The World Post-Covid - “Insure or Die”

by Oladele Akinsanya, Head Of Products - Performance, Improvement & Development, Custodian Life Assurance Limited

As the business world recovers from the effects of Covid, the insurance industry will play a pivotal role in the new world, amidst the envisaged growth momentum, inflation, digitisation, climate change, health awareness, income disparity etc. The industry is projected by SwissRe to grow at about 3.9% in 2022.

Replacing innovate with insure from the phrase “Innovate or Die” is deliberate because, remarkably, insurance has been synonymous with evolution and innovation. Insurance in its simplest form is hedging risk for continued existence. You hedge your risk by transferring, sharing, managing, creating and or improving processes/services which in turn ensures continued existence of humans and businesses. So, you either “Insure or Die.”

Also, Insurers need to embrace innovation as their key attribute to meet up with needs of the ever-changing and dynamic world post-Covid. The key principles of the “institutionalised” industry may subsist but it must evolve with the new world.

Though, the existing problems for Insurers still hold sway; globally Insurers must manage unprecedented inflation, climate catastrophes, financial exclusion, and increased regulation. This future also beckons with enormous potential and accelerated changes at a speed last seen post the bubonic plague era.

What role would the insurer of the future play in helping individuals and businesses hedge their risks innovatively as these trends unfold?

The focus areas where evolving trends unfold include:

- Digital Transformation – Technology Adoption, Automation

- Innovation

- Decentralisation & the sharing economy (new ways of interacting and sharing data, delivering complete customer experiences through digital platforms), Shifting supply chains

- Risk awareness and evolving Consumer Behaviour

- Big Data Management

- Environmental consciousness/Sustainability

- Attracting and retaining talent

Key Focus Area - Digital Transformation

Digital transformation is easily defined as utilising technology to improve business performance. The pandemic has resulted in an unprecedented leap in digitisation. It is expected that these advancements are here to stay, effectively changing the way economies operate and the operating model required. Digital transformation will also usher in business and technology collaboration to effectively serve the customer of the future.

According to authors Boueé, C. and Schaible, S., the key drivers of digitisation or digital transformation are:

- The availability of digital data

- Process automation

- Interconnection of production and supply chains

- Providing customers with access to the business through digital interface

Major organisations had to rethink their business model during the pandemic, cutting across existing business processes and products.

Funding and implementing digital initiatives became a priority for business leaders faced with limited contact with customers and staff. This is expected to continue because of the change in consumer behaviour and the rapid digital adoption.

In the same stroke, Data shows that customers changed preferences, leveraging on digital channels.

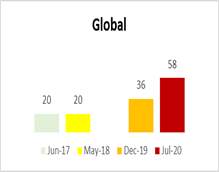

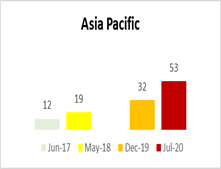

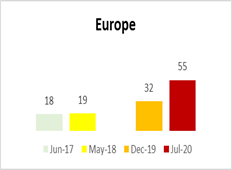

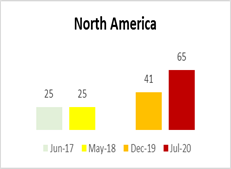

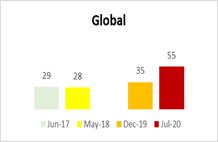

Average share of customer interactions that are digital (%)

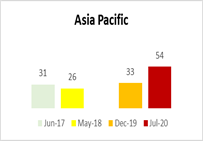

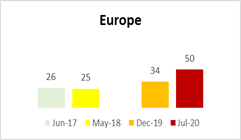

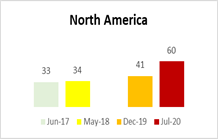

Average share of products/and or services that are partially or fully digitised%

Source: McKinsey & Company: How Covid has pushed companies over the technology tipping point and transformed business forever. (“GLOBAL MACRO RESEARCH ECONOMIC GROWTH, INFLATION CYCLES AND ASSET ...”)

