An action plan for insurance CEOs to push innovation and build new businesses

Executives know that building new businesses is both an opportunity and an imperative in the fast-evolving consumer landscape. Five crucial building blocks can help embed innovation in insurance companies’ DNA.

By Raphael Bick, Violet Chung, Vikas Gour, and Ido Segev

The C-suite already knows that innovation will play a key role in delivering long-term value. In a 2020 McKinsey survey, executive teams responded that they were focused on short-term cash management and workforce welfare at the peak of the pandemic, but that innovation was also one of their top two priorities. But despite current efforts—and by their own admission—incumbent insurers struggle to produce innovative products that respond to fast-changing consumer needs.

To harness the opportunity to use new-business building to drive growth, insurance executives must shift from leading at a methodical pace of change to decisively reinventing their businesses and operating models.

This article lays out the five factors that, in our experience, a company needs to have in place to promote the successful development and scaling of game-changing new innovations in the insurance industry: senior-management sponsorship; an agile, integrated culture; structured feedback loops to manage the risks of customer-centric innovation; value propositions that incorporate creative approaches to customer engagement and distribution; and an integrated, forward-looking talent and capability-building model.

The benefits of business building are recognized by insurance CEOs—and more broadly

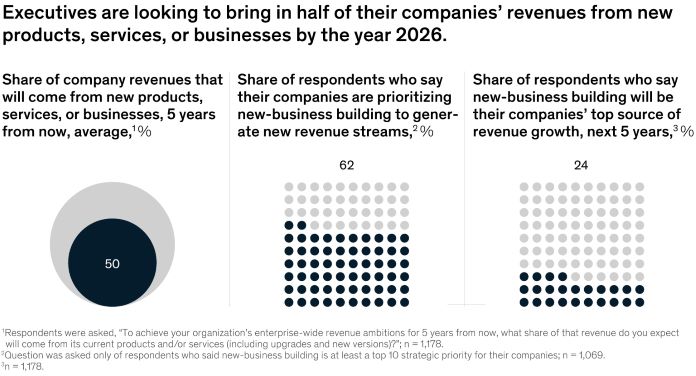

According to a 2021 McKinsey Global Survey on new-business building, business leaders expect half of their companies’ revenues in 2026 to come from products, services, or businesses that do not yet exist (Exhibit 1). Most respondents—double the share of recent years—said business building is one of their organizations’ top strategic priorities.

The industry has seen some innovation success stories, particularly during the pandemic, that provide a model for how incumbent insurers should look at innovation. During the COVID-19 lockdowns, some insurers quickly realized they needed to digitalize their customer and agent experiences, moving away from a traditional face-to-face service model. Previous McKinsey research has found that other carriers responded to demand for meaningful interactions with loyalty and gamification programs that were meant to promote customer engagement. One example is South African insurer Discovery’s Vitality loyalty program, which encourages healthy habits and good driving by allowing customers to earn points that give them access to rewards and benefits.

Insurance leaders are aware that they need to go further, and establishing new businesses is emerging as a crucial strategic industry priority. This is partly a positive agenda that recognizes innovation as the force that drives growth and reinvention. However, the renewed emphasis on innovation is an acknowledgment of the need to keep up with the quickening pace of change in the market for insurance. Multiyear innovation cycles are no longer sufficient to keep up with shifting end-user needs; insurers now need to be able to respond in months—or sometimes even weeks.

Players outside the industry have also recognized the huge potential for innovation in the insurance industry. McKinsey analysis has found that private-equity and principal investors, aware of the potential for improvement and lured by the prospect of attractive returns, aim to propel and scale up new-business creation by targeting attractive talent pools and deploying capital. With more than $15.8 billion of funding flowing into insurtechs in 2021 alone, it’s clear that there is already an accelerating flow of capital into insurance through private equity and other channels.1

However, innovation is not yet meeting consumer—or insurer—needs

In a recent survey on product development, 82 percent of insurance executives said they consider product development a core competency. Only 12 percent of respondents said their companies have a process that produces innovative products.2 In informal interactions, executives found it difficult to name any insurance industry products that they considered to be truly innovative.

