yet life insurance sales haven’t budged. The mere threat of lost data ignites a new product line and increased insurance sales, but a threat of the loss of life does nothing. Priorities are an interesting thing to understand.

Conclusion

With life insurance protection gaps growing, even during a pandemic, and prospects worsening as the gig economy grows, it is time for major markets to look at best practices from other countries. Setting up a system that requires gig workers to save for retirement and purchase life insurance benefits for their families works well in Switzerland. It may also work for other countries. Life insurance premiums have barely kept up with inflation during the past 30 years. It is time for government programs to step in and require individuals and small businesses to purchase life insurance to protect their families. The life insurance industry has just not been able to achieve this important goal on its own. Something must change.

Life insurance protects families and businesses from the financial hardships of premature death. It is an important product and one that many should be purchasing during the worst pandemic in 100 years. Yet the opposite is true. In a world that prides itself on instant gratification where the mere click of a button can purchase nearly any item that will arrive to a specific location as soon as the same day, it is difficult to find value in a product that provides protection for a potential future event. The 1989 MONY top-selling agent may only be a life insurance agent, but he should be proud of his profession. These professionals need to work hard to move up the list of trusted professionals – at least as high as lawyers!

11.2021

About the Author:

Ronnie has over 40 years of insurance and reinsurance experience having worked and lived in 3 countries. In his current role, Ronnie serves as Executive Director to the Bermuda International Long-Term Insurers and Reinsurers (BILTIR) association. He also is a Collaborating Expert of Health and Ageing for The Geneva Association located in Zürich. Ronnie is Co-Chair of the Programming Committee for the ReFocus Conference and served on the Board of Directors of the Society of Actuaries. Before this, Ronnie worked as the Head of Life Reinsurance for Zurich Insurance Group in Zürich, Head of Life Reinsurance for AIG in New York and Global Head of Life Pricing for Swiss Re in London. Ronnie began his career at Mutual of New York. A little-known fact is that Ronnie holds a patent (US20060026092A1) for the first Mortality Bond issued called Vita when he was with Swiss Re.

[1] http://www.roymorgan.com/findings/8691-image-of-professions-2021-april-2021-202104260655

[2] https://www.acli.com/-/media/acli/files/fact-books-public/07fb20_chapter_07_lifeinsurance.pdf

[3] https://www.officialdata.org/1991-dollars-in-2019?amount=4300

[4] https://statisticstimes.com/economy/world-gdp.php

[5] https://www.swissre.com/dam/jcr:ca784019-cd41-45fb-81ed-9379f2cd91e3/swiss-re-institute-sigma-resilience-index-update-june-2021.pdf

[6] https://www.wsj.com/articles/insurance-policy-private-equity-11632236526

[7] https://www.reuters.com/world/us/exclusive-us-labor-secretary-says-most-gig-workers-should-be-classified-2021-04-29/

[8] https://www.ilo.org/wcmsp5/groups/public/---ed_emp/documents/publication/wcms_790117.pdf

[9] https://fortune.com/2021/02/24/gig-economy-europe-worker-rights-eu/

[10] https://www.cnbc.com/2021/10/01/house-democrats-tax-proposal-may-affect-life-insurance-for-the-rich.html