The concept of automation in the new world will not only be about eradicating repetitive processes but also about teaching machines how to perform actions that mimic human intelligence through machine learning and artificial intelligence. Automation is also borne out of necessity because the future of work is changing. “The Great Resignation,” remote and hybrid working models amongst others is forcing organisations to rethink their business models with automation as a key imperative. Automation is not sad news for the emerging workforce as it would foster the creation of new types of jobs that fit the future of work.

Scenario Analysis – Claims Adjustment for personal lines (Retail) claims within a certain threshold.

Without AI (Artificial Intelligence): When the client submits a claim form along with the estimate of repairs, for property insurance. This will require a post-loss inspection and comparison of the prices with the prevailing market price by a loss (claim) adjuster, the result is then forwarded to the claims administrator for approval and claims settlement.

With AI (Artificial Intelligence): The client submits claim form, estimate of repair, video evidence through an integrated AI platform that ascertains the extent of loss, compares items vis – a-vis prices quoted and provides a claim settlement recommendation, saving several person-hours and physical travel.

Innovative activity has grown exponentially post covid, and it is increasingly prevalent to question the norm. With this rate of growth, it is critical that consumer focused industries such as the Insurance sector’s innovative growth rate must at least be at par. The International Patent Applications filed via WIPO’s Patent Cooperation Treaty, one of the measurement parameters for measuring innovation, grew by 4% in 2020; the highest number ever as at that period despite the decline in the Global GDP (Gross Domestic Product) of about 3.5%.

Innovation trails societal changes or happenings with great impacts, events that disrupt the world the way we know it. This is an exciting time to reinvent and adapt to the rapidly changing environment.

How does insurance support innovation? Hedging risks with mechanisms that are flexible, tailored, and help businesses fail forward. For example, the essence of Business Interuption insurance is to ensure the continued existence of a business. How can a reward for innovation be factored into policies leading to collaborations and affordable premiums?

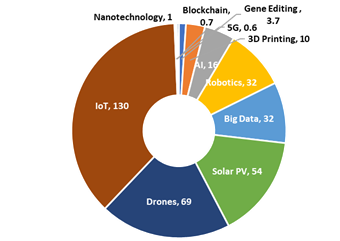

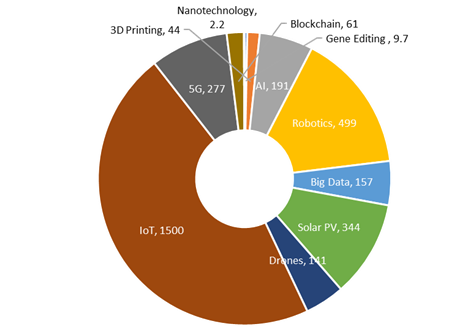

In the last few years, certain frontier technologies have been significant drivers of innovation. How do we utilise and enable the proliferation of these technologies with great potentials?

They include:

- Artificial Intelligence;

- Blockchain;

- Nanotechnology;

- 3D Printing;

- Internet of Things (IoT);

- Drones;

- Solar PV;

- Big Data;

- Robotics and;

- Gene Editing.

Market Size Estimates of frontier technologies, $billions

Source: UNCTAD (United Nations Conferences on Trade and Development) Technology and Innovation Report 2021

Key Focus Area - Decentralisation & The Sharing Economy

There is a rapid growth in popularity of financial institutions that operate without the need for regulators, traditional, or centralised systems; these are institutions that “run by themselves” often referred to as Decentralised Platforms. The growth in adoption is attributed to the perceived benefits, such as wider access to financial solutions, eliminating fees, bridging the gap of income inequality, financial inclusion, more consumer control, amongst others. This has influenced the popularity of blockchain technology as well as the creation of decentralised exchanges.

