An action plan for insurance CEOs to address climate change

Insurance CEOs have an opportunity to support decarbonization in the ways they manage their asset and underwriting portfolios and by reducing their direct emissions.

by Antonio Grimaldi and Sylvain Johansson

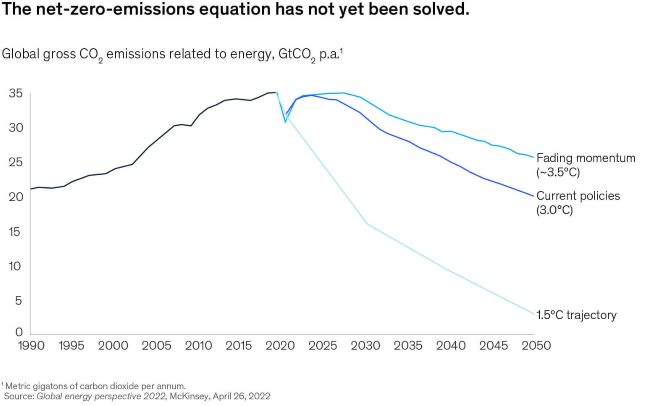

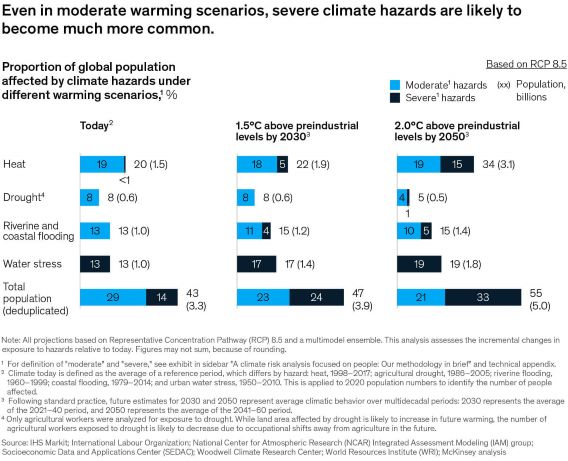

The science is clear. Global economies need to generate significantly fewer emissions of greenhouse gases (GHGs) such as CO2 to achieve the goals laid out in the Paris Agreement: first, limit warming (preferably to 1.5°C above preindustrial levels); and second, reach net-zero emissions—adding no more GHGs to the atmosphere than those that are removed—by 20501. Even if these targets are reached, a significant share of the population will confront extreme weather events between now and 2050 (Exhibit 1).

This is a massive challenge, and current projections indicate that we are not yet on the reduction path necessary to meet this goal2. Moreover, these projections do not factor in the additional setbacks to the energy transition that may result from the war in Ukraine.

This article describes the impact of the climate crisis on insurance companies, the dilemmas CEOs face, and the actions they can take to effectively steer their companies into the future.

Climate implications for insurers

While some industries are only now beginning to discover the challenges and opportunities associated with climate change and the transition to net-zero emissions, the insurance industry has been immersed in them for a long time. Observing natural catastrophes, predicting their frequency and severity, and assessing their impact on an insurance book are core to the business. And while increased volatility could stimulate insurance demand, it also heightens the need for new risk transfer propositions to maintain affordability.

Meanwhile, the traditional insurance business model is affected by climate change on many fronts. For example, the evolving frequency and severity of primary and secondary perils has a direct impact on pricing. Prevention and risk-engineering measures need to be upgraded to address new or more frequent threats. Green credentials must now also be considered in the assessment of risks (and clients). And the cost of reinsurance and peak risks transfer directly affects deployable capital.