A major issue is that insurers—particularly traditional insurers—have viewed innovation principally through the lens of risk, rather than taking a consumer-centric approach based on anticipating and meeting users’ needs and preferences.

This lack of consumer-centricity may be a specialized issue in Asia, where the insurance market has some distinctive traits. Greater China, for example, has a rapidly aging population and a culture that prioritizes the care of the youngest and oldest segments of the population, creating logistical and financial stress for the adults in the middle. Insurers that can innovate to meet these unmet needs will be tapping into a significant opportunity. According to McKinsey Global Insurance Pools, premiums as a percentage of GDP stood at just 5.6 percent for the Asia–Pacific region as a whole in 2020, compared with 10.8 percent in North America.

Some insurers are rising to the challenge. For example, one Philippines-based insurer created a protection product that covers the account owner and up to three family members. This is just one way to respond to the trends of aging populations and increasing numbers of adults who must support both children and elders.

To harness the opportunity to meet consumer needs—growing and, ultimately, delivering stakeholder value—incumbent carriers should look for gaps in the market where they can meet customer demands, cater to their organization’s strengths, and create real value.

But one good idea is not enough. Insurance players looking to innovate better and more systematically will also need to go through a process of business model reinvention. Crucially, the industry can take advantage of a shift from a “repair and replace” approach to a “predict and prevent” one across every segment of the industry (brokers, commercial property and casualty, life, personal lines, and reinsurance). As part of this transformation, the organization should not only foster agile innovation that supports the governance model but also put in place structured feedback loops to manage the risks of customer-centric innovation.

Five crucial building blocks for successful innovation

To successfully profit from innovation requires a complicated company-wide effort, but most insurers haven’t yet perfected this process—at least not consistently. McKinsey analysis has determined five factors that need to be in place before innovation can be built into the way an organization works, competes, and grows:

1. Senior-management sponsorship

The CEO and other senior management must clearly and consistently support the development of a business-building capability. The CEO should expect to contribute a significant amount of time and strategic support to these efforts. New-business building will often require expertise and capabilities that the parent company may lack.

Those in leadership roles can incorporate business building into their own resource strategies to demonstrate their commitment. Capacity—in terms of both physical and human capital—is one of the biggest barriers to innovation for insurers. Traditional incumbents trying to provide stability to customers through the disruption and uncertainty of a global pandemic have prioritized business-as-usual operations. Many insurers have thus focused on short-term initiatives such as updating existing products, maintaining existing systems, and making incremental changes. Although these short-term efforts may feel safer, they should not come at the expense of bolder moves that could be more advantageous; as we have seen, insurers that adjust their valuation criteria and free up capacity can gain access to significant opportunities.

2. An agile, integrated culture

Technological, data, and platform advances foster a test-and-learn culture in which businesses can test new ideas, processes, and hypotheses efficiently and cheaply. To take advantage of this opportunity, organizations must have an operating model in which teams can quickly experiment, learn, and develop to ensure the best product–market fit.

This operating model can only succeed in a culture that is more accepting of failure than is common in the insurance industry today. McKinsey research has examined how a “fail fast” culture grants space for experimentation, which allows the workforce to become highly attuned to—and more responsive to—ever-changing customer demands. This culture change depends on executives who value and nurture the required mindsets, and it calls for a revamp of current insurers’ governance models. Insurers will need transparent, clearly understood innovation agendas with dedicated budgets. Executives must be empowered to make decisions about continuing or abandoning projects based on their learnings from credible data and analytical results at a local level, and they must also predict the impact at a multinational level using these learnings.