The insurance sector is not left out of this wave, as there have been few in-routes to Decentralised Insurance; (or “DecIn” an acronym I coined) utilising technology that verifies and records transactions in a distributed secure ledger to drive transparency and operational efficiency. This ledger is available to and accessible across various geographical locations. The system aggregates data from all its users and empowers the users to validate the transactions. Examples of decentralised models can be found in Peer to peer (P2P), Blockchain technology and Shared platforms.

This concept derives its relevance from the sociological aspect of human interaction. In developing economies and prior to the maturity of financial institutions, individuals usually defer to family, friends, mutual associations for savings, investments, and coping with unexpected events. The principle of peer-to-peer financial relationship is usually based on social capital and trust within that community. This model has been upscaled utilising technology and existing digital communities to provide savings, investment as well as insurance solutions.

The proposed benefits of this model include:

- Trust in the process – The risk pool is such that individuals are acquainted, and they know the system is not profit oriented as members will have to sacrifice earnings in the eventuality of a loss, thereby building trust.

- Large numbers via a mutual ecosystem – The introduction of a digital platform eradicates the challenges of groups too small to be considered an effective risk pool. Social media has provided a global platform for communities with similar interests. The economic influence of such communities is evident and prevalent in this post-covid era.

- Disintermediation - The conventional model of insurance distribution through agents or brokers is absent in the P2P model. Growth of the scheme is driven by members of the community, reducing and/or eliminating intermediary costs.

- Reduced incidences of fraudulent claims – An alignment of interests reduces the incentive to claim fraudulently.

This is a distributed ledger platform where data is recorded and shared simultaneously across multiple data points or ledgers. Data is transmitted and stored in packages called blocks connected in a digital chain. This is enabled through algorithms and cryptography across a common network. It is a distributed ledger managed autonomously on a digital peer-to-peer network. It shares similar benefits with the peer-to-peer (P2P).

Other benefits include the following:

- It enables digital assets – utilisation of digital assets such as Bitcoin is made possible through block chain technology. The autonomous ledger ensures that transactions are recorded and validated simultaneously eradicating the risk of double spending.

- Creation of smart contracts – blockchain technology allows for contracts with digitally programmed agreements, which can be auto-executed. The objective of such a contract is to drive transparency, cost reduction, and efficiency of transactions.

The growing popularity of sharing platforms for cars, homes etc., has transformed the concept of property ownership. Why own a property when you can share and get access to it only when needed? The sharing economy has also extended its reach to human resources, through online staffing. Consumers only want to pay for services consumed on demand, which includes insurance and other financial services solutions. Frontier technologies such as the Internet of Things (IoT), Telematics, Space Technology etc., make it possible to monitor usage and events across digital sharing platforms.

The benefits of these platforms include:

- Cost efficient payment systems – Consumers can pay proportionately for item utilisation including insurance.

- Fractional asset ownership – Lower acquisition cost for property ownership and deepening financial inclusion

Key Focus Area - Risk awareness and evolving Consumer Behaviour

One of the positive effects of the pandemic is that people are more risk conscious, and this is a strong driver for financial planning and insurance. According to Swiss Re, “Global health and protection-type insurance premiums grew by 1.9% and 1.7%, respectively in 2020 despite social distancing affecting distribution.” Their consumer survey in 12 Asia Pacific markets in early 2021 found that many feel under-insured and aim to buy more protection, despite an already high rate of ownership. The pandemic also affected the way companies interact with their customers and heightened the awareness of cyber and supply chain risks. Limited physical interaction has driven customers to adopt online channels, a form of digital engagement across channels is required as customer behaviour evolves. This trend also drives competition between the traditional providers and new digital platforms.

The new type of customer has the following attributes;

- They seek opinion – with the vast amount of data available online, customers utilise the digital space to seek opinion. Scouring data helps make informed decisions about products and services.

- They value online interactions – With fewer physical visits or meetings, customers interact more with digital channels than brick or mortar. The user interface and the process also must be customer centric. This is different from the need of customers a few years ago.