Decarbonization progress

Insurers have made uneven progress toward achieving their sustainability objectives. On average, they have made material progress on the assets side, with the vast majority investing more sustainably and reflecting broader environmental, social, and governance (ESG) principles in their investment policies. Although insurers vary in ambition and speed, the topic is broadly on the insurance executive agenda and is accompanied by action; for example, insurers are participating in the UN-convened Net-Zero Asset Owner Alliance (NZAOA).3

On the other hand, insurance carriers’ progress on the underwriting side of the balance sheet, on average, substantially lags progress made to date on the assets side. For example, insurers are unable, for the most part, to quantify their “insured emissions” and have typically taken a passive approach to understanding the decarbonization efforts taking place in the sectors they serve, let alone to factoring them into underwriting decisions.

Granted, underwriting and financing assets are not equivalent undertakings—insurers have far less direct involvement than financiers. Moreover, the exact contribution to insured emissions is more complex to determine. The Net-Zero Insurance Alliance (NZIA) provides target-setting protocols to assist its members, who have committed to transitioning all operational and attributable GHG emissions from their insurance and reinsurance underwriting portfolios to net-zero emissions by 2050 and who will report annually on their progress.4

Although the insurance industry’s direct emissions footprint warrants attention and action, and although the industry can lead by example, its largest opportunity by far to make a material impact is through underwriting and investing (Exhibit 2).

The CEOs’ dilemmas

As stewards of their own organizations and as business leaders whose offerings influence decision making across most other industries, insurance CEOs face numerous difficult choices:

CEOs can approach their work with several overriding objectives in mind. First, insurers can use the strength of their balance sheets to promote sustainable investments. On the one hand, life insurers have a clear opportunity to support the transition through the long-term investment philosophy of their books. On the other hand, growing demand for green securities from every corner of the asset management sector is challenging returns.

On the underwriting side, appropriate actions and their resulting impact vary widely by segment, business mix, and book:

At the same time, insurance executives can strive for the following:

A CEO plan of action

First and foremost, insurance CEOs are obligated to maintain their companies as going concerns—that is, ensure they are financially stable, can meet their obligations, and can continue to operate for the foreseeable future. In the context of climate change, that means perpetuating technical margins given changing physical and transition risks and developing growth opportunities to compensate for declining parts of the portfolio.

A head of sustainability can help insurance carriers achieve their climate change goals. Among other actions, this individual can manage the many requests and activities with which the insurer will need to comply, including monitoring ESG ratings, continually assessing and updating sustainability priorities, communicating with activist groups, and embedding sustainability into roles and responsibilities throughout the enterprise. Despite the importance of this new role, it will not substitute for leadership from the top.

CEOs, meanwhile, can focus on four areas:

Insurers need to carefully assess and confront the effects of climate change on their businesses. More crucially, the net-zero transition can represent a material growth opportunity for those insurers that are willing to innovate and evolve their underwriting capabilities.

Antonio Grimaldi is a partner in McKinsey’s London office, and Sylvain Johansson is a senior partner in the Geneva office.

1 “The Paris Agreement,” United Nations Climate Change, accessed 2022.

2 Global Energy Perspective 2022, McKinsey, April 26, 2022.

3 “UN-convened Net-Zero Asset Owner Alliance,” UN Environment Programme Finance Initiative, accessed 2022.

4 “Statement of commitment by signatory companies,” Net-Zero Insurance Alliance, UN Environment Programme Finance Initiative, accessed 2022.

Insurance CEOs have an opportunity to support decarbonization in the ways they manage their asset and underwriting portfolios and by reducing their direct emissions.

by Antonio Grimaldi and Sylvain Johansson

The science is clear. Global economies need to generate significantly fewer emissions of greenhouse gases (GHGs) such as CO2 to achieve the goals laid out in the Paris Agreement: first, limit warming (preferably to 1.5°C above preindustrial levels); and second, reach net-zero emissions—adding no more GHGs to the atmosphere than those that are removed—by 20501. Even if these targets are reached, a significant share of the population will confront extreme weather events between now and 2050 (Exhibit 1).

This is a massive challenge, and current projections indicate that we are not yet on the reduction path necessary to meet this goal2. Moreover, these projections do not factor in the additional setbacks to the energy transition that may result from the war in Ukraine.