The transition to a new operating model, while challenging, can produce impressive results. For example, a global insurance company committed to driving new revenue growth through innovation after several years of flat growth. The firm revamped its operating model—which had proved ineffective at driving innovation—launched a dedicated innovation unit, and implemented a new development strategy to derisk its business models through the continual reassessment and reallocation of resources. The innovation unit became self-funding within its first year of operation and incubated four new businesses with a total revenue potential of more than $500 million over the following three to five years.

McKinsey research has found that a company risks failure when setting up an innovation lab or team without fully integrating it into the business-planning cycle or defining metrics for success. Operating in a silo without clear goals, the new team members may not see how their team’s success is critical to the success of other business lines—or the enterprise. They may also lack the connections to ensure that the innovations they develop are implemented and scaled in other parts of the organization. Insurers can create a shared understanding of the market landscape, identify opportunities, and realize their aspirations by facilitating regular communication between innovation teams and business teams.

Organizations will not get a fully effective operating model right in their first attempt. But a determined organization can develop the right capabilities over time by committing to quick feedback cycles accompanied by systematic incorporation of lessons learned.

3. Structured feedback loops to manage the risks of customer-centric innovation

With great innovation can come great risk, especially in insurance. One important measure of success is how well and early a risk can be identified in an innovative proposition.

If an organization’s product development system incorporates both a structured feedback loop from the marketing and customer functions and the robust use of “early warning” data analytics, risk identification protects this process. Making this system work effectively may require a shift to a more integrated organizational structure that makes it easier for tech functions to collaborate with the functions that are close to end users.

An insurer that set up a dedicated innovation unit with the help of McKinsey successfully established a feedback-based business model with continual reassessment, a focus on the most critical activities to accelerate progress, and resource reallocation to support. One of its focus points was using in-market pilots to test and adjust value proposition through effective collaboration among multiple company functions. This is the same innovation unit mentioned above that became self-funding within its first year of operation and incubated four new businesses.

4. Value propositions that incorporate creative approaches to customer engagement and distribution

Traditionally, carriers have used actuarial innovation, which often adds unappealing complexity for customers, as the vehicle for the development of new products. Separately, carriers also invest in updating their distribution platforms and improving their new-business and underwriting capabilities. However, McKinsey analysis finds that innovative value propositions need a great product integrated with insurance protection and prevention, customer engagement, and distribution and marketing.

Data and analytics are becoming increasingly important as users look for a more personalized experience. Powerful data analytics capabilities can be used to develop the granular profile of customers that insurers need to personalize offerings and target messaging toward every customer segment—thereby gaining an edge over competitors.

Some insurtechs have achieved huge success after improving their abilities to better target their services. Root, for example, was the third fastest-growing auto insurance company in the United States in 2018. Its revenue shot up from $4 million in 2017 to a massive $106.4 million in the last quarter of 2018.3 Such results are not merely anecdotal; more than half of insurers that have achieved individualized offerings say they have seen a positive impact on profit margins, 60 percent report increased revenue per customer, and 81 percent report increased customer retention as a result of their personalization activities.4

5. An integrated, forward-looking talent and capability-building model

Talent can no longer be an afterthought in the insurance industry. For successful innovation, organizations should evolve their talent strategies in tandem with their business strategies. At an industry level, developing innovative, customer-centric products will require significant investment in attracting new talent and upskilling the existing mix. This investment might include the following:

The insurance industry will continue to modernize and digitalize, so it is high time for insurers to increase the quality, breadth, and pace of innovation. As customer expectations continue to evolve rapidly, especially in Asia, carriers are challenged to deliver personalized and customer-centric products. Meanwhile, the C-suite is finally recognizing the power of innovation and the need to help accelerate the pace of change. Innovation that will deliver in the long term will be more than risks and product offerings. Innovation must become a priority—including a resource priority—that is embedded in an insurance carrier’s DNA.

Raphael Bick is a partner in McKinsey’s Shanghai office, Violet Chung is a partner in the Hong Kong office, Vikas Gour is an associate partner in the Singapore office, and Ido Segev is a partner in the Boston office.