- They seek quick transactions and resolutions – Customers are eager to see immediate results, efficient processes, as well as self-help options as they navigate the businesses' digital channels.

- They are well informed and contribute to the process – Customers conduct research about their prospective purchase and very much aware of the market offerings, partly due to the proliferation of aggregator and comparison websites.

- They are open to considering multiple options – Customer brand loyalty is waning as several new factors such as online advocacy, product reviews etc., influence customer choices. Customers find it easier to switch products than it was before as customer onboarding has become easier to leverage on technology.

Key Focus Area – Big Data Management

One of the key outcomes of digital transformation is the utilisation of a large amount of Data for integration, interaction, analysis, etc. This itself ushers in a new normal and the need for Data Management. The term “Big Data” refers to an exponential volume of data that cannot be accessed, processed, or analysed utilising traditional methods. It is characterised by 5 unique properties, which are:

- Volume – The amount of data stored

- Velocity – The required computational speed to get a queried response

- Variety – Heterogenous forms of data

- Veracity – Data confidentiality

- Value – Importance attached to data access

Big Data is also differentiated into three types, structured data, unstructured data, and semi-structured data depending on how easily it can be accessed or processed.

Big Data Management offers competitive advantage, helping businesses make better predictions and smarter decisions.

The main benefits of an effective Big Data Management strategy include:

- Predictive analysis

- Product/solution improvement from identifying customer pain points

- Better decision making

- Creation of new roles

- Information Security

Big Data is already being applied in predictive inventory, personalised digital marketing, live road mapping for autonomous vehicles, personalised health care amongst others.

Key Focus Area - Environmental Consciousness/Sustainability

Businesses have hitherto focused on growth, profit and return on investment, but a new metric has evolved which cannot be ignored. It is called sustainability. Covid-19 has brought about inflection, having many customers evaluating their decisions in line with what they deem important. A new type of customer wants to invest in, transact with businesses that help minimise environmental impact. The effect of sustainable practices is far reaching and not limited to the insurance or financial services sector.

The approach to a sustainable business can be achieved in the following ways:

- Reinvent business models to align with sustainability goals

- Adopt sustainable practices

- Ensure strong governance and compliance structures

- Be proactive

- Adopt performance measures to track sustainability goals

- Be transparent

- Engage all stakeholders

Key Focus Area - Attracting and Retaining Talent

According to a Deloitte Survey, CEO’s (Chief Executive Officers) have ranked labor and skills shortage as the biggest disruptor of their business strategy in the next year. This same survey showed that more than 40% of workers were considering leaving their jobs. These figures are higher in other surveys.

Though this issue is global, the challenges vary by demography, industry, and region. Some industries were badly hit during Covid, resulting in layoffs. Post-covid, attracting and keeping staff that feel they are disposable has been challenging. From a demographic standpoint, according to Molla Rani’s survey, more than 50% of American women who dropped out of the workforce during the pandemic have not returned. According to Microsoft’s WorkLab, over 52% of Gen Z and Millennials are considering changing jobs within the year.

The reasons employees want to leave their jobs include:

- A desire for flexibility – The new employee is particular about where, how and with whom they work. Some workers would seek new employment if they were unable to work remotely.

- Work-Life Balance – The pandemic gave a lot of people the opportunity to reflect and evaluate how they are spending their time. More than half of employees globally are likely to prioritise their health and well-being over work.

- More pay – This speaks mostly to the millennials, whose primary motivation may be salary. Deloitte’s 2022 Millennial Survey shows pay as the top reasons millennials left their employers in the last two years. There is competition for talent in the labour market, which provides an opportunity for employees to switch jobs for better pay.

- Workplace Culture – It has also been observed that dissatisfaction with workplace culture and the employer's commitment to sustainable practices are key considerations for employees.

- New Potentials, New Ambitions – Employees want to learn and grow, they want to embrace new opportunities. Working conditions devoid of these, would lose restless employees with lofty ambitions.