This article describes the impact of the climate crisis on insurance companies, the dilemmas CEOs face, and the actions they can take to effectively steer their companies into the future.

Climate implications for insurers

While some industries are only now beginning to discover the challenges and opportunities associated with climate change and the transition to net-zero emissions, the insurance industry has been immersed in them for a long time. Observing natural catastrophes, predicting their frequency and severity, and assessing their impact on an insurance book are core to the business. And while increased volatility could stimulate insurance demand, it also heightens the need for new risk transfer propositions to maintain affordability.

Meanwhile, the traditional insurance business model is affected by climate change on many fronts. For example, the evolving frequency and severity of primary and secondary perils has a direct impact on pricing. Prevention and risk-engineering measures need to be upgraded to address new or more frequent threats. Green credentials must now also be considered in the assessment of risks (and clients). And the cost of reinsurance and peak risks transfer directly affects deployable capital.

Decarbonization progress

Insurers have made uneven progress toward achieving their sustainability objectives. On average, they have made material progress on the assets side, with the vast majority investing more sustainably and reflecting broader environmental, social, and governance (ESG) principles in their investment policies. Although insurers vary in ambition and speed, the topic is broadly on the insurance executive agenda and is accompanied by action; for example, insurers are participating in the UN-convened Net-Zero Asset Owner Alliance (NZAOA).3

On the other hand, insurance carriers’ progress on the underwriting side of the balance sheet, on average, substantially lags progress made to date on the assets side. For example, insurers are unable, for the most part, to quantify their “insured emissions” and have typically taken a passive approach to understanding the decarbonization efforts taking place in the sectors they serve, let alone to factoring them into underwriting decisions.

Granted, underwriting and financing assets are not equivalent undertakings—insurers have far less direct involvement than financiers. Moreover, the exact contribution to insured emissions is more complex to determine. The Net-Zero Insurance Alliance (NZIA) provides target-setting protocols to assist its members, who have committed to transitioning all operational and attributable GHG emissions from their insurance and reinsurance underwriting portfolios to net-zero emissions by 2050 and who will report annually on their progress.4

Although the insurance industry’s direct emissions footprint warrants attention and action, and although the industry can lead by example, its largest opportunity by far to make a material impact is through underwriting and investing (Exhibit 2).

The CEOs’ dilemmas

As stewards of their own organizations and as business leaders whose offerings influence decision making across most other industries, insurance CEOs face numerous difficult choices:

- Contribute to reducing exposures in high-emitting sectors or companies while protecting low-wage earners (for example, by reducing commercial property coverage while continuing to cover workers’ compensation for the employees who work there).

- Adjust pricing to accurately reflect the heightened cost of risks for some perils and hazards, thus pricing themselves out of the market temporarily, or wait for a more collective approach to pricing readjustments.

- Reduce risk appetite in more climate-exposed areas, or attempt to innovate risk transfer and risk mitigation solutions to maintain some protection for local populations and businesses.

- Encourage positive changes in customer behavior (for example, with price incentives on insurance for greener assets), potentially at the expense of underwriting margin, or wait for regulatory interventions to support these changes.

- Proactively support the energy transition by lining up underwriting capital behind new, potentially unproven green technologies, or wait to build a reasonable loss history and an understanding of risks before increasing exposure.

CEOs can approach their work with several overriding objectives in mind. First, insurers can use the strength of their balance sheets to promote sustainable investments. On the one hand, life insurers have a clear opportunity to support the transition through the long-term investment philosophy of their books. On the other hand, growing demand for green securities from every corner of the asset management sector is challenging returns.

On the underwriting side, appropriate actions and their resulting impact vary widely by segment, business mix, and book:

- Large commercial and specialty insurance carriers can be materially affected depending on their exposure to high-emissions sectors such as energy or transportation. To maintain relevance, they will need to continue decarbonizing their own operations, to strengthen their underwriting skills, and to expand underwriting targets to include providers of clean tech.