1 Gallagher Re global insurtech report, Gallagher Re, April 2022.

2 “Understanding the product development process of individual life insurance and annuity companies,” Society of Actuaries, December 2017.

3 Thomas Mason, “Insurtech startup Root is growing like a weed,” S&P Global Market Intelligence, June 3, 2019.

4 The age of insurance personalization, Earnix and Insurance Innovators, November 2019.

Executives know that building new businesses is both an opportunity and an imperative in the fast-evolving consumer landscape. Five crucial building blocks can help embed innovation in insurance companies’ DNA.

By Raphael Bick, Violet Chung, Vikas Gour, and Ido Segev

The C-suite already knows that innovation will play a key role in delivering long-term value. In a 2020 McKinsey survey, executive teams responded that they were focused on short-term cash management and workforce welfare at the peak of the pandemic, but that innovation was also one of their top two priorities. But despite current efforts—and by their own admission—incumbent insurers struggle to produce innovative products that respond to fast-changing consumer needs.

To harness the opportunity to use new-business building to drive growth, insurance executives must shift from leading at a methodical pace of change to decisively reinventing their businesses and operating models.

This article lays out the five factors that, in our experience, a company needs to have in place to promote the successful development and scaling of game-changing new innovations in the insurance industry: senior-management sponsorship; an agile, integrated culture; structured feedback loops to manage the risks of customer-centric innovation; value propositions that incorporate creative approaches to customer engagement and distribution; and an integrated, forward-looking talent and capability-building model.

The benefits of business building are recognized by insurance CEOs—and more broadly

According to a 2021 McKinsey Global Survey on new-business building, business leaders expect half of their companies’ revenues in 2026 to come from products, services, or businesses that do not yet exist (Exhibit 1). Most respondents—double the share of recent years—said business building is one of their organizations’ top strategic priorities.

The industry has seen some innovation success stories, particularly during the pandemic, that provide a model for how incumbent insurers should look at innovation. During the COVID-19 lockdowns, some insurers quickly realized they needed to digitalize their customer and agent experiences, moving away from a traditional face-to-face service model. Previous McKinsey research has found that other carriers responded to demand for meaningful interactions with loyalty and gamification programs that were meant to promote customer engagement. One example is South African insurer Discovery’s Vitality loyalty program, which encourages healthy habits and good driving by allowing customers to earn points that give them access to rewards and benefits.

Insurance leaders are aware that they need to go further, and establishing new businesses is emerging as a crucial strategic industry priority. This is partly a positive agenda that recognizes innovation as the force that drives growth and reinvention. However, the renewed emphasis on innovation is an acknowledgment of the need to keep up with the quickening pace of change in the market for insurance. Multiyear innovation cycles are no longer sufficient to keep up with shifting end-user needs; insurers now need to be able to respond in months—or sometimes even weeks.

Players outside the industry have also recognized the huge potential for innovation in the insurance industry. McKinsey analysis has found that private-equity and principal investors, aware of the potential for improvement and lured by the prospect of attractive returns, aim to propel and scale up new-business creation by targeting attractive talent pools and deploying capital. With more than $15.8 billion of funding flowing into insurtechs in 2021 alone, it’s clear that there is already an accelerating flow of capital into insurance through private equity and other channels.1

However, innovation is not yet meeting consumer—or insurer—needs

In a recent survey on product development, 82 percent of insurance executives said they consider product development a core competency. Only 12 percent of respondents said their companies have a process that produces innovative products.2 In informal interactions, executives found it difficult to name any insurance industry products that they considered to be truly innovative.

A major issue is that insurers—particularly traditional insurers—have viewed innovation principally through the lens of risk, rather than taking a consumer-centric approach based on anticipating and meeting users’ needs and preferences.

This lack of consumer-centricity may be a specialized issue in Asia, where the insurance market has some distinctive traits. Greater China, for example, has a rapidly aging population and a culture that prioritizes the care of the youngest and oldest segments of the population, creating logistical and financial stress for the adults in the middle. Insurers that can innovate to meet these unmet needs will be tapping into a significant opportunity. According to McKinsey Global Insurance Pools, premiums as a percentage of GDP stood at just 5.6 percent for the Asia–Pacific region as a whole in 2020, compared with 10.8 percent in North America.