Suggestions on how to improve workforce performance:

- Review existing processes, with strong focus on the output

- Leverage on technology and automation

- Adopt innovative talent management practices

- Create opportunities for existing employees

- Upscaling and reskilling workforce

- Re-inventing the workplace

Case studies on business transformation during and post covid

Custodian, one of Africa’s leading Insurance Group commenced its digital transformation strategy prior to Covid but the pandemic accelerated implementation of some of its initiatives:

- Expanding customer touchpoints through Nigeria’s first non-banking AI (Artificial Intelligence) Chatbot (Custodian Max)

- Creation of an Innovation Lab, to warehouse and implement innovative ideas from staff and customers. Also, to create a sustainable platform of execution between technology and business

- Automated pre-loss inspections for Comprehensive Vehicle and Personal lines Insurance utilising a SaaS (Software as a Service) model

- Invested in technological infrastructure for Big Data Management and Cyber security

All State improved on its touchless claims technology by adding satellite technology and high-speed internet to its Mobile Claim Centers.

It also started using aerial imagery and other remotely accessible tools to assess household claims submissions.

It also implemented touchless digital payments for its customers.

Aon launched an APP for employers (its customers) to help monitor potential medical costs, absenteeism and identify a suitable operations strategy during a wave of Covid.

The App utilises demographic and geographic data available in the health insurers database to monitor infection rates, potential exposures, and the impact of infections. With the data, it helps provide information on how to keep employees safe with minimal impact to business operations.

What the pandemic has taught individuals and businesses is that you can wait for the next fortuitous event to happen before you react, or you can be proactive, identify the trend and key focus areas, ideate, innovate, and collaborate. You either insure or die.

“Innovation is how mankind insures his existence” - Oladele Akinsanya

- Reimagine insurance: Five keys to innovation | McKinsey

- Pandemics, plagues, and innovation in history: the striking parallels between COVID-19 and the Black Death - Marketplace (“Black Death's Instagram, Twitter & Facebook on IDCrawl”) (“Links 7/9/2021 | naked capitalism”)

- WEF_Challenges_and_Opportunities_Post_COVID_19.pdf (weforum.org)

- https://www.wipo.int/pressroom/en/articles/2021/article_0002.html

- https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

- https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-eight-trends-that-will-define-2021-and-beyond

- https://www.linkedin.com/pulse/10-trends-post-covid-19-world-aniisu-k-verghese/

- 2022 insurance industry outlook | Deloitte Insights

- deloitte-uk-insurers-digital-business.pdf

- https://documents1.worldbank.org/curated/en/583381531209953337/pdf/128157-9-7-2018-11-49-10-FintechNotesTechnologyInsuranceInclusiveFinalLowRes.pdf

- https://talentedge.com/blog/5-core-behaviors-customers-digital-world/

- Big-Data Management: A Driver for Digital Transformation? Panagiotis Kostakis and Antonios Kargas

- World Bank Document

- Boueé, C.; Schaible, S. Die Digitale Transformation der Industrie; Studie:Roland Berger und BDI: Munich, Germany, 2015.

- Types Of Big Data: Simplified (2022) (jigsawacademy.com)

- Big Data: The Management Revolution (hbr.org)

- Sustainability in a post-Covid-19 world: Is your business prepared? | NationofChange

- What Is Sustainability in Business? | HBS Online

- Why all businesses must embrace sustainability in 2022 (imd.org)

- gx-the-great-reimagination-report.pdf (deloitte.com)

- Great Expectations: Making Hybrid Work Work (microsoft.com)

- Quitting is just half the story: the truth behind the ‘Great Resignation’ | US unemployment and employment data | The Guardian

- Retain Employees During The Great Resignation With These Tips (entrepreneur.com)

- https://insuranceblog.accenture.com/5-ways-insurance-companies-rose-up-to-the-covid-19-challenge