- Midmarket and small commercial books are particularly challenging because they are typically diversified and represent a share of the local economic fabric. Transitioning such a portfolio toward net-zero emissions absolutely requires each underlying sector to move toward decarbonization. Insurers can play an acceleration role in the same way that financiers will do.

- Retail motor and homeowners portfolios represent a sizable share of insured emissions, whether through fuel consumption, electricity generation, spare-parts production, or heating. Insurers can actively promote adaptation to green alternatives, use pricing to encourage and reward climate-friendly behaviors such as increasing fuel efficiency or installing insulation, or offer innovative product bundles (for example, the financing of solar equipment coupled with preferred risk transfer).

At the same time, insurance executives can strive for the following:

- Coherence. Insurers will be challenged to develop and maintain credible coherence among their asset strategies, underwriting strategies, and internal efforts to reduce direct emissions.

- Diversification. Because of the increased frequency and severity of perils (especially secondary perils) linked to natural catastrophes, diversification within the portfolio will become increasingly important. In the same way that reinsurers have historically managed the concentration of peak risks in their portfolios through global diversification, local retail insurers may need to revisit their diversification strategies.

- Expanded coverage. To take a proactive stance and accelerate the energy transition, insurers can identify and target economic domains that are likely to see significant capital expenditure investment. This may include, for example, investment to build new sustainable infrastructure, such as solar farms or energy story plants, and to decarbonize existing operations—for example, by retrofitting industrial plants with carbon capture technologies (Exhibit 3).

- The emphasis here is on finding domains that satisfy future demand, present reasonable technology risk, fall within the insurer’s acceptable risk appetite, and can reasonably be expected to have a functioning private risk transfer market.

A CEO plan of action

First and foremost, insurance CEOs are obligated to maintain their companies as going concerns—that is, ensure they are financially stable, can meet their obligations, and can continue to operate for the foreseeable future. In the context of climate change, that means perpetuating technical margins given changing physical and transition risks and developing growth opportunities to compensate for declining parts of the portfolio.

A head of sustainability can help insurance carriers achieve their climate change goals. Among other actions, this individual can manage the many requests and activities with which the insurer will need to comply, including monitoring ESG ratings, continually assessing and updating sustainability priorities, communicating with activist groups, and embedding sustainability into roles and responsibilities throughout the enterprise. Despite the importance of this new role, it will not substitute for leadership from the top.

CEOs, meanwhile, can focus on four areas:

- Establish a baseline by quantifying the emissions that the insurance carrier finances and underwrites. Calculate how many metric tons of CO2 this represents and where the portfolio is headed without specific management interventions.

- Define the three or four highest-priority actions the company can take—for example, adapting underwriting or investment guidelines—to materially reduce emissions through its various businesses.

- Ensure the company is meticulously executing its own initiatives to achieve its Scope 1 and Scope 2 emissions reduction targets.

- Place a well-considered bet on a few green technologies to encourage innovation, deploy underwriting capital, and support the market.

Insurers need to carefully assess and confront the effects of climate change on their businesses. More crucially, the net-zero transition can represent a material growth opportunity for those insurers that are willing to innovate and evolve their underwriting capabilities.

Antonio Grimaldi is a partner in McKinsey’s London office, and Sylvain Johansson is a senior partner in the Geneva office.

Learn more from McKinsey & Company >

_______________________________1 “The Paris Agreement,” United Nations Climate Change, accessed 2022.

2 Global Energy Perspective 2022, McKinsey, April 26, 2022.

3 “UN-convened Net-Zero Asset Owner Alliance,” UN Environment Programme Finance Initiative, accessed 2022.

4 “Statement of commitment by signatory companies,” Net-Zero Insurance Alliance, UN Environment Programme Finance Initiative, accessed 2022.