Some insurers are rising to the challenge. For example, one Philippines-based insurer created a protection product that covers the account owner and up to three family members. This is just one way to respond to the trends of aging populations and increasing numbers of adults who must support both children and elders.

To harness the opportunity to meet consumer needs—growing and, ultimately, delivering stakeholder value—incumbent carriers should look for gaps in the market where they can meet customer demands, cater to their organization’s strengths, and create real value.

But one good idea is not enough. Insurance players looking to innovate better and more systematically will also need to go through a process of business model reinvention. Crucially, the industry can take advantage of a shift from a “repair and replace” approach to a “predict and prevent” one across every segment of the industry (brokers, commercial property and casualty, life, personal lines, and reinsurance). As part of this transformation, the organization should not only foster agile innovation that supports the governance model but also put in place structured feedback loops to manage the risks of customer-centric innovation.

Five crucial building blocks for successful innovation

To successfully profit from innovation requires a complicated company-wide effort, but most insurers haven’t yet perfected this process—at least not consistently. McKinsey analysis has determined five factors that need to be in place before innovation can be built into the way an organization works, competes, and grows:

1. Senior-management sponsorship

The CEO and other senior management must clearly and consistently support the development of a business-building capability. The CEO should expect to contribute a significant amount of time and strategic support to these efforts. New-business building will often require expertise and capabilities that the parent company may lack.

Those in leadership roles can incorporate business building into their own resource strategies to demonstrate their commitment. Capacity—in terms of both physical and human capital—is one of the biggest barriers to innovation for insurers. Traditional incumbents trying to provide stability to customers through the disruption and uncertainty of a global pandemic have prioritized business-as-usual operations. Many insurers have thus focused on short-term initiatives such as updating existing products, maintaining existing systems, and making incremental changes. Although these short-term efforts may feel safer, they should not come at the expense of bolder moves that could be more advantageous; as we have seen, insurers that adjust their valuation criteria and free up capacity can gain access to significant opportunities.

2. An agile, integrated culture

Technological, data, and platform advances foster a test-and-learn culture in which businesses can test new ideas, processes, and hypotheses efficiently and cheaply. To take advantage of this opportunity, organizations must have an operating model in which teams can quickly experiment, learn, and develop to ensure the best product–market fit.

This operating model can only succeed in a culture that is more accepting of failure than is common in the insurance industry today. McKinsey research has examined how a “fail fast” culture grants space for experimentation, which allows the workforce to become highly attuned to—and more responsive to—ever-changing customer demands. This culture change depends on executives who value and nurture the required mindsets, and it calls for a revamp of current insurers’ governance models. Insurers will need transparent, clearly understood innovation agendas with dedicated budgets. Executives must be empowered to make decisions about continuing or abandoning projects based on their learnings from credible data and analytical results at a local level, and they must also predict the impact at a multinational level using these learnings.

The transition to a new operating model, while challenging, can produce impressive results. For example, a global insurance company committed to driving new revenue growth through innovation after several years of flat growth. The firm revamped its operating model—which had proved ineffective at driving innovation—launched a dedicated innovation unit, and implemented a new development strategy to derisk its business models through the continual reassessment and reallocation of resources. The innovation unit became self-funding within its first year of operation and incubated four new businesses with a total revenue potential of more than $500 million over the following three to five years.

McKinsey research has found that a company risks failure when setting up an innovation lab or team without fully integrating it into the business-planning cycle or defining metrics for success. Operating in a silo without clear goals, the new team members may not see how their team’s success is critical to the success of other business lines—or the enterprise. They may also lack the connections to ensure that the innovations they develop are implemented and scaled in other parts of the organization. Insurers can create a shared understanding of the market landscape, identify opportunities, and realize their aspirations by facilitating regular communication between innovation teams and business teams.

Organizations will not get a fully effective operating model right in their first attempt. But a determined organization can develop the right capabilities over time by committing to quick feedback cycles accompanied by systematic incorporation of lessons learned.

3. Structured feedback loops to manage the risks of customer-centric innovation

With great innovation can come great risk, especially in insurance. One important measure of success is how well and early a risk can be identified in an innovative proposition.

If an organization’s product development system incorporates both a structured feedback loop from the marketing and customer functions and the robust use of “early warning” data analytics, risk identification protects this process. Making this system work effectively may require a shift to a more integrated organizational structure that makes it easier for tech functions to collaborate with the functions that are close to end users.

An insurer that set up a dedicated innovation unit with the help of McKinsey successfully established a feedback-based business model with continual reassessment, a focus on the most critical activities to accelerate progress, and resource reallocation to support. One of its focus points was using in-market pilots to test and adjust value proposition through effective collaboration among multiple company functions. This is the same innovation unit mentioned above that became self-funding within its first year of operation and incubated four new businesses.

4. Value propositions that incorporate creative approaches to customer engagement and distribution

Traditionally, carriers have used actuarial innovation, which often adds unappealing complexity for customers, as the vehicle for the development of new products. Separately, carriers also invest in updating their distribution platforms and improving their new-business and underwriting capabilities. However, McKinsey analysis finds that innovative value propositions need a great product integrated with insurance protection and prevention, customer engagement, and distribution and marketing.

Data and analytics are becoming increasingly important as users look for a more personalized experience. Powerful data analytics capabilities can be used to develop the granular profile of customers that insurers need to personalize offerings and target messaging toward every customer segment—thereby gaining an edge over competitors.

Some insurtechs have achieved huge success after improving their abilities to better target their services. Root, for example, was the third fastest-growing auto insurance company in the United States in 2018. Its revenue shot up from $4 million in 2017 to a massive $106.4 million in the last quarter of 2018.3 Such results are not merely anecdotal; more than half of insurers that have achieved individualized offerings say they have seen a positive impact on profit margins, 60 percent report increased revenue per customer, and 81 percent report increased customer retention as a result of their personalization activities.4

5. An integrated, forward-looking talent and capability-building model

Talent can no longer be an afterthought in the insurance industry. For successful innovation, organizations should evolve their talent strategies in tandem with their business strategies. At an industry level, developing innovative, customer-centric products will require significant investment in attracting new talent and upskilling the existing mix. This investment might include the following:

- Developing a vigorous learning and development (L&D) infrastructure.

- Upskilling employees in newer technical roles by hiring technology translators for those in new roles and those in the legacy business.

- Undertaking sustained, thoughtful campaigns to improve diversity.

- Building the vibrant work environments needed to attract top talent.

The insurance industry will continue to modernize and digitalize, so it is high time for insurers to increase the quality, breadth, and pace of innovation. As customer expectations continue to evolve rapidly, especially in Asia, carriers are challenged to deliver personalized and customer-centric products. Meanwhile, the C-suite is finally recognizing the power of innovation and the need to help accelerate the pace of change. Innovation that will deliver in the long term will be more than risks and product offerings. Innovation must become a priority—including a resource priority—that is embedded in an insurance carrier’s DNA.

Raphael Bick is a partner in McKinsey’s Shanghai office, Violet Chung is a partner in the Hong Kong office, Vikas Gour is an associate partner in the Singapore office, and Ido Segev is a partner in the Boston office.

Learn more from McKinsey & Company >

_______________________________1 Gallagher Re global insurtech report, Gallagher Re, April 2022.

2 “Understanding the product development process of individual life insurance and annuity companies,” Society of Actuaries, December 2017.

3 Thomas Mason, “Insurtech startup Root is growing like a weed,” S&P Global Market Intelligence, June 3, 2019.

4 The age of insurance personalization, Earnix and Insurance Innovators, November 2019.